Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EUR: Deflation Macro Hedge Via Options<br />

• The probability of a Japan-style collapse in<br />

forward rates and the term structure has<br />

increased in line with a 75bp drop in 5Y5Y since<br />

the start of this year.<br />

• STRATEGY: Buy 2.9%-2.0% 5Y5Y receiver<br />

spreads at zero cost and positive carry.<br />

The process of adjustment towards a lower<br />

equilibrium long-term rate has been ongoing since<br />

the start of this year. We have made the case for<br />

lower 5Y5Y rates in a series of research notes (e.g.<br />

“EUR: Long-Term Equilibrium <strong>Rate</strong>s”, 5 March, and<br />

“EUR: Equilibrium <strong>Rate</strong>s Revisited”, 4 June). Here,<br />

we provide ways to play this theme with controlled<br />

downside risk.<br />

Since the start of this year, EUR 5Y5Y has declined<br />

by 75bp, reflecting a combination of rallying Bunds<br />

and flatter term structure. Outright bullish strategies<br />

such as 2.50% 5Y5Y receivers have performed very<br />

well on the back of this underlying dynamic (+75%).<br />

The main argument for such a strategy is based on<br />

long-term fundamental projections (Table 1). Our<br />

macro scenario implies another 50-55bp of decline in<br />

5Y5Y rates (based on long-term average growth,<br />

inflation and term premium). However, if we<br />

substitute our forecast with realised inflation and<br />

growth in Japan from the 1992-2002 sample, the<br />

argument for receiving 5Y5Y rates is even more<br />

compelling, as the equilibrium rate declines to around<br />

1.4%. Note that JPY 5Y5Y ended 2002 at around<br />

1.5%.<br />

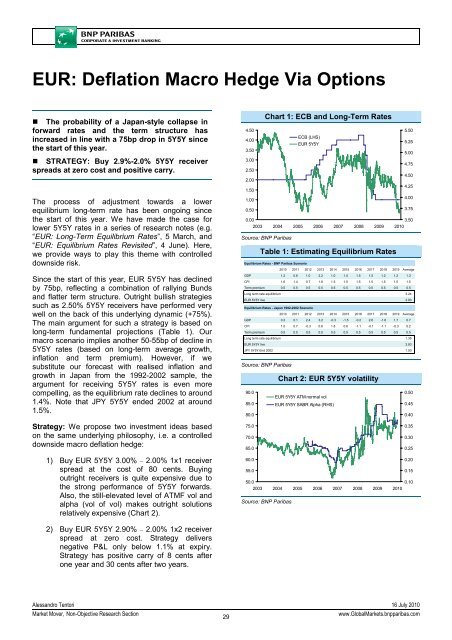

Chart 1: ECB and Long-Term <strong>Rate</strong>s<br />

4.50<br />

5.50<br />

4.00<br />

ECB (LHS)<br />

EUR 5Y5Y<br />

5.25<br />

3.50<br />

5.00<br />

3.00<br />

4.75<br />

2.50<br />

4.50<br />

2.00<br />

4.25<br />

1.50<br />

1.00<br />

4.00<br />

0.50<br />

3.75<br />

0.00<br />

3.50<br />

2003 2004 2005 2006 2007 2008 2009 2010<br />

Source: <strong>BNP</strong> Paribas<br />

Table 1: Estimating Equilibrium <strong>Rate</strong>s<br />

Equilibrium <strong>Rate</strong>s - <strong>BNP</strong> Paribas Scenario<br />

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Average<br />

GDP 1.2 0.6 1.0 2.2 1.0 1.5 1.5 1.5 1.2 1.2 1.3<br />

CPI 1.6 1.4 0.7 1.8 1.5 1.5 1.5 1.5 1.5 1.5 1.5<br />

Term premium 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5<br />

Long term rate equilibrium 3.24<br />

EUR 5Y5Y live 3.83<br />

Equilibrium <strong>Rate</strong>s - Japan 1992-2002 Scenario<br />

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Average<br />

GDP 0.3 0.1 2.4 3.2 -0.3 -1.5 -0.2 2.6 -1.6 1.7 0.7<br />

CPI 1.0 0.7 -0.3 0.6 1.8 0.6 -1.1 -0.1 -1.1 -0.3 0.2<br />

Term premium 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5 0.5<br />

Long term rate equilibrium 1.35<br />

EUR 5Y5Y live 3.83<br />

JPY 5Y5Y End 2002 1.50<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 2: EUR 5Y5Y volatility<br />

90.0<br />

0.50<br />

EUR 5Y5Y ATM normal vol<br />

85.0 EUR 5Y5Y SABR Alpha (RHS)<br />

0.45<br />

80.0<br />

0.40<br />

<strong>Strategy</strong>: We propose two investment ideas based<br />

on the same underlying philosophy, i.e. a controlled<br />

downside macro deflation hedge:<br />

75.0<br />

70.0<br />

65.0<br />

0.35<br />

0.30<br />

0.25<br />

1) Buy EUR 5Y5Y 3.00% – 2.00% 1x1 receiver<br />

spread at the cost of 80 cents. Buying<br />

outright receivers is quite expensive due to<br />

the strong performance of 5Y5Y forwards.<br />

Also, the still-elevated level of ATMF vol and<br />

alpha (vol of vol) makes outright solutions<br />

relatively expensive (Chart 2).<br />

60.0<br />

0.20<br />

55.0<br />

0.15<br />

50.0<br />

0.10<br />

2003 2004 2005 2006 2007 2008 2009 2010<br />

Source: <strong>BNP</strong> Paribas<br />

2) Buy EUR 5Y5Y 2.90% – 2.00% 1x2 receiver<br />

spread at zero cost. <strong>Strategy</strong> delivers<br />

negative P&L only below 1.1% at expiry.<br />

<strong>Strategy</strong> has positive carry of 8 cents after<br />

one year and 30 cents after two years.<br />

Alessandro Tentori 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

29<br />

www.Global<strong>Market</strong>s.bnpparibas.com