Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

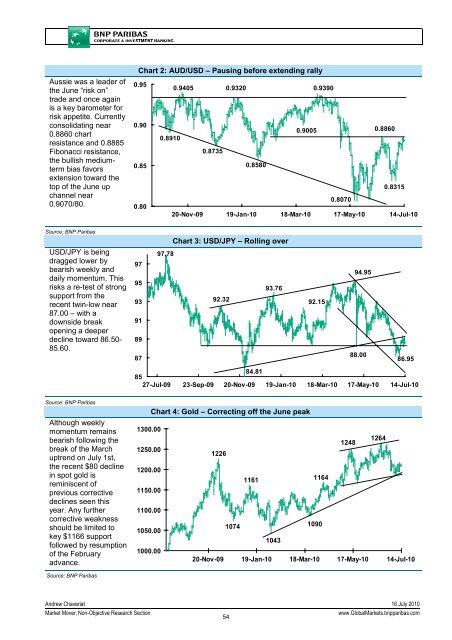

Chart 2: AUD/USD – Pausing before extending rally<br />

Aussie was a leader of<br />

the June “risk on”<br />

trade and once again<br />

is a key barometer for<br />

risk appetite. Currently<br />

0.95<br />

0.9405<br />

0.9320<br />

0.9390<br />

consolidating near 0.90<br />

0.9005<br />

0.8860 chart<br />

0.8910<br />

resistance and 0.8885<br />

Fibonacci resistance,<br />

0.8735<br />

the bullish mediumterm<br />

bias favors<br />

extension toward the<br />

top of the June up<br />

0.85<br />

0.8580<br />

channel near<br />

0.9070/80. 0.80<br />

0.8070<br />

20-Nov-09 19-Jan-10 18-Mar-10 17-May-10<br />

0.8860<br />

0.8315<br />

14-Jul-10<br />

Source: <strong>BNP</strong> Paribas<br />

USD/JPY is being<br />

dragged lower by<br />

bearish weekly and<br />

daily momentum. This<br />

risks a re-test of strong<br />

support from the<br />

recent twin-low near<br />

87.00 – with a<br />

downside break<br />

opening a deeper<br />

decline toward 86.50-<br />

85.60.<br />

97<br />

95<br />

93<br />

91<br />

89<br />

87<br />

Chart 3: USD/JPY – Rolling over<br />

97.78<br />

93.76<br />

92.32<br />

92.15<br />

94.95<br />

88.00<br />

86.95<br />

85<br />

27-Jul-09<br />

23-Sep-09<br />

84.81<br />

20-Nov-09<br />

19-Jan-10<br />

18-Mar-10<br />

17-May-10<br />

14-Jul-10<br />

Source: <strong>BNP</strong> Paribas<br />

Although weekly<br />

momentum remains<br />

bearish following the<br />

break of the March<br />

uptrend on July 1st,<br />

the recent $80 decline<br />

in spot gold is<br />

reminiscent of<br />

previous corrective<br />

declines seen this<br />

year. Any further<br />

corrective weakness<br />

should be limited to<br />

key $1166 support<br />

followed by resumption<br />

of the February<br />

advance.<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 4: Gold – Correcting off the June peak<br />

1300.00<br />

1250.00<br />

1226<br />

1200.00<br />

1161<br />

1164<br />

1150.00<br />

1100.00<br />

1050.00<br />

1074<br />

1090<br />

1043<br />

1000.00<br />

20-Nov-09 19-Jan-10 18-Mar-10<br />

1264<br />

1248<br />

17-May-10 14-Jul-10<br />

Andrew Chaveriat 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

54<br />

www.Global<strong>Market</strong>s.bnpparibas.com