Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

open for further measures if required, elsewhere the<br />

withdrawal of liquidity is gaining momentum. Despite<br />

the fiscal problems in eurozone, the ECB has<br />

continued on the path of unwinding unorthodox<br />

measures, with the more hawkish members<br />

reiterating the need to normalise money markets. In<br />

the US, Fed Chairman Bernanke has also laid out<br />

the process of liquidity withdrawal and policy<br />

normalisation. This removal of liquidity from the<br />

global financial system will have a huge impact given<br />

that this was the fuel driving asset and commodity<br />

markets over the past year. We would suggest that<br />

the asset markets currencies which were the biggest<br />

beneficiaries of this liquidity injection will now be the<br />

most at risk.<br />

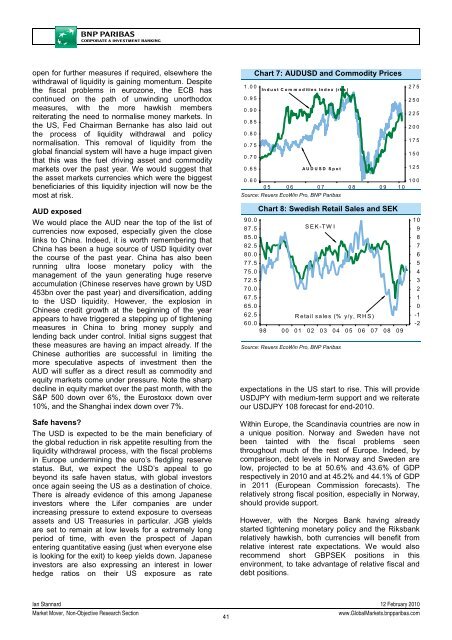

Chart 7: AUDUSD and Commodity Prices<br />

1.00 Indust Commodities Index (rhs)<br />

0.95<br />

0.90<br />

0.85<br />

0.80<br />

0.75<br />

0.70<br />

0.65<br />

AUDUSD Spot<br />

0.60<br />

05 06 07 08 09 10<br />

Source: Reuers EcoWin Pro, <strong>BNP</strong> Paribas<br />

275<br />

250<br />

225<br />

200<br />

175<br />

150<br />

125<br />

100<br />

AUD exposed<br />

We would place the AUD near the top of the list of<br />

currencies now exposed, especially given the close<br />

links to China. Indeed, it is worth remembering that<br />

China has been a huge source of USD liquidity over<br />

the course of the past year. China has also been<br />

running ultra loose monetary policy with the<br />

management of the yaun generating huge reserve<br />

accumulation (Chinese reserves have grown by USD<br />

453bn over the past year) and diversification, adding<br />

to the USD liquidity. However, the explosion in<br />

Chinese credit growth at the beginning of the year<br />

appears to have triggered a stepping up of tightening<br />

measures in China to bring money supply and<br />

lending back under control. Initial signs suggest that<br />

these measures are having an impact already. If the<br />

Chinese authorities are successful in limiting the<br />

more speculative aspects of investment then the<br />

AUD will suffer as a direct result as commodity and<br />

equity markets come under pressure. Note the sharp<br />

decline in equity market over the past month, with the<br />

S&P 500 down over 6%, the Eurostoxx down over<br />

10%, and the Shanghai index down over 7%.<br />

Safe havens?<br />

The USD is expected to be the main beneficiary of<br />

the global reduction in risk appetite resulting from the<br />

liquidity withdrawal process, with the fiscal problems<br />

in Europe undermining the euro’s fledgling reserve<br />

status. But, we expect the USD’s appeal to go<br />

beyond its safe haven status, with global investors<br />

once again seeing the US as a destination of choice.<br />

There is already evidence of this among Japanese<br />

investors where the Lifer companies are under<br />

increasing pressure to extend exposure to overseas<br />

assets and US Treasuries in particular. JGB yields<br />

are set to remain at low levels for a extremely long<br />

period of time, with even the prospect of Japan<br />

entering quantitative easing (just when everyone else<br />

is looking for the exit) to keep yields down. Japanese<br />

investors are also expressing an interest in lower<br />

hedge ratios on their US exposure as rate<br />

Chart 8: Swedish Retail Sales and SEK<br />

90.0<br />

87.5<br />

SEK-TWI<br />

85.0<br />

82.5<br />

80.0<br />

77.5<br />

75.0<br />

72.5<br />

70.0<br />

67.5<br />

65.0<br />

62.5<br />

R etail sales (% y/y, RH S)<br />

60.0<br />

98 00 01 02 03 04 05 06 07 08 09<br />

Source: Reuers EcoWin Pro, <strong>BNP</strong> Paribas<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

expectations in the US start to rise. This will provide<br />

USDJPY with medium-term support and we reiterate<br />

our USDJPY 108 forecast for end-2010.<br />

Within Europe, the Scandinavia countries are now in<br />

a unique position. Norway and Sweden have not<br />

been tainted with the fiscal problems seen<br />

throughout much of the rest of Europe. Indeed, by<br />

comparison, debt levels in Norway and Sweden are<br />

low, projected to be at 50.6% and 43.6% of GDP<br />

respectively in 2010 and at 45.2% and 44.1% of GDP<br />

in 2011 (European Commission forecasts). The<br />

relatively strong fiscal position, especially in Norway,<br />

should provide support.<br />

However, with the Norges Bank having already<br />

started tightening monetary policy and the Riksbank<br />

relatively hawkish, both currencies will benefit from<br />

relative interest rate expectations. We would also<br />

recommend short GBPSEK positions in this<br />

environment, to take advantage of relative fiscal and<br />

debt positions.<br />

Ian Stannard 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong>, Non-Objective Research Section<br />

41<br />

www.Global<strong>Market</strong>s.bnpparibas.com