Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

US: Corporate Issuance and Swap Spreads<br />

• Summer doldrums: USD high grade<br />

corporate bond issuance tends to be lowest in<br />

the months of July and August, averaging USD<br />

48bn (5.6%) and USD 58bn (6.7% of total<br />

issuance for the year), respectively, over the<br />

past five years (Chart 3). Despite predictions<br />

by some analysts of an increase in corporate<br />

issuance for the summer of 2010, July<br />

issuance so far is right on trend at USD 33<br />

billion, and will likely slow through the<br />

remainder of the month as US earnings season<br />

enters high gear.<br />

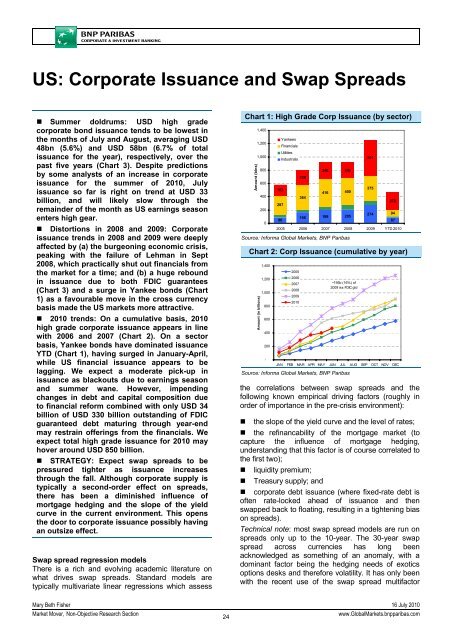

• Distortions in 2008 and 2009: Corporate<br />

issuance trends in 2008 and 2009 were deeply<br />

affected by (a) the burgeoning economic crisis,<br />

peaking with the failure of Lehman in Sept<br />

2008, which practically shut out financials from<br />

the market for a time; and (b) a huge rebound<br />

in issuance due to both FDIC guarantees<br />

(Chart 3) and a surge in Yankee bonds (Chart<br />

1) as a favourable move in the cross currency<br />

basis made the US markets more attractive.<br />

• 2010 trends: On a cumulative basis, 2010<br />

high grade corporate issuance appears in line<br />

with 2006 and 2007 (Chart 2). On a sector<br />

basis, Yankee bonds have dominated issuance<br />

YTD (Chart 1), having surged in January-April,<br />

while US financial issuance appears to be<br />

lagging. We expect a moderate pick-up in<br />

issuance as blackouts due to earnings season<br />

and summer wane. However, impending<br />

changes in debt and capital composition due<br />

to financial reform combined with only USD 34<br />

billion of USD 330 billion outstanding of FDIC<br />

guaranteed debt maturing through year-end<br />

may restrain offerings from the financials. We<br />

expect total high grade issuance for 2010 may<br />

hover around USD 850 billion.<br />

• STRATEGY: Expect swap spreads to be<br />

pressured tighter as issuance increases<br />

through the fall. Although corporate supply is<br />

typically a second-order effect on spreads,<br />

there has been a diminished influence of<br />

mortgage hedging and the slope of the yield<br />

curve in the current environment. This opens<br />

the door to corporate issuance possibly having<br />

an outsize effect.<br />

Swap spread regression models<br />

There is a rich and evolving academic literature on<br />

what drives swap spreads. Standard models are<br />

typically multivariate linear regressions which assess<br />

Chart 1: High Grade Corp Issuance (by sector)<br />

Amount (blns)<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

163<br />

287<br />

86<br />

Yankees<br />

Financials<br />

Utilities<br />

Industrials<br />

238<br />

364<br />

248 242<br />

416 400<br />

166 199 205<br />

the correlations between swap spreads and the<br />

following known empirical driving factors (roughly in<br />

order of importance in the pre-crisis environment):<br />

• the slope of the yield curve and the level of rates;<br />

• the refinancability of the mortgage market (to<br />

capture the influence of mortgage hedging,<br />

understanding that this factor is of course correlated to<br />

the first two);<br />

• liquidity premium;<br />

• Treasury supply; and<br />

• corporate debt issuance (where fixed-rate debt is<br />

often rate-locked ahead of issuance and then<br />

swapped back to floating, resulting in a tightening bias<br />

on spreads).<br />

Technical note: most swap spread models are run on<br />

spreads only up to the 10-year. The 30-year swap<br />

spread across currencies has long been<br />

acknowledged as something of an anomaly, with a<br />

dominant factor being the hedging needs of exotics<br />

options desks and therefore volatility. It has only been<br />

with the recent use of the swap spread multifactor<br />

541<br />

375<br />

274<br />

270<br />

94<br />

87<br />

2005 2006 2007 2008 2009 YTD 2010<br />

Source: Informa Global <strong>Market</strong>s, <strong>BNP</strong> Paribas<br />

Chart 2: Corp Issuance (cumulative by year)<br />

Amount (in billions)<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

-<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

~195b (16%) of<br />

2009 iss FDIC gtd<br />

JAN FEB MA R APR MAY JUN JUL AUG SEP OCT NOV DEC<br />

Source: Informa Global <strong>Market</strong>s, <strong>BNP</strong> Paribas<br />

Mary Beth Fisher 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

24<br />

www.Global<strong>Market</strong>s.bnpparibas.com