Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Global Inflation Watch<br />

June CPI in Focus<br />

The final release of the eurozone HICP for July<br />

showed a marginal rise in core inflation (from 0.85%<br />

y/y to 0.92%) offset by a slowdown in energy<br />

inflation, as a modest fall in energy prices over the<br />

month (-0.4%) was exacerbated by base effects. The<br />

modest acceleration in prices of clothing and<br />

recreational items probably reflects the impact of the<br />

weaker euro. Spanish data also revealed some passthrough<br />

from the VAT hike. We expect more in July<br />

but, with the main retailers announcing that they have<br />

not transferred it to their customers, the overall<br />

impact of the tax hike should remain limited (we<br />

assume a 40% pass-through, implying a boost to<br />

Spanish core inflation of around 0.6pp).<br />

All in all, neither the euro weakening nor the VAT<br />

increases implemented in some countries appears to<br />

be sufficient to halt the underlying downward trend in<br />

core inflation that we expect to resume from July,<br />

with aggressive discounts putting downward pressure<br />

on the prices of goods such as clothing and furniture.<br />

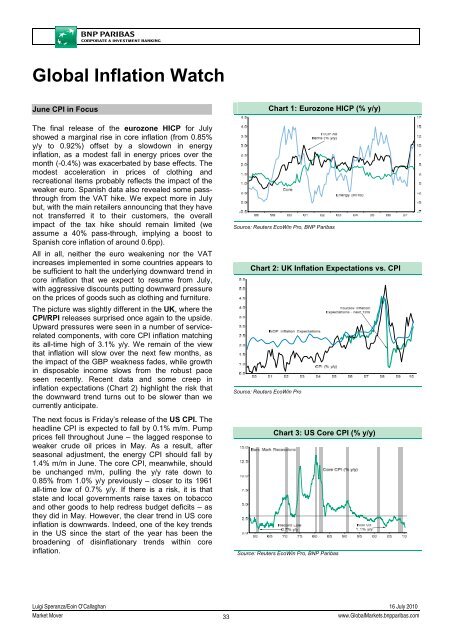

The picture was slightly different in the UK, where the<br />

CPI/RPI releases surprised once again to the upside.<br />

Upward pressures were seen in a number of servicerelated<br />

components, with core CPI inflation matching<br />

its all-time high of 3.1% y/y. We remain of the view<br />

that inflation will slow over the next few months, as<br />

the impact of the GBP weakness fades, while growth<br />

in disposable income slows from the robust pace<br />

seen recently. Recent data and some creep in<br />

inflation expectations (Chart 2) highlight the risk that<br />

the downward trend turns out to be slower than we<br />

currently anticipate.<br />

The next focus is Friday’s release of the US CPI. The<br />

headline CPI is expected to fall by 0.1% m/m. Pump<br />

prices fell throughout June – the lagged response to<br />

weaker crude oil prices in May. As a result, after<br />

seasonal adjustment, the energy CPI should fall by<br />

1.4% m/m in June. The core CPI, meanwhile, should<br />

be unchanged m/m, pulling the y/y rate down to<br />

0.85% from 1.0% y/y previously – closer to its 1961<br />

all-time low of 0.7% y/y. If there is a risk, it is that<br />

state and local governments raise taxes on tobacco<br />

and other goods to help redress budget deficits – as<br />

they did in May. However, the clear trend in US core<br />

inflation is downwards. Indeed, one of the key trends<br />

in the US since the start of the year has been the<br />

broadening of disinflationary trends within core<br />

inflation.<br />

Chart 1: Eurozone HICP (% y/y)<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Chart 2: UK Inflation Expectations vs. CPI<br />

Source: Reuters EcoWin Pro<br />

Chart 3: US Core CPI (% y/y)<br />

Source: Reuters EcoWin Pro, <strong>BNP</strong> Paribas<br />

Luigi Speranza/Eoin O’Callaghan 16 July 2010<br />

<strong>Market</strong> Mover<br />

33<br />

www.Global<strong>Market</strong>s.bnpparibas.com