Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Technical Analysis – Interest Rates & Commodities<br />

Bond & Short-Term Contracts<br />

• Europe: ST pullback on key 3.09/12 area may be over but a further rebound is needed to rekindle MT rising bias<br />

• US: ST pullback seen on key 3.50/55 area & market is now trying to resume MT rising bias towards 4% initially<br />

• Short-term contracts m0: Still a MT supportive bias but ST bias remains toppish/slightly consolidative<br />

Equities & Commodities<br />

• WTI (Cl1): Rebounded slightly above its MT rising channel support, but be beware of a renewed break below it<br />

• Equity markets: ST bias turned consolidative given break of MT rising pattern’s supports<br />

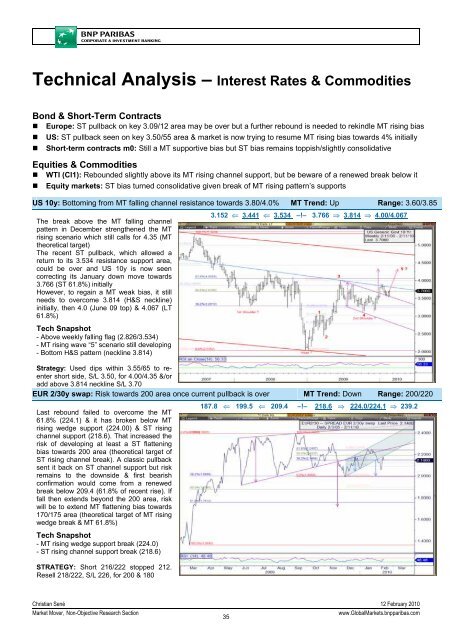

US 10y: Bottoming from MT falling channel resistance towards 3.80/4.0% MT Trend: Up Range: 3.60/3.85<br />

The break above the MT falling channel<br />

pattern in December strengthened the MT<br />

rising scenario which still calls for 4.35 (MT<br />

theoretical target)<br />

The recent ST pullback, which allowed a<br />

return to its 3.534 resistance support area,<br />

could be over and US 10y is now seen<br />

correcting its January down move towards<br />

3.766 (ST 61.8%) initially<br />

However, to regain a MT weak bias, it still<br />

needs to overcome 3.814 (H&S neckline)<br />

initially, then 4.0 (June 09 top) & 4.067 (LT<br />

61.8%)<br />

3.152 ⇐ 3.441 ⇐ 3.534 –!– 3.766 ⇒ 3.814 ⇒ 4.00/4.067<br />

Tech Snapshot<br />

- Above weekly falling flag (2.826/3.534)<br />

- MT rising wave “5” scenario still developing<br />

- Bottom H&S pattern (neckline 3.814)<br />

Strategy: Used dips within 3.55/65 to reenter<br />

short side, S/L 3.50, for 4.00/4.35 &/or<br />

add above 3.814 neckline S/L 3.70<br />

EUR 2/30y swap: Risk towards 200 area once current pullback is over MT Trend: Down Range: 200/220<br />

Last rebound failed to overcome the MT<br />

61.8% (224.1) & it has broken below MT<br />

rising wedge support (224.00) & ST rising<br />

channel support (218.6). That increased the<br />

risk of developing at least a ST flattening<br />

bias towards 200 area (theoretical target of<br />

ST rising channel break). A classic pullback<br />

sent it back on ST channel support but risk<br />

remains to the downside & first bearish<br />

confirmation would come from a renewed<br />

break below 209.4 (61.8% of recent rise). If<br />

fall then extends beyond the 200 area, risk<br />

will be to extend MT flattening bias towards<br />

170/175 area (theoretical target of MT rising<br />

wedge break & MT 61.8%)<br />

187.8 ⇐ 199.5 ⇐ 209.4 –!– 218.6 ⇒ 224.0/224.1 ⇒ 239.2<br />

Tech Snapshot<br />

- MT rising wedge support break (224.0)<br />

- ST rising channel support break (218.6)<br />

STRATEGY: Short 216/222 stopped 212.<br />

Resell 218/222, S/L 226, for 200 & 180<br />

Christian Sené 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong>, Non-Objective Research Section<br />

35<br />

www.Global<strong>Market</strong>s.bnpparibas.com