Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Global Inflation Watch<br />

April Inflation: Easter Effect Unwinding<br />

The eurozone flash estimate for April printed 1.5%<br />

y/y, up 0.1pp on the month and the highest rate since<br />

December 2008.<br />

We will have to wait until mid-May to get the<br />

breakdown, but we expect it to reveal that the rise in<br />

inflation over the month was purely driven by food<br />

and energy inflation. Energy price base effects are<br />

now past, but a rise in oil prices over the month to<br />

above USD 85/bbl should have pushed up energy<br />

inflation. In addition, food price base effects are only<br />

now really kicking in and point to a rise in food<br />

inflation through the rest of the spring and the<br />

summer.<br />

In contrast, core inflation should have declined<br />

sharply in April after rising in March, as the timing of<br />

Easter continued to play havoc with the data. Nearly<br />

all the strength in core in March was explained by<br />

just two components – package holiday and hotel<br />

prices. Because Easter fell in early April this year, we<br />

believe that some of the traditional Easter strength<br />

you typically see in these components bled into the<br />

March data. As a result, this should have unwound in<br />

April, pushing core back down to a new record low of<br />

0.7% y/y. These dynamics are consistent with what<br />

we saw in the weak preliminary German data, which<br />

suggested that core inflation there fell by 0.7pp in<br />

April to reach 0.2% y/y.<br />

Easter distortions will finally work their way out in<br />

May, when core inflation is likely to increase again<br />

but finish at a lower level than in February, confirming<br />

that the trend in core inflation remains downwards.<br />

We will get more insight into the dynamics for April in<br />

the coming week with data for France, Spain, Italy<br />

and Germany. The French data is the most important<br />

release – we have already had preliminary data for<br />

the others. We expect French CPI inflation to have<br />

ticked higher in April by 0.1pp to reach 1.7%, its<br />

highest level since November 2008. The move<br />

should be entirely due to energy – following a near<br />

10% hike in the regulated price of natural gas. In<br />

contrast, core inflation should have eased, even<br />

though the French data are typically not as affected<br />

by Easter seasonality as the German numbers.<br />

Service price inflation should prove the driver,<br />

pushed lower by declining wage costs.<br />

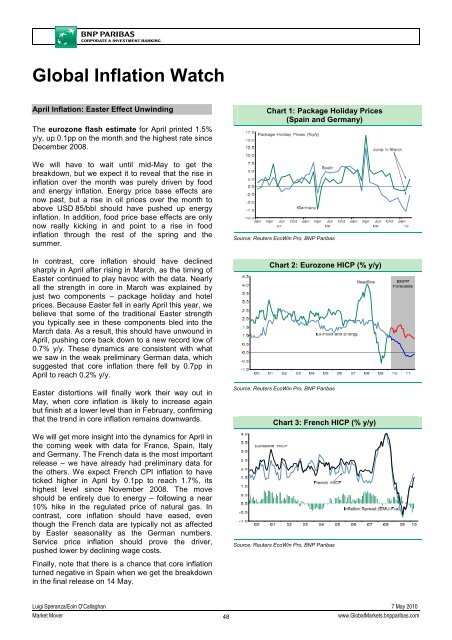

Chart 1: Package Holiday Prices<br />

(Spain and Germany)<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Chart 2: Eurozone HICP (% y/y)<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Chart 3: French HICP (% y/y)<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Finally, note that there is a chance that core inflation<br />

turned negative in Spain when we get the breakdown<br />

in the final release on 14 May.<br />

Luigi Speranza/Eoin O’Callaghan 7 May 2010<br />

<strong>Market</strong> Mover<br />

48<br />

www.Global<strong>Market</strong>s.bnpparibas.com