Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

EUR: Demand for ECB’s Liquidity Still High<br />

• Demand at this week’s MRO was significant<br />

given the existing level of excess liquidity.<br />

Recent limited tensions on OIS/BOR spreads<br />

could partly explain such behaviour.<br />

• As concerns over sovereign debt and<br />

liquidity should moderate in the coming weeks,<br />

we expect OIS/BOR spreads to tighten back<br />

slightly, preventing demand for safety from<br />

gaining momentum.<br />

• STRATEGY: Play a tactical compression of<br />

OIS/BOR spreads. Receive the 3mth OIS/BOR<br />

spread (first ER contract).<br />

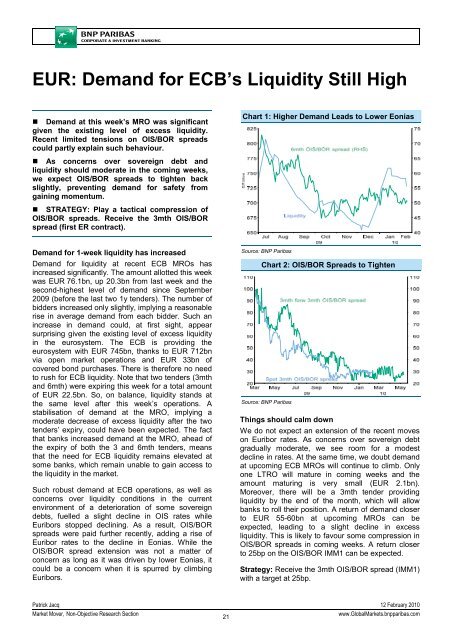

Chart 1: Higher Demand Leads to Lower Eonias<br />

Demand for 1-week liquidity has increased<br />

Demand for liquidity at recent ECB MROs has<br />

increased significantly. The amount allotted this week<br />

was EUR 76.1bn, up 20.3bn from last week and the<br />

second-highest level of demand since September<br />

2009 (before the last two 1y tenders). The number of<br />

bidders increased only slightly, implying a reasonable<br />

rise in average demand from each bidder. Such an<br />

increase in demand could, at first sight, appear<br />

surprising given the existing level of excess liquidity<br />

in the eurosystem. The ECB is providing the<br />

eurosystem with EUR 745bn, thanks to EUR 712bn<br />

via open market operations and EUR 33bn of<br />

covered bond purchases. There is therefore no need<br />

to rush for ECB liquidity. Note that two tenders (3mth<br />

and 6mth) were expiring this week for a total amount<br />

of EUR 22.5bn. So, on balance, liquidity stands at<br />

the same level after this week’s operations. A<br />

stabilisation of demand at the MRO, implying a<br />

moderate decrease of excess liquidity after the two<br />

tenders’ expiry, could have been expected. The fact<br />

that banks increased demand at the MRO, ahead of<br />

the expiry of both the 3 and 6mth tenders, means<br />

that the need for ECB liquidity remains elevated at<br />

some banks, which remain unable to gain access to<br />

the liquidity in the market.<br />

Such robust demand at ECB operations, as well as<br />

concerns over liquidity conditions in the current<br />

environment of a deterioration of some sovereign<br />

debts, fuelled a slight decline in OIS rates while<br />

Euribors stopped declining. As a result, OIS/BOR<br />

spreads were paid further recently, adding a rise of<br />

Euribor rates to the decline in Eonias. While the<br />

OIS/BOR spread extension was not a matter of<br />

concern as long as it was driven by lower Eonias, it<br />

could be a concern when it is spurred by climbing<br />

Euribors.<br />

Source: <strong>BNP</strong> Paribas<br />

Chart 2: OIS/BOR Spreads to Tighten<br />

Source: <strong>BNP</strong> Paribas<br />

Things should calm down<br />

We do not expect an extension of the recent moves<br />

on Euribor rates. As concerns over sovereign debt<br />

gradually moderate, we see room for a modest<br />

decline in rates. At the same time, we doubt demand<br />

at upcoming ECB MROs will continue to climb. Only<br />

one LTRO will mature in coming weeks and the<br />

amount maturing is very small (EUR 2.1bn).<br />

Moreover, there will be a 3mth tender providing<br />

liquidity by the end of the month, which will allow<br />

banks to roll their position. A return of demand closer<br />

to EUR 55-60bn at upcoming MROs can be<br />

expected, leading to a slight decline in excess<br />

liquidity. This is likely to favour some compression in<br />

OIS/BOR spreads in coming weeks. A return closer<br />

to 25bp on the OIS/BOR IMM1 can be expected.<br />

Strategy: Receive the 3mth OIS/BOR spread (IMM1)<br />

with a target at 25bp.<br />

Patrick Jacq 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong>, Non-Objective Research Section<br />

21<br />

www.Global<strong>Market</strong>s.bnpparibas.com