Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Inflation: Sell 30y in the UK & US<br />

• GLOBAL: Stocks are hot but CPIs are not.<br />

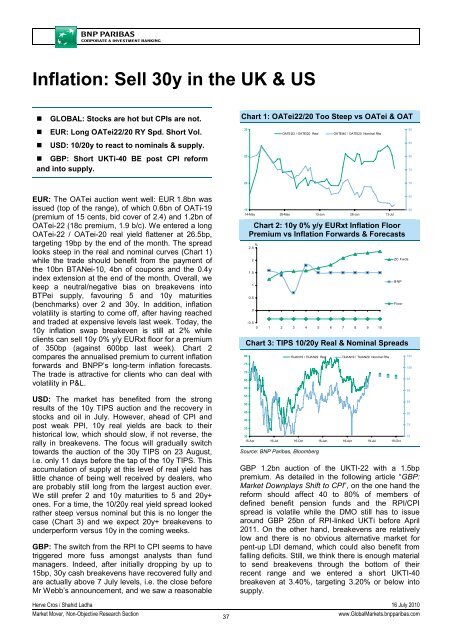

Chart 1: OATei22/20 Too Steep vs OATei & OAT<br />

• EUR: Long OATei22/20 RY Spd. Short Vol.<br />

30<br />

OATEI22 / OATEI20 Real<br />

OATEI40 / OATEI20 Nominal Rhs<br />

90<br />

• USD: 10/20y to react to nominals & supply.<br />

85<br />

• GBP: Short UKTi-40 BE post CPI reform<br />

and into supply.<br />

25<br />

80<br />

75<br />

20<br />

70<br />

EUR: The OATei auction went well: EUR 1.8bn was<br />

issued (top of the range), of which 0.6bn of OATi-19<br />

(premium of 15 cents, bid cover of 2.4) and 1.2bn of<br />

OATei-22 (18c premium, 1.9 b/c). We entered a long<br />

OATei-22 / OATei-20 real yield flattener at 26.5bp,<br />

targeting 19bp by the end of the month. The spread<br />

looks steep in the real and nominal curves (Chart 1)<br />

while the trade should benefit from the payment of<br />

the 10bn BTANei-10, 4bn of coupons and the 0.4y<br />

index extension at the end of the month. Overall, we<br />

keep a neutral/negative bias on breakevens into<br />

BTPei supply, favouring 5 and 10y maturities<br />

(benchmarks) over 2 and 30y. In addition, inflation<br />

volatility is starting to come off, after having reached<br />

and traded at expensive levels last week. Today, the<br />

10y inflation swap breakeven is still at 2% while<br />

clients can sell 10y 0% y/y EURxt floor for a premium<br />

of 350bp (against 600bp last week). Chart 2<br />

compares the annualised premium to current inflation<br />

forwards and <strong>BNP</strong>P’s long-term inflation forecasts.<br />

The trade is attractive for clients who can deal with<br />

volatility in P&L.<br />

USD: The market has benefited from the strong<br />

results of the 10y TIPS auction and the recovery in<br />

stocks and oil in July. However, ahead of CPI and<br />

post weak PPI, 10y real yields are back to their<br />

historical low, which should slow, if not reverse, the<br />

rally in breakevens. The focus will gradually switch<br />

towards the auction of the 30y TIPS on 23 August,<br />

i.e. only 11 days before the tap of the 10y TIPS. This<br />

accumulation of supply at this level of real yield has<br />

little chance of being well received by dealers, who<br />

are probably still long from the largest auction ever.<br />

We still prefer 2 and 10y maturities to 5 and 20y+<br />

ones. For a time, the 10/20y real yield spread looked<br />

rather steep versus nominal but this is no longer the<br />

case (Chart 3) and we expect 20y+ breakevens to<br />

underperform versus 10y in the coming weeks.<br />

GBP: The switch from the RPI to CPI seems to have<br />

triggered more fuss amongst analysts than fund<br />

managers. Indeed, after initially dropping by up to<br />

15bp, 30y cash breakevens have recovered fully and<br />

are actually above 7 July levels, i.e. the close before<br />

Mr Webb’s announcement, and we saw a reasonable<br />

15<br />

14-May 29-May 13-Jun 28-Jun 13-Jul<br />

Chart 2: 10y 0% y/y EURxt Inflation Floor<br />

Premium vs Inflation Forwards & Forecasts<br />

%<br />

2.5<br />

2<br />

1.5<br />

1<br />

0.5<br />

0<br />

-0.5<br />

0 1 2 3 4 5 6 7 8 9 10<br />

ZC Fwds<br />

GBP 1.2bn auction of the UKTI-22 with a 1.5bp<br />

premium. As detailed in the following article “GBP:<br />

<strong>Market</strong> Downplays Shift to CPI”, on the one hand the<br />

reform should affect 40 to 80% of members of<br />

defined benefit pension funds and the RPI/CPI<br />

spread is volatile while the DMO still has to issue<br />

around GBP 25bn of RPI-linked UKTi before April<br />

2011. On the other hand, breakevens are relatively<br />

low and there is no obvious alternative market for<br />

pent-up LDI demand, which could also benefit from<br />

falling deficits. Still, we think there is enough material<br />

to send breakevens through the bottom of their<br />

recent range and we entered a short UKTI-40<br />

breakeven at 3.40%, targeting 3.20% or below into<br />

supply.<br />

<strong>BNP</strong><br />

Floor<br />

Chart 3: TIPS 10/20y Real & Nominal Spreads<br />

80<br />

75<br />

70<br />

65<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

TIIJAN19 / TIIJAN29 Real<br />

30<br />

15-Apr 16-Jul 16-Oct 16-Jan 18-Apr 19-Jul 19-Oct<br />

Source: <strong>BNP</strong> Paribas, Bloomberg<br />

TIIJAN19 / TIIJAN29 Nominal Rhs<br />

65<br />

60<br />

105<br />

100<br />

95<br />

90<br />

85<br />

80<br />

75<br />

70<br />

Herve Cros / Shahid Ladha 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

37<br />

www.Global<strong>Market</strong>s.bnpparibas.com