Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Key Data Preview<br />

120<br />

115<br />

110<br />

105<br />

100<br />

95<br />

90<br />

85<br />

80<br />

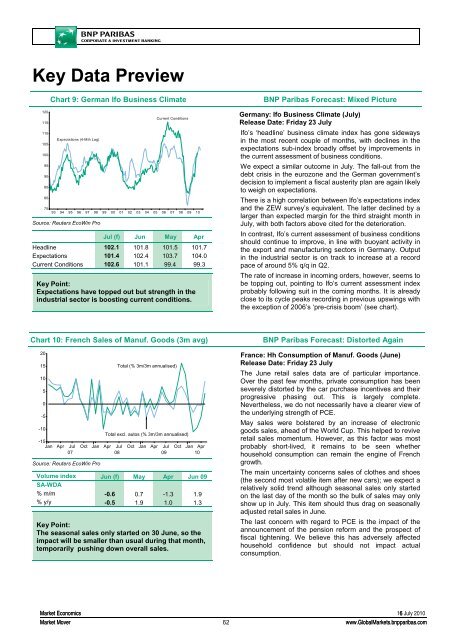

Chart 9: German Ifo Business Climate<br />

Expectations (4-Mth Lag)<br />

Current Conditions<br />

75<br />

93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10<br />

Source: Reuters EcoWin Pro<br />

Jul (f) Jun May Apr<br />

Headline 102.1 101.8 101.5 101.7<br />

Expectations 101.4 102.4 103.7 104.0<br />

Current Conditions 102.6 101.1 99.4 99.3<br />

Key Point:<br />

Expectations have topped out but strength in the<br />

industrial sector is boosting current conditions.<br />

<strong>BNP</strong> Paribas Forecast: Mixed Picture<br />

Germany: Ifo Business Climate (July)<br />

Release Date: Friday 23 July<br />

Ifo’s ‘headline’ business climate index has gone sideways<br />

in the most recent couple of months, with declines in the<br />

expectations sub-index broadly offset by improvements in<br />

the current assessment of business conditions.<br />

We expect a similar outcome in July. The fall-out from the<br />

debt crisis in the eurozone and the German government’s<br />

decision to implement a fiscal austerity plan are again likely<br />

to weigh on expectations.<br />

There is a high correlation between Ifo’s expectations index<br />

and the ZEW survey’s equivalent. The latter declined by a<br />

larger than expected margin for the third straight month in<br />

July, with both factors above cited for the deterioration.<br />

In contrast, Ifo’s current assessment of business conditions<br />

should continue to improve, in line with buoyant activity in<br />

the export and manufacturing sectors in Germany. Output<br />

in the industrial sector is on track to increase at a record<br />

pace of around 5% q/q in Q2.<br />

The rate of increase in incoming orders, however, seems to<br />

be topping out, pointing to Ifo’s current assessment index<br />

probably following suit in the coming months. It is already<br />

close to its cycle peaks recording in previous upswings with<br />

the exception of 2006’s ‘pre-crisis boom’ (see chart).<br />

Chart 10: French Sales of Manuf. Goods (3m avg)<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

Total (% 3m/3m annualised)<br />

-10<br />

Total excl. autos (% 3m/3m annualised)<br />

-15<br />

Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr Jul Oct Jan Apr<br />

07 08 09 10<br />

Source: Reuters EcoWin Pro<br />

Volume index Jun (f) May Apr Jun 09<br />

SA-WDA<br />

% m/m -0.6 0.7 -1.3 1.9<br />

% y/y -0.5 1.9 1.0 1.3<br />

Key Point:<br />

The seasonal sales only started on 30 June, so the<br />

impact will be smaller than usual during that month,<br />

temporarily pushing down overall sales.<br />

<strong>BNP</strong> Paribas Forecast: Distorted Again<br />

France: Hh Consumption of Manuf. Goods (June)<br />

Release Date: Friday 23 July<br />

The June retail sales data are of particular importance.<br />

Over the past few months, private consumption has been<br />

severely distorted by the car purchase incentives and their<br />

progressive phasing out. This is largely complete.<br />

Nevertheless, we do not necessarily have a clearer view of<br />

the underlying strength of PCE.<br />

May sales were bolstered by an increase of electronic<br />

goods sales, ahead of the World Cup. This helped to revive<br />

retail sales momentum. However, as this factor was most<br />

probably short-lived, it remains to be seen whether<br />

household consumption can remain the engine of French<br />

growth.<br />

The main uncertainty concerns sales of clothes and shoes<br />

(the second most volatile item after new cars); we expect a<br />

relatively solid trend although seasonal sales only started<br />

on the last day of the month so the bulk of sales may only<br />

show up in July. This item should thus drag on seasonally<br />

adjusted retail sales in June.<br />

The last concern with regard to PCE is the impact of the<br />

announcement of the pension reform and the prospect of<br />

fiscal tightening. We believe this has adversely affected<br />

household confidence but should not impact actual<br />

consumption.<br />

<strong>Market</strong> <strong>Economics</strong> 166 July 2010<br />

<strong>Market</strong> Mover<br />

62<br />

www.Global<strong>Market</strong>s.bnpparibas.com