Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

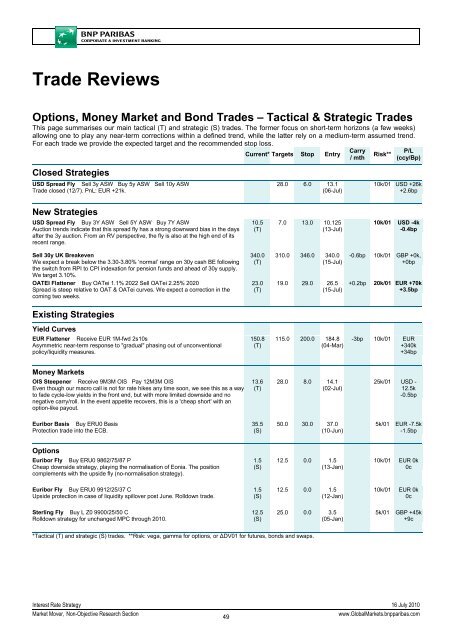

Trade Reviews<br />

Options, Money <strong>Market</strong> and Bond Trades – Tactical & Strategic Trades<br />

This page summarises our main tactical (T) and strategic (S) trades. The former focus on short-term horizons (a few weeks)<br />

allowing one to play any near-term corrections within a defined trend, while the latter rely on a medium-term assumed trend.<br />

For each trade we provide the expected target and the recommended stop loss.<br />

Current* Targets Stop Entry<br />

Closed Strategies<br />

USD Spread Fly Sell 3y ASW Buy 5y ASW Sell 10y ASW<br />

Trade closed (12/7). PnL: EUR +21k.<br />

28.0 6.0 13.1<br />

(06-Jul)<br />

Carry<br />

/ mth<br />

Risk**<br />

P/L<br />

(ccy/Bp)<br />

10k/01 USD +26k<br />

+2.6bp<br />

New Strategies<br />

USD Spread Fly Buy 3Y ASW Sell 5Y ASW Buy 7Y ASW<br />

Auction trends indicate that this spread fly has a strong downward bias in the days<br />

after the 3y auction. From an RV perspective, the fly is also at the high end of its<br />

recent range.<br />

10.5<br />

(T)<br />

7.0 13.0 10.125<br />

(13-Jul)<br />

10k/01 USD -4k<br />

-0.4bp<br />

Sell 30y UK Breakeven<br />

We expect a break below the 3.30-3.80% ‘normal’ range on 30y cash BE following<br />

the switch from RPI to CPI indexation for pension funds and ahead of 30y supply.<br />

We target 3.10%.<br />

OATEI Flattener Buy OATei 1.1% 2022 Sell OATei 2.25% 2020<br />

Spread is steep relative to OAT & OATei curves. We expect a correction in the<br />

coming two weeks.<br />

340.0<br />

(T)<br />

23.0<br />

(T)<br />

310.0 346.0 340.0<br />

(15-Jul)<br />

19.0 29.0 26.5<br />

(15-Jul)<br />

-0.6bp<br />

10k/01 GBP +0k,<br />

+0bp<br />

+0.2bp 20k/01 EUR +70k<br />

+3.5bp<br />

Existing Strategies<br />

Yield Curves<br />

EUR Flattener Receive EUR 1M-fwd 2s10s<br />

Asymmetric near-term response to "gradual" phasing out of unconventional<br />

policy/liquidity measures.<br />

150.8<br />

(T)<br />

115.0 200.0 184.8<br />

(04-Mar)<br />

-3bp 10k/01 EUR<br />

+340k<br />

+34bp<br />

Money <strong>Market</strong>s<br />

OIS Steepener Receive 9M3M OIS Pay 12M3M OIS<br />

Even though our macro call is not for rate hikes any time soon, we see this as a way<br />

to fade cycle-low yields in the front end, but with more limited downside and no<br />

negative carry/roll. In the event appetite recovers, this is a 'cheap short' with an<br />

option-like payout.<br />

13.6<br />

(T)<br />

28.0 8.0 14.1<br />

(02-Jul)<br />

25k/01 USD -<br />

12.5k<br />

-0.5bp<br />

Euribor Basis Buy ERU0 Basis<br />

Protection trade into the ECB.<br />

35.5<br />

(S)<br />

50.0 30.0 37.0<br />

(10-Jun)<br />

5k/01 EUR -7.5k<br />

-1.5bp<br />

Options<br />

Euribor Fly Buy ERU0 9862/75/87 P<br />

Cheap downside strategy, playing the normalisation of Eonia. The position<br />

complements with the upside fly (no-normalisation strategy).<br />

1.5<br />

(S)<br />

12.5 0.0 1.5<br />

(13-Jan)<br />

10k/01 EUR 0k<br />

0c<br />

Euribor Fly Buy ERU0 9912/25/37 C<br />

Upside protection in case of liquidity spillover post June. Rolldown trade.<br />

1.5<br />

(S)<br />

12.5 0.0 1.5<br />

(12-Jan)<br />

10k/01 EUR 0k<br />

0c<br />

Sterling Fly Buy L Z0 9900/25/50 C<br />

Rolldown strategy for unchanged MPC through 2010.<br />

12.5<br />

(S)<br />

25.0 0.0 3.5<br />

(05-Jan)<br />

5k/01 GBP +45k<br />

+9c<br />

*Tactical (T) and strategic (S) trades. **Risk: vega, gamma for options, or ΔDV01 for futures, bonds and swaps.<br />

<strong>Interest</strong> <strong>Rate</strong> <strong>Strategy</strong> 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

49<br />

www.Global<strong>Market</strong>s.bnpparibas.com