Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

• The plan also contains a number of measures to<br />

boost competitiveness, growth and strengthen<br />

capitalisation of domestic banks. These include:<br />

i. Restructuring of the labour legislation<br />

framework;<br />

ii. Reinforcement of flexibility in the labour<br />

market;<br />

iii. Measures to tackle uninsured and illegal<br />

labour;<br />

iv. Restructuring of the social protection<br />

framework;<br />

v. Reforming the regulatory framework for<br />

competition; and<br />

vi. Establishing a new investment framework<br />

through a new development law, to attract<br />

foreign investment.<br />

These measures are an essential part of the<br />

adjustment process. While a sharp rebalancing in<br />

tax revenues and spending is needed in the short<br />

term, fiscal sustainability in the long term requires<br />

a return to more elevated and sustainable growth<br />

rates, which in turn require a significant<br />

improvement in Greece’s external<br />

competitiveness.<br />

• Finally, it contains an overhaul of the pension<br />

system including:<br />

i. Increase of women’s minimum retirement<br />

age to 65 years by the end of 2013, with the<br />

process starting in 2011;<br />

ii. Pensions to be calculated on the basis of<br />

earnings over the whole labour life cycle;<br />

iii. Increase in the minimum early retirement<br />

age to 60 years;<br />

iv. Increase of minimum contribution period<br />

from 37 to 40 years by 2015;<br />

v. Automatic adjustment of pensions to life<br />

expectancy; and<br />

vi. Reduction in the number of social security<br />

organisations (to three);<br />

The proposed pension reforms are a relevant aspect<br />

of the plan with potentially significant implications in<br />

the long term. The EU Commission estimated that,<br />

on unchanged legislation, age-related public<br />

spending would increase by 16% of GDP between<br />

2010 and 2060.<br />

Overall, the plan is certainly coherent, based on a set<br />

of more realistic assumptions than in the past and<br />

potentially able to deliver what Greece needs most at<br />

the moment, which is credibility.<br />

But the implications for growth of the envisaged fiscal<br />

correction, which are more credibly spelled out this<br />

time, would be massive. As we emphasised in<br />

previous research, such an adjustment in such a<br />

short time is unprecedented across advanced<br />

economy and its drag on GDP and employment is<br />

likely to be significant, questioning its social<br />

feasibility. This emphasises there is a persistent<br />

implementation risk which markets will continue to<br />

price in for a while.<br />

Moreover, even if the adjustment is implemented as<br />

planned, Greece would still land up with a debt-to-<br />

GDP ratio of around 145% in 2014. Under the<br />

assumption of nominal growth of 4% and interest<br />

rates of 6%, Greece would need a primary surplus of<br />

2.8% to stabilise the debt-to-GDP ratio at these<br />

levels. But under different assumptions for growth,<br />

the scenario would be less favourable. Persistent low<br />

nominal growth (equal to or less than 2% for<br />

example) is likely to be associated with higher risk<br />

premia (interest rates at or above 6%). In that case,<br />

the primary surplus needed to stabilise the debt-to-<br />

GDP ratio would shoot to 7.1% of GDP. This would<br />

probably be too costly from a social point of view,<br />

opening the door again to alternative options such as<br />

debt restructuring (for more on the possible<br />

scenarios for the Greek outlook see “Greece: What’s<br />

Next?” published on 29 April 2010).<br />

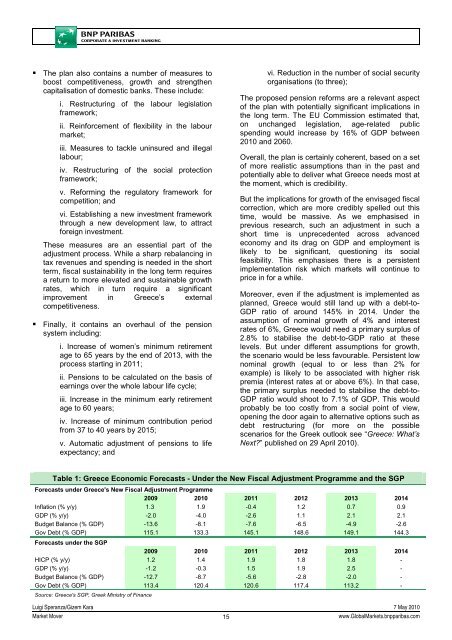

Table 1: Greece Economic Forecasts - Under the New Fiscal Adjustment Programme and the SGP<br />

Forecasts under Greece's New Fiscal Adjustment Programme<br />

2009 2010 2011 2012 2013 2014<br />

Inflation (% y/y) 1.3 1.9 -0.4 1.2 0.7 0.9<br />

GDP (% y/y) -2.0 -4.0 -2.6 1.1 2.1 2.1<br />

Budget Balance (% GDP) -13.6 -8.1 -7.6 -6.5 -4.9 -2.6<br />

Gov Debt (% GDP) 115.1 133.3 145.1 148.6 149.1 144.3<br />

Forecasts under the SGP<br />

2009 2010 2011 2012 2013 2014<br />

HICP (% y/y) 1.2 1.4 1.9 1.8 1.8 -<br />

GDP (% y/y) -1.2 -0.3 1.5 1.9 2.5 -<br />

Budget Balance (% GDP) -12.7 -8.7 -5.6 -2.8 -2.0 -<br />

Gov Debt (% GDP) 113.4 120.4 120.6 117.4 113.2 -<br />

Source: Greece's SGP, Greek Ministry of Finance<br />

Luigi Speranza/Gizem Kara 7 May 2010<br />

<strong>Market</strong> Mover<br />

15<br />

www.Global<strong>Market</strong>s.bnpparibas.com