Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

type of regulation would reduce monetary velocity<br />

and, if the decline in velocity were not compensated<br />

by a sufficient increase of central bank liquidity,<br />

would push the USD higher. In addition, less USD<br />

liquidity would not bode well for risky assets, which in<br />

recent years have enjoyed a liquidity-supported rally.<br />

EMU’s contagion and liquidity<br />

Most commentators are debating the pro and cons of<br />

a currency union in terms of diverging intra-EMU<br />

competitiveness and wealth levels, leaving liquidity<br />

considerations outside the debate. The IMF and<br />

EMU on the one hand and Greece on the other have<br />

finally agreed on a EU 110bn support package<br />

spread over three years, with Greece committing<br />

itself to a substantial budget consolidation<br />

programme. Concerning the liquidity implications of<br />

the programme, we have to differentiate between<br />

IMF and EMU funds. IMF funds have a liquidity<br />

increasing effect as the IMF takes SDRs out of its<br />

balance sheet and converts them into EUR. Hence,<br />

IMF funds work like a monetary/fiscal support<br />

programme. The EMU part of the programme has<br />

fiscal but no monetary effects.<br />

EMU has provided Greece with a EUR 75bn bridge<br />

loan aimed at keeping the country out of capital<br />

markets for three years. EMU countries will mostly<br />

raise these funds off balance sheet by issuing bonds<br />

and transferring these funds to Greece. If these offbalance-sheet<br />

programmes have no effect on<br />

national budgets in the sense that expenditure plans<br />

are left unchanged, raising these funds in the capital<br />

market would be a plus from a global liquidity point.<br />

However, national budget deficits are high across the<br />

eurozone and off-balance-sheet funding will not fool<br />

financial markets with regard to the risk premium to<br />

be paid for these assets. Remember the German<br />

unification days when GDR-related expenditure was<br />

funded via unification bonds? At that time, German<br />

bond yields reflected the higher German borrowing<br />

needs and the market did not care if the additional<br />

funds needed for German unification were funded on<br />

or off the federal balance sheet. Nowadays there will<br />

be no difference. In order not to see their own<br />

financial credibility being undermined, EMU countries<br />

supporting Greece financially will have to cut<br />

domestic expenditure or increase domestic taxes.<br />

This will especially apply to countries with high debt<br />

or deficit levels such as Portugal, Spain, Ireland, Italy<br />

and France. So the EMU bridge loan represents a<br />

fiscal transfer, but will not increase the pool of fiscal<br />

means available for the eurozone. In this sense, the<br />

EMU package is different from the IMF money, which<br />

in fact brings new funds into the eurozone and hence<br />

provides a measure of relief.<br />

However, we still believe that EMU instability will<br />

negatively affect global liquidity. Greece illustrated<br />

how the sovereign crisis has undermined the banking<br />

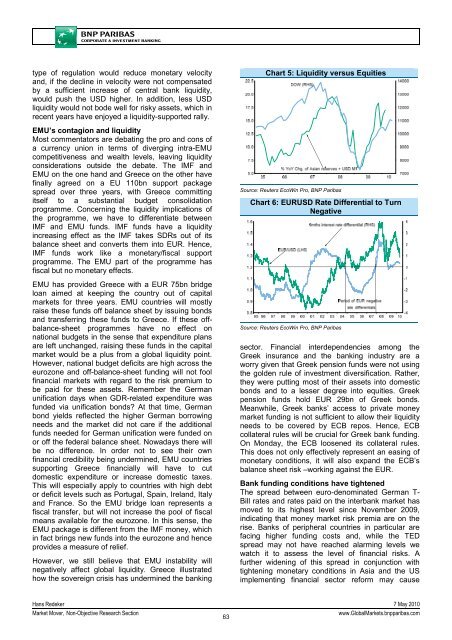

Chart 5: Liquidity versus Equities<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Chart 6: EURUSD <strong>Rate</strong> Differential to Turn<br />

Negative<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

sector. Financial interdependencies among the<br />

Greek insurance and the banking industry are a<br />

worry given that Greek pension funds were not using<br />

the golden rule of investment diversification. Rather,<br />

they were putting most of their assets into domestic<br />

bonds and to a lesser degree into equities. Greek<br />

pension funds hold EUR 29bn of Greek bonds.<br />

Meanwhile, Greek banks’ access to private money<br />

market funding is not sufficient to allow their liquidity<br />

needs to be covered by ECB repos. Hence, ECB<br />

collateral rules will be crucial for Greek bank funding.<br />

On Monday, the ECB loosened its collateral rules.<br />

This does not only effectively represent an easing of<br />

monetary conditions, it will also expand the ECB’s<br />

balance sheet risk –working against the EUR.<br />

Bank funding conditions have tightened<br />

The spread between euro-denominated German T-<br />

Bill rates and rates paid on the interbank market has<br />

moved to its highest level since November 2009,<br />

indicating that money market risk premia are on the<br />

rise. Banks of peripheral countries in particular are<br />

facing higher funding costs and, while the TED<br />

spread may not have reached alarming levels we<br />

watch it to assess the level of financial risks. A<br />

further widening of this spread in conjunction with<br />

tightening monetary conditions in Asia and the US<br />

implementing financial sector reform may cause<br />

Hans Redeker 7 May 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

63<br />

www.Global<strong>Market</strong>s.bnpparibas.com