Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

US: 10y Range Trade with a Receiver Fly<br />

• Investors are increasingly comfortable with<br />

the prospect of the 10y rate hovering around<br />

3% in the near term, without a strong<br />

directional trend.<br />

• The range trade lends itself to selling<br />

volatility, but there is a strong preference to<br />

limit the downside in any trade.<br />

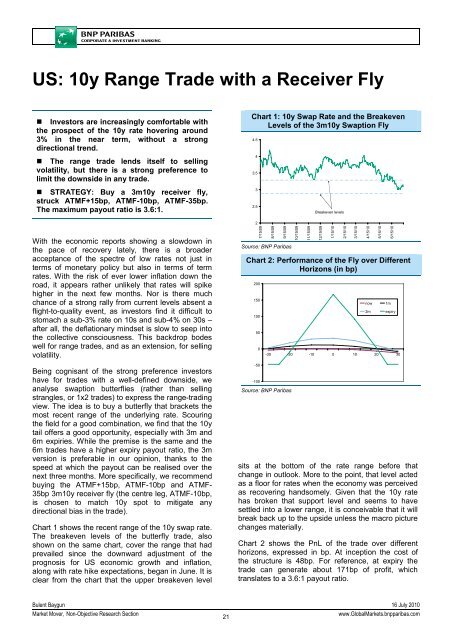

Chart 1: 10y Swap <strong>Rate</strong> and the Breakeven<br />

Levels of the 3m10y Swaption Fly<br />

4.5<br />

4<br />

3.5<br />

• STRATEGY: Buy a 3m10y receiver fly,<br />

struck ATMF+15bp, ATMF-10bp, ATMF-35bp.<br />

The maximum payout ratio is 3.6:1.<br />

3<br />

2.5<br />

Breakeven levels<br />

2<br />

With the economic reports showing a slowdown in<br />

the pace of recovery lately, there is a broader<br />

acceptance of the spectre of low rates not just in<br />

terms of monetary policy but also in terms of term<br />

rates. With the risk of ever lower inflation down the<br />

road, it appears rather unlikely that rates will spike<br />

higher in the next few months. Nor is there much<br />

chance of a strong rally from current levels absent a<br />

flight-to-quality event, as investors find it difficult to<br />

stomach a sub-3% rate on 10s and sub-4% on 30s –<br />

after all, the deflationary mindset is slow to seep into<br />

the collective consciousness. This backdrop bodes<br />

well for range trades, and as an extension, for selling<br />

volatility.<br />

Being cognisant of the strong preference investors<br />

have for trades with a well-defined downside, we<br />

analyse swaption butterflies (rather than selling<br />

strangles, or 1x2 trades) to express the range-trading<br />

view. The idea is to buy a butterfly that brackets the<br />

most recent range of the underlying rate. Scouring<br />

the field for a good combination, we find that the 10y<br />

tail offers a good opportunity, especially with 3m and<br />

6m expiries. While the premise is the same and the<br />

6m trades have a higher expiry payout ratio, the 3m<br />

version is preferable in our opinion, thanks to the<br />

speed at which the payout can be realised over the<br />

next three months. More specifically, we recommend<br />

buying the ATMF+15bp, ATMF-10bp and ATMF-<br />

35bp 3m10y receiver fly (the centre leg, ATMF-10bp,<br />

is chosen to match 10y spot to mitigate any<br />

directional bias in the trade).<br />

Chart 1 shows the recent range of the 10y swap rate.<br />

The breakeven levels of the butterfly trade, also<br />

shown on the same chart, cover the range that had<br />

prevailed since the downward adjustment of the<br />

prognosis for US economic growth and inflation,<br />

along with rate hike expectations, began in June. It is<br />

clear from the chart that the upper breakeven level<br />

7/15/09<br />

8/15/09<br />

9/15/09<br />

Source: <strong>BNP</strong> Paribas<br />

10/15/09<br />

11/15/09<br />

12/15/09<br />

Chart 2: Performance of the Fly over Different<br />

Horizons (in bp)<br />

200<br />

150<br />

100<br />

50<br />

0<br />

-50<br />

-100<br />

sits at the bottom of the rate range before that<br />

change in outlook. More to the point, that level acted<br />

as a floor for rates when the economy was perceived<br />

as recovering handsomely. Given that the 10y rate<br />

has broken that support level and seems to have<br />

settled into a lower range, it is conceivable that it will<br />

break back up to the upside unless the macro picture<br />

changes materially.<br />

Chart 2 shows the PnL of the trade over different<br />

horizons, expressed in bp. At inception the cost of<br />

the structure is 48bp. For reference, at expiry the<br />

trade can generate about 171bp of profit, which<br />

translates to a 3.6:1 payout ratio.<br />

1/15/10<br />

-30 -20 -10 0 10 20 30<br />

Source: <strong>BNP</strong> Paribas<br />

2/15/10<br />

3/15/10<br />

4/15/10<br />

now<br />

2m<br />

5/15/10<br />

1m<br />

6/15/10<br />

expiry<br />

Bulent Baygun 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

21<br />

www.Global<strong>Market</strong>s.bnpparibas.com