Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

should not come as a complete surprise given the<br />

attempts by the authorities to remove some of the tax<br />

incentives put in place for steel exporters since June<br />

of last year.<br />

…as administrative measures cool overheating…<br />

Effective from 15 July, the Chinese Ministry of<br />

Finance will abolish a 9% tax rebate on exports, such<br />

as hot and cold rolled coils, and long steel, which are<br />

primarily used in the construction sector. This could<br />

discourage Chinese makers from aggressively<br />

expanding steel production, which in turn would not<br />

bode well for Australia’s iron ore exports. If these<br />

developments start to be reflected in a slowdown of<br />

Australian exports, the AUD would become<br />

vulnerable to at least a corrective setback of recent<br />

gains.<br />

Our Asian economics team have lowered their<br />

Chinese growth forecast for 2010 to 9.8% from<br />

10.50% previously, and forecast a further growth<br />

slowdown in 2011 to 8.4%, anticipating further policy<br />

tightening via a mixture of quantitative credit controls<br />

and regulation of local government investment.<br />

Indeed, the authorities appear to be steadfast in their<br />

policies to tame speculative investments via curbs on<br />

loans to multi-home buyers in the property market,<br />

an area which has been a source of concern for<br />

some time.<br />

…but global policy will remain supportive<br />

Although the risk of a slowdown in China and the US<br />

has been clearly identified, it is encouraging that<br />

monetary authorities have responded. The latest<br />

FOMC minutes show a significant shift in tone, taking<br />

on a more dovish stance, suggesting that liquidity will<br />

be left in the system for longer than the market was<br />

initially anticipating. Some members of the FOMC<br />

have also put the case for further measures to be<br />

taken if the outlook deteriorates further. Furthermore,<br />

the Chinese authorities have reaffirmed their<br />

commitment to using an active fiscal policy together<br />

with a moderately accommodative monetary policy to<br />

maintain sustained growth. In an environment of<br />

continued ample global liquidity, we would expect<br />

asset markets to remain supported and investor<br />

confidence to be maintained, which will provide a<br />

favourable backdrop for the commodity and procyclical<br />

currencies.<br />

The risk of a sharper slowdown in Europe<br />

Along with many other central banks, Chinese<br />

officials have recently expressed concern over the<br />

external demand picture (namely Europe). As a<br />

producer of intermediate goods which are then<br />

finished and exported to the rest of the world, the<br />

largest destination being Europe, these concerns are<br />

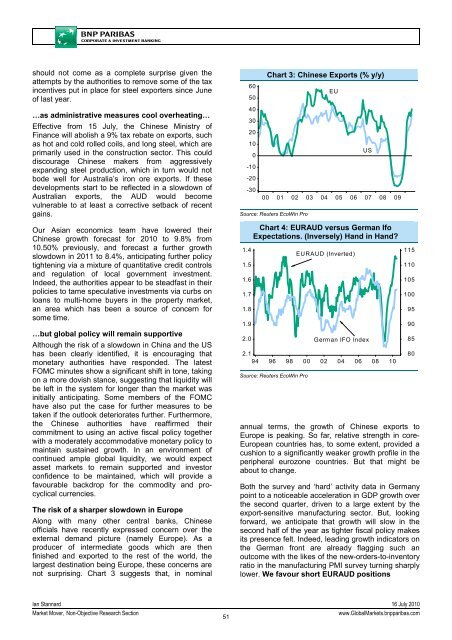

not surprising. Chart 3 suggests that, in nominal<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

Chart 3: Chinese Exports (% y/y)<br />

00 01 02 03 04 05 06 07 08 09<br />

Source: Reuters EcoWin Pro<br />

1.4<br />

1.5<br />

1.6<br />

1.7<br />

1.8<br />

1.9<br />

2.0<br />

EU<br />

annual terms, the growth of Chinese exports to<br />

Europe is peaking. So far, relative strength in core-<br />

European countries has, to some extent, provided a<br />

cushion to a significantly weaker growth profile in the<br />

peripheral eurozone countries. But that might be<br />

about to change.<br />

Both the survey and ‘hard’ activity data in Germany<br />

point to a noticeable acceleration in GDP growth over<br />

the second quarter, driven to a large extent by the<br />

export-sensitive manufacturing sector. But, looking<br />

forward, we anticipate that growth will slow in the<br />

second half of the year as tighter fiscal policy makes<br />

its presence felt. Indeed, leading growth indicators on<br />

the German front are already flagging such an<br />

outcome with the likes of the new-orders-to-inventory<br />

ratio in the manufacturing PMI survey turning sharply<br />

lower. We favour short EURAUD positions<br />

US<br />

Chart 4: EURAUD versus German Ifo<br />

Expectations. (Inversely) Hand in Hand?<br />

2.1<br />

94 96 98 00 02 04 06 08 10<br />

Source: Reuters EcoWin Pro<br />

EURAUD (Inverted)<br />

German IFO Index<br />

115<br />

110<br />

105<br />

100<br />

95<br />

90<br />

85<br />

80<br />

Ian Stannard 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

51<br />

www.Global<strong>Market</strong>s.bnpparibas.com