Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

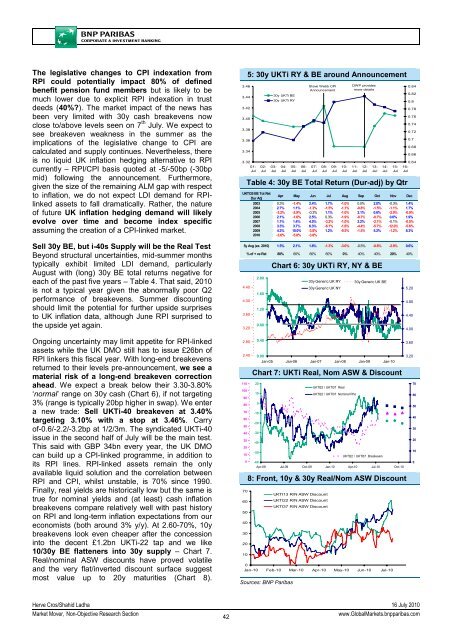

The legislative changes to CPI indexation from<br />

RPI could potentially impact 80% of defined<br />

benefit pension fund members but is likely to be<br />

much lower due to explicit RPI indexation in trust<br />

deeds (40%?). The market impact of the news has<br />

been very limited with 30y cash breakevens now<br />

close to/above levels seen on 7 th July. We expect to<br />

see breakeven weakness in the summer as the<br />

implications of the legislative change to CPI are<br />

calculated and supply continues. Nevertheless, there<br />

is no liquid UK inflation hedging alternative to RPI<br />

currently – RPI/CPI basis quoted at -5/-50bp (-30bp<br />

mid) following the announcement. Furthermore,<br />

given the size of the remaining ALM gap with respect<br />

to inflation, we do not expect LDI demand for RPIlinked<br />

assets to fall dramatically. Rather, the nature<br />

of future UK inflation hedging demand will likely<br />

evolve over time and become index specific<br />

assuming the creation of a CPI-linked market.<br />

Sell 30y BE, but i-40s Supply will be the Real Test<br />

Beyond structural uncertainties, mid-summer months<br />

typically exhibit limited LDI demand, particularly<br />

August with (long) 30y BE total returns negative for<br />

each of the past five years – Table 4. That said, 2010<br />

is not a typical year given the abnormally poor Q2<br />

performance of breakevens. Summer discounting<br />

should limit the potential for further upside surprises<br />

to UK inflation data, although June RPI surprised to<br />

the upside yet again.<br />

Ongoing uncertainty may limit appetite for RPI-linked<br />

assets while the UK DMO still has to issue £26bn of<br />

RPI linkers this fiscal year. With long-end breakevens<br />

returned to their levels pre-announcement, we see a<br />

material risk of a long-end breakeven correction<br />

ahead. We expect a break below their 3.30-3.80%<br />

‘normal’ range on 30y cash (Chart 6), if not targeting<br />

3% (range is typically 20bp higher in swap). We enter<br />

a new trade: Sell UKTi-40 breakeven at 3.40%<br />

targeting 3.10% with a stop at 3.46%. Carry<br />

of-0.6/-2.2/-3.2bp at 1/2/3m. The syndicated UKTi-40<br />

issue in the second half of July will be the main test.<br />

This said with GBP 34bn every year, the UK DMO<br />

can build up a CPI-linked programme, in addition to<br />

its RPI lines. RPI-linked assets remain the only<br />

available liquid solution and the correlation between<br />

RPI and CPI, whilst unstable, is 70% since 1990.<br />

Finally, real yields are historically low but the same is<br />

true for nominal yields and (at least) cash inflation<br />

breakevens compare relatively well with past history<br />

on RPI and long-term inflation expectations from our<br />

economists (both around 3% y/y). At 2.60-70%, 10y<br />

