Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Euro Dives<br />

• The euro is collapsing across the board with a break through major support levels on most<br />

crosses suggesting that an acceleration of the downtrend is now unfolding<br />

• EURUSD is currently accelerating the downtrend following the break below major support with the<br />

bottom end of the six month channel being tested<br />

• EURJPY has collapsed breaking below the February low, opening the way for further significant<br />

losses over the medium term<br />

• EURGBP now approaching major medium term support, a break of which will turn the longer term<br />

outlook bearish<br />

The euro has accelerated its recent decline, with<br />

losses across the board triggering important<br />

bearish technical signals suggesting that further<br />

significant downside potential is now developing.<br />

Indeed, it is interesting to note that the euro is<br />

already the weakest currency year-to-date<br />

among the majors, with losses of over 11%<br />

against the USD. The current collapse is<br />

confirming the medium term bearish outlook for<br />

the euro.<br />

Indeed, EURUSD has accelerated the major<br />

downtrend through the key support at the 1.2890<br />

level to confirm the longer term bearish technical<br />

picture and the bottom end of the six-month<br />

descending channel at the 1.2595 level is now<br />

being targeted. A further break below here will<br />

open downside potential back to the 1.2330 lows<br />

seen in October 2008. Longer term, the structure<br />

of the decline seen since the 1.5145 November<br />

2009 high implies an eventual break below the<br />

1.2330 support. Such a break lower confirms the<br />

long term bearish outlook for the euro, putting the<br />

focus on the 1.1645 November 2005 lows. The<br />

overall bearish picture is consistent with the negative<br />

signals currently being generated by technical<br />

indicators, which suggest that bearish momentum is<br />

set to be sustained in the coming weeks.<br />

However, one of the most bearish technical signals<br />

currently being generated by the euro is on EURJPY,<br />

where the long term pivotal support at the 119.70<br />

level has been broken. This break lower has now<br />

turned the longer term EURJPY outlook bearish and<br />

losses are expected to target the 115.95 level<br />

initially, which represents the bottom end of the sixmonth<br />

descending channel. Over the medium term,<br />

the 112.10 January 2009 low is also expected to be<br />

targeted. Longer term charts suggest that the<br />

EURJPY trading activity seen since the beginning of<br />

2009 is corrective and that the down trend from the<br />

169.95 July 2008 high is set to be resumed target<br />

100.35.<br />

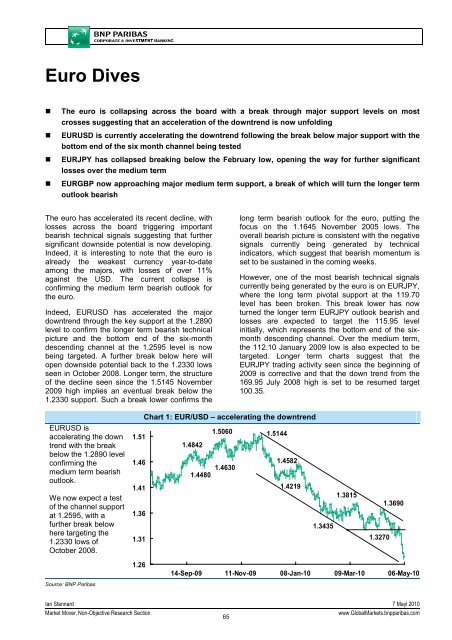

Chart 1: EUR/USD – accelerating the downtrend<br />

EURUSD is<br />

accelerating the down<br />

trend with the break<br />

below the 1.2890 level<br />

confirming the<br />

medium term bearish<br />

outlook.<br />

We now expect a test<br />

of the channel support<br />

at 1.2595, with a<br />

further break below<br />

here targeting the<br />

1.2330 lows of<br />

October 2008.<br />

1.5060<br />

1.51<br />

1.5144<br />

1.4842<br />

1.46<br />

1.4582<br />

1.4630<br />

1.4480<br />

1.41<br />

1.4219<br />

1.36<br />

1.3435<br />

1.31<br />

1.3815<br />

1.3270<br />

1.3690<br />

1.26<br />

14-Sep-09<br />

11-Nov-09<br />

08-Jan-10<br />

09-Mar-10<br />

06-May-10<br />

Source: <strong>BNP</strong> Paribas<br />

Ian Stannard 7 Mayl 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

65<br />

www.Global<strong>Market</strong>s.bnpparibas.com