Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

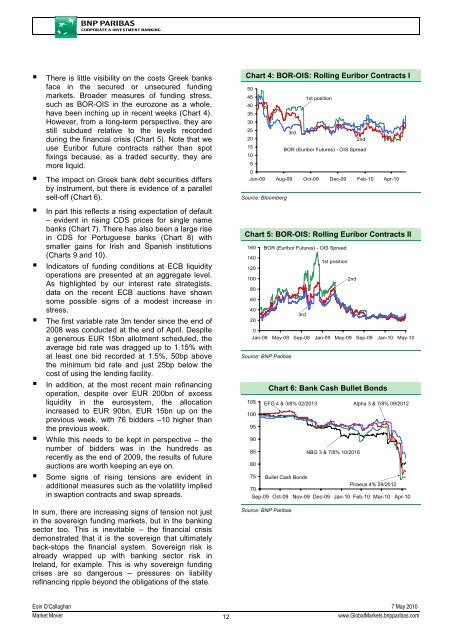

• There is little visibility on the costs Greek banks<br />

face in the secured or unsecured funding<br />

markets. Broader measures of funding stress,<br />

such as BOR-OIS in the eurozone as a whole,<br />

have been inching up in recent weeks (Chart 4).<br />

However, from a long-term perspective, they are<br />

still subdued relative to the levels recorded<br />

during the financial crisis (Chart 5). Note that we<br />

use Euribor future contracts rather than spot<br />

fixings because, as a traded security, they are<br />

more liquid.<br />

• The impact on Greek bank debt securities differs<br />

by instrument, but there is evidence of a parallel<br />

sell-off (Chart 6).<br />

• In part this reflects a rising expectation of default<br />

– evident in rising CDS prices for single name<br />

banks (Chart 7). There has also been a large rise<br />

in CDS for Portuguese banks (Chart 8) with<br />

smaller gains for Irish and Spanish institutions<br />

(Charts 9 and 10).<br />

• Indicators of funding conditions at ECB liquidity<br />

operations are presented at an aggregate level.<br />

As highlighted by our interest rate strategists,<br />

data on the recent ECB auctions have shown<br />

some possible signs of a modest increase in<br />

stress.<br />

• The first variable rate 3m tender since the end of<br />

2008 was conducted at the end of April. Despite<br />

a generous EUR 15bn allotment scheduled, the<br />

average bid rate was dragged up to 1.15% with<br />

at least one bid recorded at 1.5%, 50bp above<br />

the minimum bid rate and just 25bp below the<br />

cost of using the lending facility.<br />

• In addition, at the most recent main refinancing<br />

operation, despite over EUR 200bn of excess<br />

liquidity in the eurosystem, the allocation<br />

increased to EUR 90bn, EUR 15bn up on the<br />

previous week, with 76 bidders –10 higher than<br />

the previous week.<br />

• While this needs to be kept in perspective – the<br />

number of bidders was in the hundreds as<br />

recently as the end of 2009, the results of future<br />

auctions are worth keeping an eye on.<br />

• Some signs of rising tensions are evident in<br />

additional measures such as the volatility implied<br />

in swaption contracts and swap spreads.<br />

In sum, there are increasing signs of tension not just<br />

in the sovereign funding markets, but in the banking<br />

sector too. This is inevitable – the financial crisis<br />

demonstrated that it is the sovereign that ultimately<br />

back-stops the financial system. Sovereign risk is<br />

already wrapped up with banking sector risk in<br />

Ireland, for example. This is why sovereign funding<br />

crises are so dangerous – pressures on liability<br />

refinancing ripple beyond the obligations of the state.<br />

Chart 4: BOR-OIS: Rolling Euribor Contracts I<br />

50<br />

45<br />

1st position<br />

40<br />

35<br />

30<br />

25<br />

3rd<br />

20<br />

2nd<br />

15<br />

BOR (Euribor Futures) - OIS Spread<br />

10<br />

5<br />

0<br />

Jun-09 Aug-09 Oct-09 Dec-09 Feb-10 Apr-10<br />

Source: Bloomberg<br />

Chart 5: BOR-OIS: Rolling Euribor Contracts II<br />

160 BOR (Euribor Futures) - OIS Spread<br />

140<br />

1st position<br />

120<br />

100<br />

2nd<br />

80<br />

60<br />

40<br />

3rd<br />

20<br />

0<br />

Jan-08 May-08 Sep-08 Jan-09 May-09 Sep-09 Jan-10 May-10<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 6: Bank Cash Bullet Bonds<br />

105 EFG 4 & 3/8% 02/2013 Alpha 3 & 7/8% 09/2012<br />

100<br />

95<br />

90<br />

85<br />

NBG 3 & 7/8% 10/2016<br />

80<br />

75 Bullet Cash Bonds<br />

Piraeus 4% 09/2012<br />

70<br />

Sep-09 Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10<br />

Source: <strong>BNP</strong> Paribas<br />

Eoin O’Callaghan 7 May 2010<br />

<strong>Market</strong> Mover<br />

12<br />

www.Global<strong>Market</strong>s.bnpparibas.com