Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

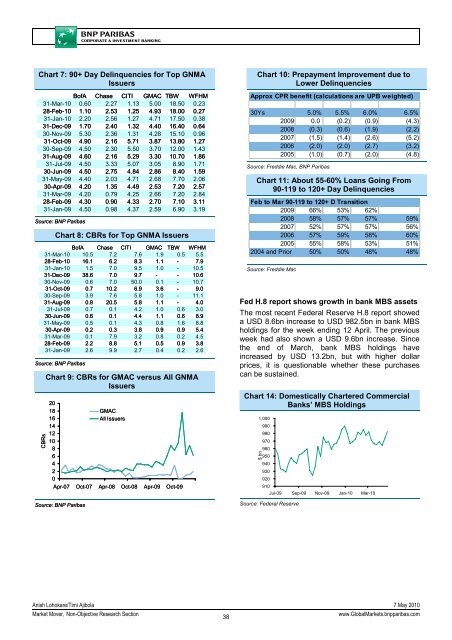

Chart 7: 90+ Day Delinquencies for Top GNMA<br />

Issuers<br />

BofA Chase CITI GMAC TBW WFHM<br />

31-Mar-10 0.60 2.27 1.13 5.00 18.50 0.23<br />

28-Feb-10 1.10 2.53 1.25 4.93 18.00 0.27<br />

31-Jan-10 2.20 2.56 1.27 4.71 17.50 0.38<br />

31-Dec-09 1.70 2.40 1.32 4.40 16.40 0.64<br />

30-Nov-09 5.30 2.36 1.31 4.28 15.10 0.96<br />

31-Oct-09 4.90 2.16 5.71 3.87 13.80 1.27<br />

30-Sep-09 4.50 2.30 5.50 3.70 12.00 1.43<br />

31-Aug-09 4.60 2.16 5.29 3.30 10.70 1.86<br />

31-Jul-09 4.50 3.33 5.07 3.05 8.90 1.71<br />

30-Jun-09 4.50 2.75 4.84 2.86 8.40 1.59<br />

31-May-09 4.40 2.03 4.71 2.68 7.70 2.06<br />

30-Apr-09 4.20 1.35 4.49 2.53 7.20 2.57<br />

31-Mar-09 4.20 0.79 4.25 2.66 7.20 2.84<br />

28-Feb-09 4.30 0.90 4.33 2.70 7.10 3.11<br />

31-Jan-09 4.50 0.98 4.37 2.59 6.90 3.19<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 8: CBRs for Top GNMA Issuers<br />

BofA Chase CITI GMAC TBW WFHM<br />

31-Mar-10 10.5 7.2 7.6 1.9 0.5 5.5<br />

28-Feb-10 16.1 6.2 8.3 1.1 - 7.9<br />

31-Jan-10 1.5 7.0 9.5 1.0 - 10.5<br />

31-Dec-09 38.6 7.0 9.7 - - 10.6<br />

30-Nov-09 0.6 7.0 50.0 0.1 - 10.7<br />

31-Oct-09 0.7 10.2 6.9 3.6 - 9.0<br />

30-Sep-09 3.9 7.6 5.8 1.0 - 11.1<br />

31-Aug-09 0.8 20.5 5.8 1.1 - 4.0<br />

31-Jul-09 0.7 0.1 4.2 1.0 0.6 3.0<br />

30-Jun-09 0.6 0.1 4.4 1.1 0.6 8.9<br />

31-May-09 0.5 0.1 4.3 0.8 1.6 8.8<br />

30-Apr-09 0.2 0.3 3.8 0.9 0.9 5.4<br />

31-Mar-09 0.1 7.9 3.2 0.8 0.2 4.5<br />

28-Feb-09 2.2 8.8 5.1 0.5 0.9 3.8<br />

31-Jan-09 2.6 9.9 2.7 0.4 0.2 2.6<br />

Source: <strong>BNP</strong> Paribas<br />

CBRs<br />

Chart 9: CBRS CBRs for GMAC versus All GNMA<br />

Issuers<br />

20<br />

18<br />

GMAC<br />

16<br />

All Issuers<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Apr-07 Oct-07 Apr-08 Oct-08 Apr-09 Oct-09<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 10: Prepayment Improvement due to<br />

Lower Delinquencies<br />

Approx CPR benefit (calculations are UPB weighted)<br />

30Ys 5.0% 5.5% 6.0% 6.5%<br />

2009 0.0 (0.2) (0.9) (4.3)<br />

2008 (0.3) (0.6) (1.9) (2.2)<br />

2007 (1.5) (1.4) (2.6) (5.2)<br />

2006 (2.0) (2.0) (2.7) (3.2)<br />

2005 (1.0) (0.7) (2.0) (4.8)<br />

Source: Freddie Mac, <strong>BNP</strong> Paribas<br />

Chart 11: About 55-60% Loans Going From<br />

90-119 to 120+ Day Delinquencies<br />

Feb to Mar 90-119 to 120+ D Transition<br />

2009 66% 53% 62%<br />

2008 58% 57% 57% 59%<br />

2007 52% 57% 57% 56%<br />

2006 57% 59% 58% 60%<br />

2005 55% 58% 53% 51%<br />

2004 and Prior 50% 50% 48% 48%<br />

Source: Freddie Mac<br />

Fed H.8 report shows growth in bank MBS assets<br />

The most recent Federal Reserve H.8 report showed<br />

a USD 8.6bn increase to USD 982.5bn in bank MBS<br />

holdings for the week ending 12 April. The previous<br />

week had also shown a USD 9.6bn increase. Since<br />

the end of March, bank MBS holdings have<br />

increased by USD 13.2bn, but with higher dollar<br />

prices, it is questionable whether these purchases<br />

can be sustained.<br />

Chart 14: Domestically Chartered Commercial<br />

Banks’ MBS Holdings<br />

1,000<br />

$ bn<br />

990<br />

980<br />

970<br />

960<br />

950<br />

940<br />

930<br />

920<br />

910<br />

Source: Federal Reserve<br />

Jul-09 Sep-09 Nov-09 Jan-10 Mar-10<br />

Anish Lohokare/Timi Ajibola 7 May 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

38<br />

www.Global<strong>Market</strong>s.bnpparibas.com