Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

swaps. The overall volume of USD 9.2 bn was small<br />

compared to the system-wide fails. Granted, a chain of<br />

fails can show up as an artificially high number but the<br />

magnitudes are clearly a multiple. While convexity is a<br />

concern in these coupons, the limited response to lower<br />

rates and the reduced float will only serve to exacerbate<br />

the squeeze in the coupons.<br />

Could refi's on higher coupons pick up in coming<br />

months?<br />

In a pre-prepay note, we had discussed that banks<br />

may have processed applications quicker in June to<br />

save capital by converting loans to MBS. This may<br />

have caused elevated June supply, possibly causing<br />

prepays to come in higher than expected (June<br />

borrowing prepays from July). Prepays on lower<br />

coupons did come in faster than expected but those<br />

on higher coupons didn’t. However, if banks did<br />

indeed process applications quicker, those with<br />

cleaner credit would have likely been processed<br />

more easily. This may explain the sharp discrepancy<br />

in prepays in the coupon stack.<br />

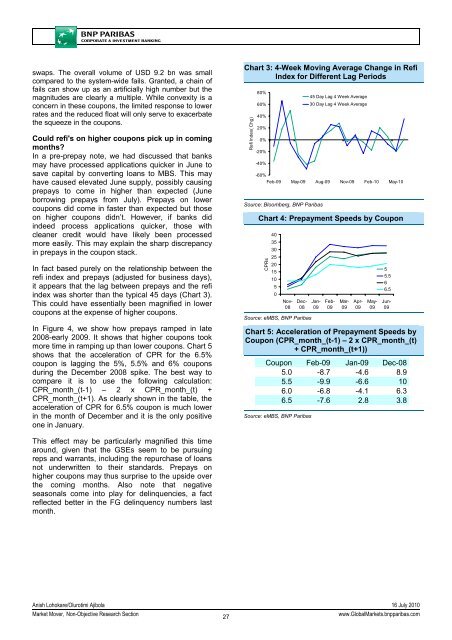

In fact based purely on the relationship between the<br />

refi index and prepays (adjusted for business days),<br />

it appears that the lag between prepays and the refi<br />

index was shorter than the typical 45 days (Chart 3).<br />

This could have essentially been magnified in lower<br />

coupons at the expense of higher coupons.<br />

In Figure 4, we show how prepays ramped in late<br />

2008-early 2009. It shows that higher coupons took<br />

more time in ramping up than lower coupons. Chart 5<br />

shows that the acceleration of CPR for the 6.5%<br />

coupon is lagging the 5%, 5.5% and 6% coupons<br />

during the December 2008 spike. The best way to<br />

compare it is to use the following calculation:<br />

CPR_month_(t-1) – 2 x CPR_month_(t) +<br />

CPR_month_(t+1). As clearly shown in the table, the<br />

acceleration of CPR for 6.5% coupon is much lower<br />

in the month of December and it is the only positive<br />

one in January.<br />

Chart 3: 4-Week Moving Average Change in Refi<br />

Index for Different Lag Periods<br />

Refi Index( Chg)<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

-20%<br />

-40%<br />

-60%<br />

Feb-09 May-09 Aug-09 Nov-09 Feb-10 May-10<br />

Source: Bloomberg, <strong>BNP</strong> Paribas<br />

45 Day Lag 4 Week Average<br />

30 Day Lag 4 Week Average<br />

Chart 4: Prepayment Speeds by Coupon<br />

CPRs<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Nov-<br />

08<br />

Dec-<br />

08<br />

Source: eMBS, <strong>BNP</strong> Paribas<br />

Jan-<br />

09<br />

Feb-<br />

09<br />

Mar-<br />

09<br />

Apr-<br />

09<br />

May-<br />

09<br />

5<br />

5.5<br />

6<br />

6.5<br />

Jun-<br />

09<br />

Chart 5: Acceleration of Prepayment Speeds by<br />

Coupon (CPR_month_(t-1) – 2 x CPR_month_(t)<br />

+ CPR_month_(t+1))<br />

Coupon Feb-09 Jan-09 Dec-08<br />

5.0 -8.7 -4.6 8.9<br />

5.5 -9.9 -6.6 10<br />

6.0 -6.8 -4.1 6.3<br />

6.5 -7.6 2.8 3.8<br />

Source: eMBS, <strong>BNP</strong> Paribas<br />

This effect may be particularly magnified this time<br />

around, given that the GSEs seem to be pursuing<br />

reps and warrants, including the repurchase of loans<br />

not underwritten to their standards. Prepays on<br />

higher coupons may thus surprise to the upside over<br />

the coming months. Also note that negative<br />

seasonals come into play for delinquencies, a fact<br />

reflected better in the FG delinquency numbers last<br />

month.<br />

Anish Lohokare/Olurotimi Ajibola 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

27<br />

www.Global<strong>Market</strong>s.bnpparibas.com