Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Market Economics | Interest Rate Strategy - BNP PARIBAS ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EUR/USD Rally Sets Sights on 1.3000<br />

• This week’s EUR/USD bullish trend reversal opens scope for a corrective rally toward 1.3125-<br />

1.3510 lasting until late-August to early-October.<br />

• However, extremely strong weekly momentum is fuelling the EUR/USD rise, potentially creating a<br />

larger rebound toward 1.37-1.39.<br />

• The EUR/USD advance has powerful allies in GBP/USD and AUD/USD with both currencies poised<br />

to extend gains during the next few weeks towards 1.55 and 0.9080, respectively.<br />

Tuesday’s EUR/USD breakout above the<br />

December downtrend near 1.27 triggered a<br />

bullish trend reversal. This indicated the Nov-<br />

June decline (1.5145-1.1875) is being unwound<br />

via a medium-term corrective rally toward at least<br />

1.3125-1.3510 representing the 38.2-50%<br />

retracement points of the Nov-June decline.<br />

Potentially a larger EUR/USD rise could occur<br />

toward 1.3895 – the common 61.8% retracement<br />

point -- given bullish momentum and pattern<br />

factors. 1) Momentum: Half way through July, the<br />

monthly chart shows this month’s rise is currently<br />

the largest since May’09: such a powerful surge<br />

is a propitious way to begin a sizable rally. The<br />

rally is fuelled by the strongest bout of weekly<br />

momentum since the explosive December’08<br />

jump. And weekly momentum is not overbought,<br />

suggesting more gains to follow. Although a<br />

somewhat arbitrary technical factor, the “slope” of<br />

the current June advance off 1.1875 is close to<br />

45-degrees on the daily chart – the most<br />

sustainable type of rally. 2) Pattern: Elliott wave<br />

analysis suggests “the logical point of return” for<br />

the correction is the 1.3692 April 12 high<br />

representing the last prominent high on the<br />

EUR/USD daily chart.<br />

The EUR/USD advance is also finding allies in<br />

GBP/USD and AUD/USD. GBP/USD broke out to a<br />

10-week high Wednesday and robust bullish weekly<br />

momentum favors now favor extending the gain<br />

toward 1.5490-1.5525 including a test of the April<br />

high. The AUD/USD rally, buoyed by accelerating<br />

bullish weekly momentum that is even stronger than<br />

at the start of the massive March-Nov’09 advance,<br />

next targets a break above 0.8885 retracement<br />

resistance with medium-term scope toward June up<br />

channel resistance near 0.9070/80.<br />

The bullish EUR/USD bias will get a boost if the S&P<br />

500 Index can confirm rising risk appetite by breaking<br />

above its April downtrend near 1093. A bullish trend<br />

reversal would open 1102-1106 resistance, with a<br />

break of 1106 opening scope for a bigger multi-week<br />

Wall Street rebound toward 1117-1131-1142. If the<br />

S&P 500 Index confirms this week’s bullish<br />

EUR/USD trend reversal, it would create a strong<br />

technical argument for “risk on” spanning several<br />

more weeks, as rising stock prices assist the<br />

EUR/USD rebound.<br />

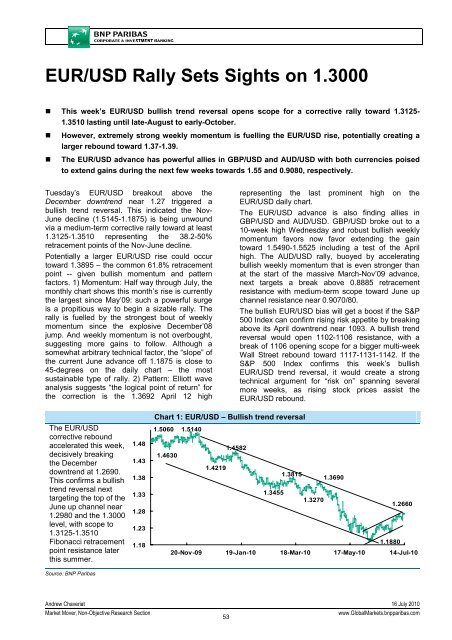

Chart 1: EUR/USD – Bullish trend reversal<br />

The EUR/USD<br />

corrective rebound<br />

accelerated this week,<br />

decisively breaking<br />

the December<br />

downtrend at 1.2690.<br />

This confirms a bullish<br />

trend reversal next<br />

targeting the top of the<br />

June up channel near<br />

1.2980 and the 1.3000<br />

level, with scope to<br />

1.3125-1.3510<br />

Fibonacci retracement<br />

point resistance later<br />

this summer.<br />

1.48<br />

1.43<br />

1.38<br />

1.33<br />

1.28<br />

1.23<br />

1.18<br />

1.5060<br />

1.4630<br />

1.5140<br />

1.4582<br />

1.4219<br />

1.3815<br />

1.3690<br />

1.3455<br />

1.3270<br />

20-Nov-09 19-Jan-10 18-Mar-10 17-May-10<br />

1.1880<br />

1.2660<br />

14-Jul-10<br />

Source: <strong>BNP</strong> Paribas<br />

Andrew Chaveriat 16 July 2010<br />

<strong>Market</strong> Mover, Non-Objective Research Section<br />

53<br />

www.Global<strong>Market</strong>s.bnpparibas.com