Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

US: Impact of Buyouts on Rates and MBS<br />

• The GSE buyout announcements are<br />

bearish for mortgages, as they could shrink the<br />

potential base of investors post MBSPP end,<br />

erode carry in the interim and potentially<br />

remove GSEs as a backstop bid.<br />

• We like being long the 5Y swap spread on<br />

concerns around mortgage selling and a<br />

possible flight to quality into Treasuries.<br />

• The added uncertainty around the<br />

conclusion of MBSPP is likely to provide a bid<br />

to vol. We like being long gamma vol on 5y and<br />

10y tails.<br />

With GSE portfolios dedicated to buyouts, the<br />

possibility of them being a backstop bid after the Fed<br />

stops buying has diminished considerably. Money<br />

managers are likely to be the only major buyer of<br />

MBS, but would be hurt by the diminished liquidity in<br />

the mortgage market and unable to stem an overall<br />

increase in risk premia. As we have discussed<br />

previously, banks are unlikely to support mortgages<br />

in size. Overseas investors, already hurt by<br />

capricious GN prepayments (only 16% of the market)<br />

would be unlikely to support mortgages. We now look<br />

for a 30+bp widening in mortgages, and with the<br />

carry (in FGs) until Fed exit essentially lost, we've<br />

turned negative on mortgages. Also, with the Fed<br />

mostly in lower coupon fixed and other investors in<br />

higher coupons and ARMs, the private market is<br />

primarily taking the losses – and those too, quite<br />

suddenly.<br />

For FGs, with 30Y pools trading on the basis of Feb<br />

prepays, with large negative carry and TBAs for<br />

March settle, the market is likely to trade with<br />

difficulty. With the ratio of ARM to Fixed<br />

delinquencies at 5 times (12.54% vs 2.46%), the<br />

price depreciation is likely to impact this market<br />

particularly negatively. The CMO market also faces<br />

difficulty given the price depreciation in Inverse IOs<br />

due both to the type of collateral and leverage to<br />

prepays.<br />

For FNs, it is difficult to price TBAs, given the<br />

variable term of buyouts and also since the<br />

deliverability option is considerable. For example, at<br />

80 CPR, the carry on FN 6s is -13 ticks, at 90 CPR<br />

-27 ticks, at 99 CPR -79 ticks. Furthermore, very little<br />

information is available on products other than 30Ys.<br />

Since FN delinquencies for credit enhanced collateral<br />

are about 70% higher than FGs, market such as<br />

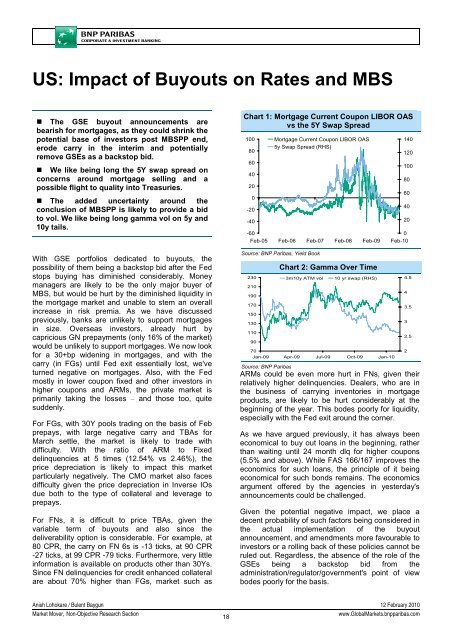

Chart 1: Mortgage Current Coupon LIBOR OAS<br />

vs the 5Y Swap Spread<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

-20<br />

-40<br />

Mortgage Current Coupon LIBOR OAS<br />

5y Swap Spread (RHS)<br />

-60<br />

0<br />

Feb-05 Feb-06 Feb-07 Feb-08 Feb-09 Feb-10<br />

Source: <strong>BNP</strong> Paribas, Yield Book<br />

230<br />

210<br />

190<br />

170<br />

150<br />

130<br />

110<br />

90<br />

Chart 2: Gamma Over Time<br />

70<br />

Jan-09 Apr-09 Jul-09 Oct-09 Jan-10<br />

Source: <strong>BNP</strong> Paribas<br />

3m10y ATM vol<br />

10 yr swap (RHS)<br />

140<br />

120<br />

100<br />

ARMs could be even more hurt in FNs, given their<br />

relatively higher delinquencies. Dealers, who are in<br />

the business of carrying inventories in mortgage<br />

products, are likely to be hurt considerably at the<br />

beginning of the year. This bodes poorly for liquidity,<br />

especially with the Fed exit around the corner.<br />

As we have argued previously, it has always been<br />

economical to buy out loans in the beginning, rather<br />

than waiting until 24 month dlq for higher coupons<br />

(5.5% and above). While FAS 166/167 improves the<br />

economics for such loans, the principle of it being<br />

economical for such bonds remains. The economics<br />

argument offered by the agencies in yesterday's<br />

announcements could be challenged.<br />

Given the potential negative impact, we place a<br />

decent probability of such factors being considered in<br />

the actual implementation of the buyout<br />

announcement, and amendments more favourable to<br />

investors or a rolling back of these policies cannot be<br />

ruled out. Regardless, the absence of the role of the<br />

GSEs being a backstop bid from the<br />

administration/regulator/government's point of view<br />

bodes poorly for the basis.<br />

80<br />

60<br />

40<br />

20<br />

4.5<br />

4<br />

3.5<br />

3<br />

2.5<br />

2<br />

Anish Lohokare / Bulent Baygun 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong>, Non-Objective Research Section<br />

18<br />

www.Global<strong>Market</strong>s.bnpparibas.com