Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The question is whether the 110 resistance can<br />

be broken on a sustainable basis; for us, it could<br />

only happen if a majority of bears throw the towel<br />

after a strong rally in equities. Can it happen in the<br />

current macro environment? We have some doubts<br />

and even if the tone of the earnings season<br />

remains on the positive side (so far, the three blue<br />

chips which reported, Alcoa, Intel and JPM, came<br />

above forecasts), the outlook can not be<br />

promising enough to trigger an equity rally that<br />

sends MAIN below 100.<br />

What’s the call? The only strategy which makes<br />

sense to us for the moment is to play the 110-120<br />

range.<br />

MAIN vs. FIN SEN<br />

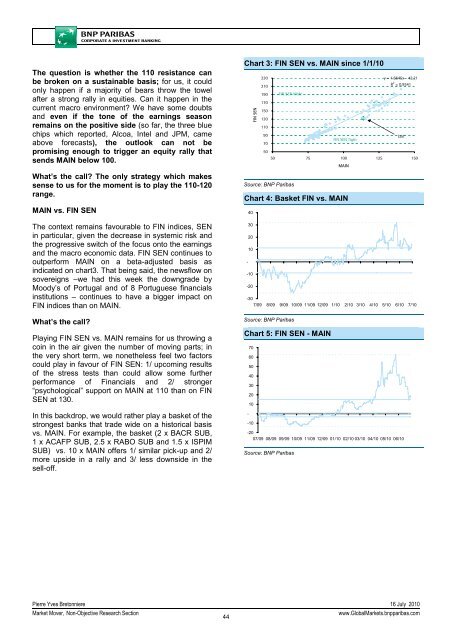

The context remains favourable to FIN indices, SEN<br />

in particular, given the decrease in systemic risk and<br />

the progressive switch of the focus onto the earnings<br />

and the macro economic data. FIN SEN continues to<br />

outperform MAIN on a beta-adjusted basis as<br />

indicated on chart3. That being said, the newsflow on<br />

sovereigns –we had this week the downgrade by<br />

Moody’s of Portugal and of 8 Portuguese financials<br />

institutions – continues to have a bigger impact on<br />

FIN indices than on MAIN.<br />

What’s the call?<br />

Playing FIN SEN vs. MAIN remains for us throwing a<br />

coin in the air given the number of moving parts; in<br />

the very short term, we nonetheless feel two factors<br />

could play in favour of FIN SEN: 1/ upcoming results<br />

of the stress tests than could allow some further<br />

performance of Financials and 2/ stronger<br />

“psychological” support on MAIN at 110 than on FIN<br />

SEN at 130.<br />

In this backdrop, we would rather play a basket of the<br />

strongest banks that trade wide on a historical basis<br />

vs. MAIN. For example, the basket (2 x BACR SUB,<br />

1 x ACAFP SUB, 2.5 x RABO SUB and 1.5 x ISPIM<br />

SUB) vs. 10 x MAIN offers 1/ similar pick-up and 2/<br />

more upside in a rally and 3/ less downside in the<br />

sell-off.<br />

Chart 3: FIN SEN vs. MAIN since 1/1/10<br />

FIN SEN<br />

230<br />

210<br />

190<br />

170<br />

150<br />

130<br />

110<br />

90<br />

70<br />

50<br />

FIN SEN Wide<br />

Source: <strong>BNP</strong> Paribas<br />

FIN SEN Tight<br />

y = 1.6645x - 42.21<br />

R 2 = 0.9541<br />

50 75 100 125 150<br />

MAIN<br />

Chart 4: Basket FIN vs. MAIN<br />

-<br />

40<br />

30<br />

20<br />

10<br />

-10<br />

-20<br />

-30<br />

7/09 8/09 9/09 10/09 11/09 12/09 1/10 2/10 3/10 4/10 5/10 6/10 7/10<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 5: FIN SEN - MAIN<br />

-<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

-10<br />

-20<br />

07/09 08/09 09/09 10/09 11/09 12/09 01/10 02/10 03/10 04/10 05/10 06/10<br />

Source: <strong>BNP</strong> Paribas<br />

Last<br />

Pierre Yves Bretonniere 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

44<br />

www.Global<strong>Market</strong>s.bnpparibas.com