breakevens look even cheaper after the concession<br />

into the decent £1.2bn UKTi-22 tap and we like<br />

10/30y BE flatteners into 30y supply – Chart 7.<br />

Real/nominal ASW discounts have proved volatile<br />

and the very flat/inverted discount surface suggest<br />

most value up to 20y maturities (Chart 8).<br />

3.46<br />

3.44<br />

3.42<br />

3.40<br />

3.38<br />

3.36<br />

3.34<br />

5: 30y UKTi RY & BE around Announcement<br />

3.32<br />

01-<br />

Jul<br />

02-<br />

Jul<br />

30y UKTi BE<br />

30y UKTi RY<br />

03-<br />

Jul<br />

04-<br />

Jul<br />

05-<br />

Jul<br />

06-<br />

Jul<br />

Steve Webb CPI<br />

Announcement<br />

07-<br />

Jul<br />

08-<br />

Jul<br />

09-<br />

Jul<br />

10-<br />

Jul<br />

DWP provides<br />

more details<br />

Table 4: 30y BE Total Return (Dur-adj) by Qtr<br />

11-<br />

Jul<br />

12-<br />

Jul<br />

13-<br />

Jul<br />

14-<br />

Jul<br />

15-<br />

Jul<br />

0.84<br />

0.82<br />

0.8<br />

0.78<br />

0.76<br />

0.74<br />

0.72<br />

0.7<br />

0.68<br />

0.66<br />

0.64<br />

16-<br />

Jul<br />

UKTI35 BE Tot Ret<br />

Dur Adj<br />

Apr May Jun Jul Aug Sep Oct Nov Dec<br />

2003 0.3% -1.4% 2.4% 1.7% -1.0% 0.0% 2.0% -0.3% 1.4%<br />

2004 2.7% 1.1% -1.3% -1.5% -1.1% -0.8% -1.5% -1.1% 1.7%<br />

2005 -3.2% -2.9% -0.3% 1.1% -1.0% 2.1% 0.6% -2.0% -0.9%<br />

2006 2.1% -1.6% 2.5% 0.3% -1.9% -0.7% -0.7% 0.6% 1.9%<br />

2007 1.1% 1.4% 4.5% -3.2% -1.0% 2.2% -2.1% -0.1% -0.5%<br />

2008 3.3% 3.7% 6.3% -6.1% -1.6% -4.4% -5.7% -12.0% -5.6%<br />

2009 4.2% 10.0% -3.8% 1.2% -9.5% -1.5% 5.2% -1.2% 8.3%<br />

2010 -3.6% -5.8% -3.8%<br />

5y Avg (ex. 2010) 1.5% 2.1% 1.8% -1.3% -3.0% -0.5% -0.6% -2.9% 0.6%<br />

4.40<br />

4.00<br />

3.60<br />

3.20<br />

2.80<br />

2.40<br />

110<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

% of + ve Ret 80% 60% 60% 60% 0% 40% 40% 20% 40%<br />

2.00<br />

1.60<br />

1.20<br />

0.80<br />

0.40<br />

Chart 6: 30y UKTi RY, NY & BE<br />

30y Generic UK RY<br />

30y Generic UK NY<br />

30y Generic UK BE<br />

0.00<br />

Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10<br />

Chart 7: UKTi Real, Nom ASW & Discount<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

-40<br />

-50<br />

UKTI22 / UKTI37 Real<br />

UKTI22 / UKTI37 Nominal Rhs<br />

UKTI22 / UKTI37 Breakeven<br />

-60<br />

Apr-09 Jul-09 Oct-09 Jan-10 Apr-10 Jul-10 Oct-10<br />

8: Front, 10y & 30y Real/Nom ASW Discount<br />

0<br />

Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10 Jul-10<br />

Sources: <strong>BNP</strong> Paribas<br />

UKTI13 R/N ASW Discount<br />

UKTI22 R/N ASW Discount<br />

UKTI37 R/N ASW Discount<br />

5.20<br />

4.80<br />

4.40<br />

4.00<br />

3.60<br />

3.20<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Herve Cros/Shahid Ladha 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

42<br />

www.Global<strong>Market</strong>s.bnpparibas.com