Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EUR: Yet Another Volatility Deflation Trade<br />

• With the exception of severe dislocations at<br />

the height of the credit crisis, the 10y10y skew<br />

has undergone flattening and steepening<br />

pressures with rising rates and falling rates,<br />

respectively.<br />

• STRATEGY: Buy the EUR 10y10y<br />

3.50%-2.75%-1.00% swaption receiver ladder.<br />

Historically, there has been a negative relationship<br />

between the steepness of the swaption implied<br />

volatility skew and the level of rates. This makes<br />

intuitive sense: everything else being equal, at higher<br />

levels of rates, deep out-of-the-money swaption<br />

receivers are more attractive than deep out-of-themoney<br />

payers. The opposite holds when rates are<br />

low.<br />

2.0<br />

2.5<br />

3.0<br />

3.5<br />

4.0<br />

4.5<br />

5.0<br />

5.5<br />

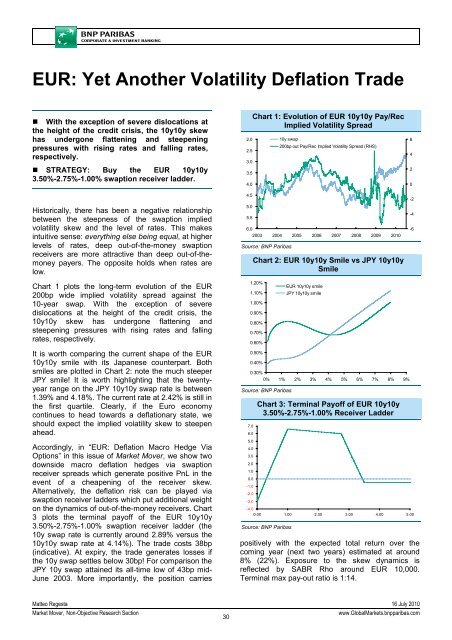

Chart 1: Evolution of EUR 10y10y Pay/Rec<br />

Implied Volatility Spread<br />

10y swap<br />

6.0<br />

2003 2004 2005 2006 2007 2008 2009 2010<br />

Source: <strong>BNP</strong> Paribas<br />

200bp out Pay/Rec Implied Volatility Spread (RHS)<br />

Chart 2: EUR 10y10y Smile vs JPY 10y10y<br />

Smile<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

Chart 1 plots the long-term evolution of the EUR<br />

200bp wide implied volatility spread against the<br />

10-year swap. With the exception of severe<br />

dislocations at the height of the credit crisis, the<br />

10y10y skew has undergone flattening and<br />

steepening pressures with rising rates and falling<br />

rates, respectively.<br />

It is worth comparing the current shape of the EUR<br />

10y10y smile with its Japanese counterpart. Both<br />

smiles are plotted in Chart 2: note the much steeper<br />

JPY smile! It is worth highlighting that the twentyyear<br />

range on the JPY 10y10y swap rate is between<br />

1.39% and 4.18%. The current rate at 2.42% is still in<br />

the first quartile. Clearly, if the Euro economy<br />

continues to head towards a deflationary state, we<br />

should expect the implied volatility skew to steepen<br />

ahead.<br />

Accordingly, in “EUR: Deflation Macro Hedge Via<br />

Options” in this issue of <strong>Market</strong> Mover, we show two<br />

downside macro deflation hedges via swaption<br />

receiver spreads which generate positive PnL in the<br />

event of a cheapening of the receiver skew.<br />

Alternatively, the deflation risk can be played via<br />

swaption receiver ladders which put additional weight<br />

on the dynamics of out-of-the-money receivers. Chart<br />

3 plots the terminal payoff of the EUR 10y10y<br />

3.50%-2.75%-1.00% swaption receiver ladder (the<br />

10y swap rate is currently around 2.89% versus the<br />

10y10y swap rate at 4.14%). The trade costs 38bp<br />

(indicative). At expiry, the trade generates losses if<br />

the 10y swap settles below 30bp! For comparison the<br />

JPY 10y swap attained its all-time low of 43bp mid-<br />

June 2003. More importantly, the position carries<br />

1.20%<br />

1.10%<br />

1.00%<br />

0.90%<br />

0.80%<br />

0.70%<br />

0.60%<br />

0.50%<br />

0.40%<br />

EUR 10y10y smile<br />

JPY 10y10y smile<br />

0.30%<br />

0% 1% 2% 3% 4% 5% 6% 7% 8% 9%<br />

Source: <strong>BNP</strong> Paribas<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

0.0<br />

-1.0<br />

-2.0<br />

-3.0<br />

Chart 3: Terminal Payoff of EUR 10y10y<br />

3.50%-2.75%-1.00% Receiver Ladder<br />

-4.0<br />

0.00 1.00 2.00 3.00 4.00 5.00<br />

Source: <strong>BNP</strong> Paribas<br />

positively with the expected total return over the<br />

coming year (next two years) estimated at around<br />

8% (22%). Exposure to the skew dynamics is<br />

reflected by SABR Rho around EUR 10,000.<br />

Terminal max pay-out ratio is 1:14.<br />

Matteo Regesta 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

30<br />

www.Global<strong>Market</strong>s.bnpparibas.com