Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

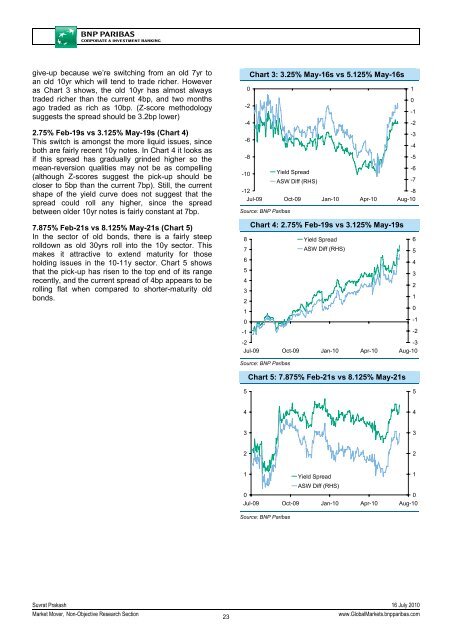

give-up because we’re switching from an old 7yr to<br />

an old 10yr which will tend to trade richer. However<br />

as Chart 3 shows, the old 10yr has almost always<br />

traded richer than the current 4bp, and two months<br />

ago traded as rich as 10bp. (Z-score methodology<br />

suggests the spread should be 3.2bp lower)<br />

2.75% Feb-19s vs 3.125% May-19s (Chart 4)<br />

This switch is amongst the more liquid issues, since<br />

both are fairly recent 10y notes. In Chart 4 it looks as<br />

if this spread has gradually grinded higher so the<br />

mean-reversion qualities may not be as compelling<br />

(although Z-scores suggest the pick-up should be<br />

closer to 5bp than the current 7bp). Still, the current<br />

shape of the yield curve does not suggest that the<br />

spread could roll any higher, since the spread<br />

between older 10yr notes is fairly constant at 7bp.<br />

Chart 3: 3.25% May-16s vs 5.125% May-16s<br />

0<br />

1<br />

0<br />

-2<br />

-1<br />

-4<br />

-2<br />

-3<br />

-6<br />

-4<br />

-8<br />

-5<br />

-10 Yield Spread<br />

-6<br />

ASW Diff (RHS)<br />

-7<br />

-12<br />

-8<br />

Jul-09 Oct-09 Jan-10 Apr-10 Aug-10<br />

Source: <strong>BNP</strong> Paribas<br />

7.875% Feb-21s vs 8.125% May-21s (Chart 5)<br />

In the sector of old bonds, there is a fairly steep<br />

rolldown as old 30yrs roll into the 10y sector. This<br />

makes it attractive to extend maturity for those<br />

holding issues in the 10-11y sector. Chart 5 shows<br />

that the pick-up has risen to the top end of its range<br />

recently, and the current spread of 4bp appears to be<br />

rolling flat when compared to shorter-maturity old<br />

bonds.<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

Chart 4: 2.75% Feb-19s vs 3.125% May-19s<br />

Yield Spread<br />

ASW Diff (RHS)<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

0<br />

-1<br />

-1<br />

-2<br />

-2<br />

-3<br />

Jul-09 Oct-09 Jan-10 Apr-10 Aug-10<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 5: 7.875% Feb-21s vs 8.125% May-21s<br />

5<br />

5<br />

4<br />

4<br />

3<br />

3<br />

2<br />

2<br />

1<br />

Yield Spread<br />

1<br />

ASW Diff (RHS)<br />

0<br />

0<br />

Jul-09 Oct-09 Jan-10 Apr-10 Aug-10<br />

Source: <strong>BNP</strong> Paribas<br />

Suvrat Prakash 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

23<br />

www.Global<strong>Market</strong>s.bnpparibas.com