Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Europe ITraxx Credit Indices<br />

• Outright: Being long or short MAIN has<br />

moved further towards being a macro call on<br />

European sovereigns. The trade which offers<br />

the best risk/reward to play further volatility in<br />

Sovereign is the “Long risk XO / Short risk MAIN<br />

x5” trade.<br />

• SUB/SEN: the attractive entry point and the<br />

non-directionality of the trade over the mediumterm<br />

prompt us to recommend the SUB/SEN<br />

decompression trade with a ratio of 1.5 x 1.<br />

That’s a normalization trade with limited<br />

downside.<br />

• XO/MAIN: although the ratio has reached<br />

new lows this week, we think there is more to<br />

come and keep our recommendation “Long risk<br />

XO / Short risk MAIN x5” trade which has<br />

already performed by 85bp.<br />

• LVL/FIN SEN: thanks to further<br />

underperformance of FIN SEN vs. MAIN and<br />

some decompression HVL/MAIN, LVL has kept<br />

on outperforming all other indices. We advise<br />

investors to took profit on the “Long risk LVL /<br />

Short risk FIN SEN” recommended the 18-Feb.<br />

• FIN SEN and SUB 5/10y: we have been right<br />

to call for the flattening of these two curves.<br />

After their retracement of 6bp (in SEN and SUB),<br />

the downside at +4 in SEN and +3 in SUB looks<br />

extremely limited. We like the two steepeners as<br />

mid-term normalization/carry-trades.<br />

• XO 5/10y: we keep our steepeners in s12<br />

and s13.<br />

Outright<br />

Being long or short MAIN has moved further towards<br />

being a macro call on European sovereigns; it is<br />

mainly due to the spill-over of the Greek crisis into<br />

Spain and Portugal and the increase of single-names<br />

related to threatened sovereigns; there is only one<br />

Greek name (OTE) but the number of PIIGS names<br />

is 18 (Portugal: 3; Ireland: 0; Italy: 8; Greece: 1;<br />

Spain: 6). Actually, the picture is a bit more complex<br />

with direct exposure of non-PIIGS based financials<br />

(and to a lower extent non-financials) to PIIGS risk.<br />

In any case, the correlation between MAIN and<br />

SOVX has reached new highs.<br />

The direct consequence of the loss of confidence in<br />

the weakest members of the Eurozone has been<br />

further pressure on the EUR currency, which has<br />

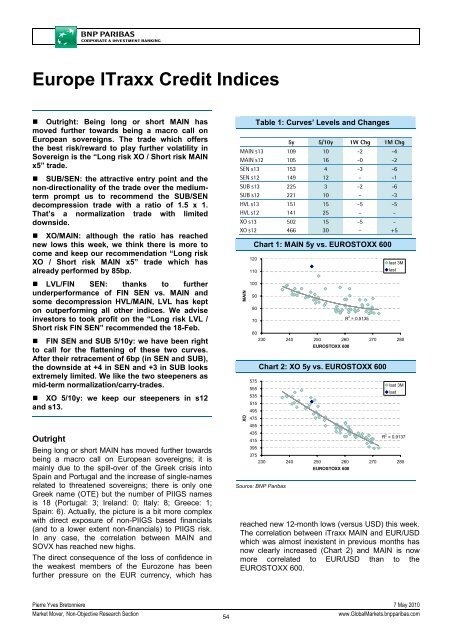

Table 1: Curves’ Levels and Changes<br />

5y 5/10y 1W Chg 1M Chg<br />

MAIN s13 109 10 -2 -4<br />

MAIN s12 105 16 -0 -2<br />

SEN s13 153 4 -3 -6<br />

SEN s12 149 12 - -1<br />

SUB s13 225 3 -2 -6<br />

SUB s12 221 10 - -3<br />

HVL s13 151 15 -5 -5<br />

HVL s12 141 25 - -<br />

XO s13 502 15 -5 -<br />

XO s12 466 30 - +5<br />

MAIN<br />

XO<br />

120<br />

110<br />

100<br />

Chart 1: MAIN 5y vs. EUROSTOXX 600<br />

90<br />

80<br />

70<br />

R 2 = 0.5135<br />

60<br />

230 240 250 260 270 280<br />

575<br />

555<br />

535<br />

515<br />

495<br />

475<br />

455<br />

435<br />

415<br />

395<br />

EUROSTOXX 600<br />

Chart 2: XO 5y vs. EUROSTOXX 600<br />

last 3M<br />

reached new 12-month lows (versus USD) this week.<br />

The correlation between iTraxx MAIN and EUR/USD<br />

which was almost inexistent in previous months has<br />

now clearly increased (Chart 2) and MAIN is now<br />

more correlated to EUR/USD than to the<br />

EUROSTOXX 600.<br />

last<br />

R 2 = 0.9137<br />

375<br />

230 240 250 260 270 280<br />

Source: <strong>BNP</strong> Paribas<br />

EUROSTOXX 600<br />

last 3M<br />

last<br />

Pierre Yves Bretonniere 7 May 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

54<br />

www.Global<strong>Market</strong>s.bnpparibas.com