Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

At first glance, this latest development is puzzling. A<br />

current account surplus and changes in capital flows<br />

mean Denmark is still running a basic balance<br />

surplus, pointing to a stronger currency. Also, there is<br />

still a 25bp gap between the interest rate on<br />

certificates of deposit in Denmark and the ECB<br />

deposit rate – hence arbitrage opportunities continue.<br />

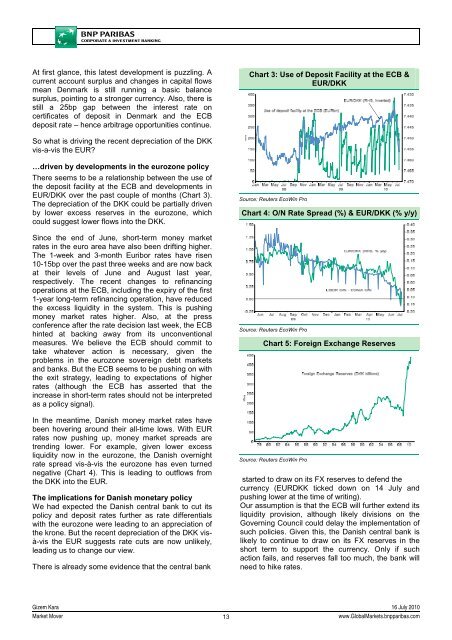

Chart 3: Use of Deposit Facility at the ECB &<br />

EUR/DKK<br />

So what is driving the recent depreciation of the DKK<br />

vis-a-vis the EUR?<br />

…driven by developments in the eurozone policy<br />

There seems to be a relationship between the use of<br />

the deposit facility at the ECB and developments in<br />

EUR/DKK over the past couple of months (Chart 3).<br />

The depreciation of the DKK could be partially driven<br />

by lower excess reserves in the eurozone, which<br />

could suggest lower flows into the DKK.<br />

Since the end of June, short-term money market<br />

rates in the euro area have also been drifting higher.<br />

The 1-week and 3-month Euribor rates have risen<br />

10-15bp over the past three weeks and are now back<br />

at their levels of June and August last year,<br />

respectively. The recent changes to refinancing<br />

operations at the ECB, including the expiry of the first<br />

1-year long-term refinancing operation, have reduced<br />

the excess liquidity in the system. This is pushing<br />

money market rates higher. Also, at the press<br />

conference after the rate decision last week, the ECB<br />

hinted at backing away from its unconventional<br />

measures. We believe the ECB should commit to<br />

take whatever action is necessary, given the<br />

problems in the eurozone sovereign debt markets<br />

and banks. But the ECB seems to be pushing on with<br />

the exit strategy, leading to expectations of higher<br />

rates (although the ECB has asserted that the<br />

increase in short-term rates should not be interpreted<br />

as a policy signal).<br />

In the meantime, Danish money market rates have<br />

been hovering around their all-time lows. With EUR<br />

rates now pushing up, money market spreads are<br />

trending lower. For example, given lower excess<br />

liquidity now in the eurozone, the Danish overnight<br />

rate spread vis-à-vis the eurozone has even turned<br />

negative (Chart 4). This is leading to outflows from<br />

the DKK into the EUR.<br />

The implications for Danish monetary policy<br />

We had expected the Danish central bank to cut its<br />

policy and deposit rates further as rate differentials<br />

with the eurozone were leading to an appreciation of<br />

the krone. But the recent depreciation of the DKK visà-vis<br />

the EUR suggests rate cuts are now unlikely,<br />

leading us to change our view.<br />

There is already some evidence that the central bank<br />

Source: Reuters EcoWin Pro<br />

Chart 4: O/N <strong>Rate</strong> Spread (%) & EUR/DKK (% y/y)<br />

Source: Reuters EcoWin Pro<br />

Chart 5: Foreign Exchange Reserves<br />

Source: Reuters EcoWin Pro<br />

started to draw on its FX reserves to defend the<br />

currency (EURDKK ticked down on 14 July and<br />

pushing lower at the time of writing).<br />

Our assumption is that the ECB will further extend its<br />

liquidity provision, although likely divisions on the<br />

Governing Council could delay the implementation of<br />

such policies. Given this, the Danish central bank is<br />

likely to continue to draw on its FX reserves in the<br />

short term to support the currency. Only if such<br />

action fails, and reserves fall too much, the bank will<br />

need to hike rates.<br />

Gizem Kara 16 July 2010<br />

<strong>Market</strong> Mover<br />

13<br />

www.Global<strong>Market</strong>s.bnpparibas.com