Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

leave the euro significantly lower. Under the first<br />

scenario, Adjustment, the Greek authorities are<br />

successful in implementing the required reforms and<br />

slowly regain the confidence of markets. However,<br />

this would be a slow process and still runs high risks,<br />

suggesting that any euro recovery is likely to remain<br />

limited. Although this would likely be the most<br />

favourable outcome for the euro, much would still<br />

depend on the developments in the other peripheral<br />

countries, especially how Portugal and Spain<br />

implement their reforms. Ultimately,<br />

underperformance of the euro would still be expected<br />

as a high risk premium would remain in place and<br />

our EURUSD 1.27 year-end forecast would still be<br />

achievable.<br />

Under the second scenario, Financial Support or<br />

bailout, Greece would effectively have to borrow the<br />

credibility of other states or international institutions,<br />

buying Greece time to carry out reforms. However,<br />

although the announcement of a bailout may cause<br />

an initial euro rebound, we would not expect this to<br />

be sustained as the longer-term implications would<br />

likely be extremely negative, with the issue of moral<br />

hazard playing a major role. In fact we would expect<br />

the EURUSD to come under even greater pressure<br />

than in the first scenario, with EURUSD declines<br />

likely to exceed our 1.27 forecast targeting at least<br />

1.25 by year-end.<br />

The third scenario examined was Debt Restructuring<br />

or soft default. In this case, Greece would lose<br />

credibility and fail to borrow credibility from<br />

elsewhere, suggesting that it could encounter<br />

problems meeting its obligations – forcing it to<br />

restructure its debt. We would consider such an<br />

outcome as outright euro bearish, especially if there<br />

were spill-over effects into the rest of the European<br />

periphery. Significant portfolio and capital outflows<br />

from the eurozone would be seen. Under such<br />

circumstances, EURUSD would be vulnerable to a<br />

collapse towards the 1.10 area.<br />

Disorderly Default was the fourth and final scenario<br />

examined, where events unfolded beyond the control<br />

of the Greek authorities. This would be clearly the<br />

most bearish scenario for the euro, where the decline<br />

in the currency would likely be very abrupt, with even<br />

the 1.10 area exceeded.<br />

Bailout will not support the euro<br />

Given the extent of recent market rumours and<br />

media speculation, some sort of assistance or aid<br />

package to support Greece currently looks the more<br />

likely outcome, although there still appears to be<br />

significant disagreement with regards to how this<br />

may be carried out, not to mention the legal issues<br />

as to how this would be consistent with the<br />

Maastricht Treaty. While the risk of moral hazard<br />

30<br />

20<br />

10<br />

0<br />

-1 0<br />

-2 0<br />

-3 0<br />

-4 0<br />

-5 0<br />

-6 0<br />

-7 0<br />

-8 0<br />

-9 0<br />

-100<br />

Chart 3: Net Financial Positions (% GDP)<br />

Portugal<br />

96 97 98 99 00 01 02 03 04 05 06 07 08<br />

Source: CEIC, <strong>BNP</strong> Paribas<br />

Germany<br />

Ireland<br />

Greece<br />

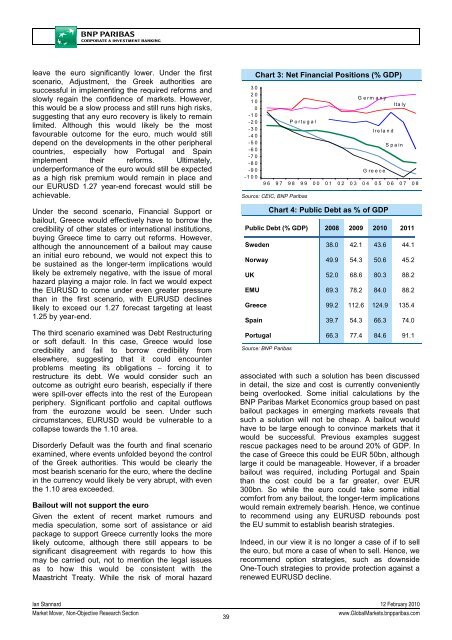

Chart 4: Public Debt as % of GDP<br />

Ita ly<br />

Spain<br />

Public Debt (% GDP) 2008 2009 2010 2011<br />

Sweden 38.0 42.1 43.6 44.1<br />

Norway 49.9 54.3 50.6 45.2<br />

UK 52.0 68.6 80.3 88.2<br />

EMU 69.3 78.2 84.0 88.2<br />

Greece 99.2 112.6 124.9 135.4<br />

Spain 39.7 54.3 66.3 74.0<br />

Portugal 66.3 77.4 84.6 91.1<br />

Source: <strong>BNP</strong> Paribas<br />

associated with such a solution has been discussed<br />

in detail, the size and cost is currently conveniently<br />

being overlooked. Some initial calculations by the<br />

<strong>BNP</strong> Paribas <strong>Market</strong> Economics group based on past<br />

bailout packages in emerging markets reveals that<br />

such a solution will not be cheap. A bailout would<br />

have to be large enough to convince markets that it<br />

would be successful. Previous examples suggest<br />

rescue packages need to be around 20% of GDP. In<br />

the case of Greece this could be EUR 50bn, although<br />

large it could be manageable. However, if a broader<br />

bailout was required, including Portugal and Spain<br />

than the cost could be a far greater, over EUR<br />

300bn. So while the euro could take some initial<br />

comfort from any bailout, the longer-term implications<br />

would remain extremely bearish. Hence, we continue<br />

to recommend using any EURUSD rebounds post<br />

the EU summit to establish bearish strategies.<br />

Indeed, in our view it is no longer a case of if to sell<br />

the euro, but more a case of when to sell. Hence, we<br />

recommend option strategies, such as downside<br />

One-Touch strategies to provide protection against a<br />

renewed EURUSD decline.<br />

Ian Stannard 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong>, Non-Objective Research Section<br />

39<br />

www.Global<strong>Market</strong>s.bnpparibas.com