Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Returning to EURAUD Bearish Strategies<br />

• Initial signs of a slowdown in the Chinese<br />

and US economies are being met by a<br />

commitment to maintain (or even extend) loose<br />

policy…<br />

• …suggesting that investor confidence will<br />

be maintained. Hence we maintain our positive<br />

view on commodity currencies.<br />

• We recommend taking advantage of the<br />

euro’s current recovery to establish short<br />

EURAUD positions once again.<br />

• Indeed, we believe that the euro’s recent<br />

recovery is coming to an end as optimism<br />

regarding European rescue packages and<br />

stress tests starts to fade.<br />

Percent<br />

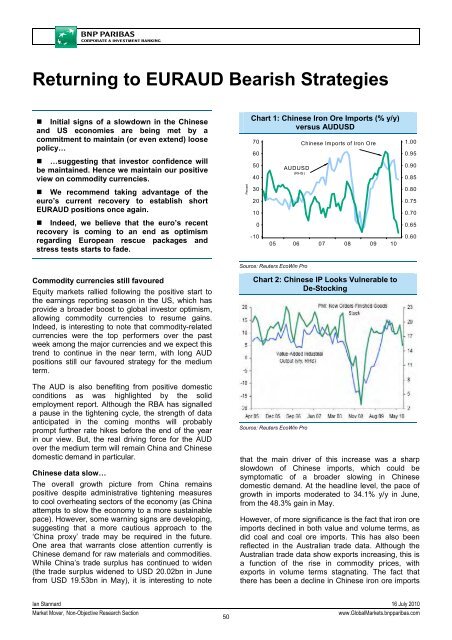

Chart 1: Chinese Iron Ore Imports (% y/y)<br />

versus AUDUSD<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

AUDUSD<br />

(RHS)<br />

Chinese Imports of Iron Ore<br />

05 06 07 08 09 10<br />

1.00<br />

0.95<br />

0.90<br />

0.85<br />

0.80<br />

0.75<br />

0.70<br />

0.65<br />

0.60<br />

Commodity currencies still favoured<br />

Equity markets rallied following the positive start to<br />

the earnings reporting season in the US, which has<br />

provide a broader boost to global investor optimism,<br />

allowing commodity currencies to resume gains.<br />

Indeed, is interesting to note that commodity-related<br />

currencies were the top performers over the past<br />

week among the major currencies and we expect this<br />

trend to continue in the near term, with long AUD<br />

positions still our favoured strategy for the medium<br />

term.<br />

Source: Reuters EcoWin Pro<br />

Chart 2: Chinese IP Looks Vulnerable to<br />

De-Stocking<br />

The AUD is also benefiting from positive domestic<br />

conditions as was highlighted by the solid<br />

employment report. Although the RBA has signalled<br />

a pause in the tightening cycle, the strength of data<br />

anticipated in the coming months will probably<br />

prompt further rate hikes before the end of the year<br />

in our view. But, the real driving force for the AUD<br />

over the medium term will remain China and Chinese<br />

domestic demand in particular.<br />

Chinese data slow…<br />

The overall growth picture from China remains<br />

positive despite administrative tightening measures<br />

to cool overheating sectors of the economy (as China<br />

attempts to slow the economy to a more sustainable<br />

pace). However, some warning signs are developing,<br />

suggesting that a more cautious approach to the<br />

‘China proxy’ trade may be required in the future.<br />

One area that warrants close attention currently is<br />

Chinese demand for raw materials and commodities.<br />

While China’s trade surplus has continued to widen<br />

(the trade surplus widened to USD 20.02bn in June<br />

from USD 19.53bn in May), it is interesting to note<br />

Source: Reuters EcoWin Pro<br />

that the main driver of this increase was a sharp<br />

slowdown of Chinese imports, which could be<br />

symptomatic of a broader slowing in Chinese<br />

domestic demand. At the headline level, the pace of<br />

growth in imports moderated to 34.1% y/y in June,<br />

from the 48.3% gain in May.<br />

However, of more significance is the fact that iron ore<br />

imports declined in both value and volume terms, as<br />

did coal and coal ore imports. This has also been<br />

reflected in the Australian trade data. Although the<br />

Australian trade data show exports increasing, this is<br />

a function of the rise in commodity prices, with<br />

exports in volume terms stagnating. The fact that<br />

there has been a decline in Chinese iron ore imports<br />

Ian Stannard 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

50<br />

www.Global<strong>Market</strong>s.bnpparibas.com