MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

MARKET MOVER - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

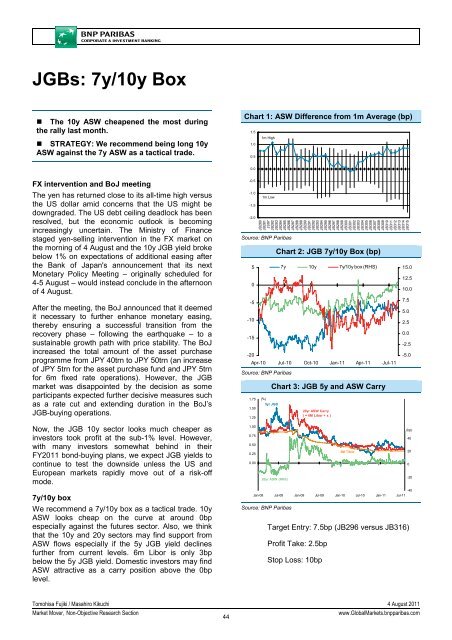

JGBs: 7y/10y Box<br />

• The 10y ASW cheapened the most during<br />

the rally last month.<br />

• STRATEGY: We recommend being long 10y<br />

ASW against the 7y ASW as a tactical trade.<br />

Chart 1: ASW Difference from 1m Average (bp)<br />

1.5<br />

1m High<br />

1.0<br />

0.5<br />

0.0<br />

FX intervention and BoJ meeting<br />

The yen has returned close to its all-time high versus<br />

the US dollar amid concerns that the US might be<br />

downgraded. The US debt ceiling deadlock has been<br />

resolved, but the economic outlook is becoming<br />

increasingly uncertain. The Ministry of Finance<br />

staged yen-selling intervention in the FX market on<br />

the morning of 4 August and the 10y JGB yield broke<br />

below 1% on expectations of additional easing after<br />

the Bank of Japan's announcement that its next<br />

Monetary Policy Meeting – originally scheduled for<br />

4-5 August – would instead conclude in the afternoon<br />

of 4 August.<br />

After the meeting, the BoJ announced that it deemed<br />

it necessary to further enhance monetary easing,<br />

thereby ensuring a successful transition from the<br />

recovery phase – following the earthquake – to a<br />

sustainable growth path with price stability. The BoJ<br />

increased the total amount of the asset purchase<br />

programme from JPY 40trn to JPY 50trn (an increase<br />

of JPY 5trn for the asset purchase fund and JPY 5trn<br />

for 6m fixed rate operations). However, the JGB<br />

market was disappointed by the decision as some<br />

participants expected further decisive measures such<br />

as a rate cut and extending duration in the BoJ’s<br />

JGB-buying operations.<br />

Now, the JGB 10y sector looks much cheaper as<br />

investors took profit at the sub-1% level. However,<br />

with many investors somewhat behind in their<br />

FY2011 bond-buying plans, we expect JGB yields to<br />

continue to test the downside unless the US and<br />

European markets rapidly move out of a risk-off<br />

mode.<br />

7y/10y box<br />

We recommend a 7y/10y box as a tactical trade. 10y<br />

ASW looks cheap on the curve at around 0bp<br />

especially against the futures sector. Also, we think<br />

that the 10y and 20y sectors may find support from<br />

ASW flows especially if the 5y JGB yield declines<br />

further from current levels. 6m Libor is only 3bp<br />

below the 5y JGB yield. Domestic investors may find<br />

ASW attractive as a carry position above the 0bp<br />

level.<br />

-0.5<br />

-1.0<br />

-1.5<br />

-2.0<br />

1m Low<br />

JB280<br />

JB281<br />

JS97<br />

JB282<br />

JB283<br />

JB284<br />

JB285<br />

JB286<br />

JB287<br />

JB288<br />

JB289<br />

JB290<br />

JB291<br />

JB292<br />

JB293<br />

JB294<br />

JB295<br />

JB296<br />

JB297<br />

JB298<br />

JB299<br />

JB300<br />

JB301<br />

JB302<br />

JB303<br />

JB304<br />

JB305<br />

JB306<br />

JB307<br />

JB308<br />

JB309<br />

JB310<br />

JB311<br />

JB312<br />

JB313<br />

JB314<br />

JB315<br />

Source: <strong>BNP</strong> Paribas<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

-20<br />

Chart 2: JGB 7y/10y Box (bp)<br />

Apr-10 Jul-10 Oct-10 Jan-11 Apr-11 Jul-11<br />

Source: <strong>BNP</strong> Paribas<br />

1.75<br />

1.50<br />

1.25<br />

1.00<br />

0.75<br />

0.50<br />

0.25<br />

0.00<br />

-0.25<br />

-0.50<br />

(%)<br />

5yr JGB<br />

7y 10y 7y/10y box (RHS)<br />

Chart 3: JGB 5y and ASW Carry<br />

20yr ASW (RHS)<br />

Target Entry: 7.5bp (JB296 versus JB316)<br />

Profit Take: 2.5bp<br />

Stop Loss: 10bp<br />

15.0<br />

12.5<br />

10.0<br />

7.5<br />

5.0<br />

2.5<br />

0.0<br />

-2.5<br />

-5.0<br />

60<br />

(bp)<br />

-0.75<br />

-40<br />

Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11<br />

Source: <strong>BNP</strong> Paribas<br />

20yr ASW Carry<br />

( = 6M Libor + x )<br />

3M Tibor<br />

100<br />

80<br />

40<br />

20<br />

0<br />

-20<br />

Tomohisa Fujiki / Masahiro Kikuchi 4 August 2011<br />

Market Mover, Non-Objective Research Section<br />

44<br />

www.GlobalMarkets.bnpparibas.com