Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Market</strong> Outlook<br />

The market has already<br />

reacted positively to the<br />

EU statement on Greece -<br />

the conditions of any<br />

financial support will be<br />

key<br />

The Greek crisis has turned into a critical test of EMU, forcing EU officials to<br />

demonstrate greater coordination and solidarity. There is no alternative for<br />

Greece but to implement those fiscal measures already announced and<br />

probably more – pension reform will be discussed in the spring. But after<br />

pressuring Greece for several weeks to impose the necessary fiscal<br />

discipline, the outcome of the EU leaders’ summit on Thursday was a very<br />

clear message backing Greece.<br />

The statement represents progress. The EU has moved from an implicit to<br />

explicit commitment to protect Greece. Strict conditions attached could lend<br />

Greece the credibility it sorely needs. However, details are still lacking. We<br />

may get some details on a commitment to act if needed after the Finance<br />

Ministers’ meetings early next week.<br />

Details on potential financial assistance for Greece under strict conditions<br />

would further enhance market confidence – the 10y GGB/Bund spread has<br />

already compressed by roughly 90bp this week to close to 270bp, after<br />

peaking at 400bp at the end of January. Ultimately, the current debate is<br />

about EMU governments (Greece at this stage) giving up part of their<br />

independence in terms of fiscal policy; this has been the missing link within<br />

EMU since day one. The EMU framework may emerge strengthened from<br />

the current crisis although none of the governments will willingly cede fiscal<br />

autonomy.<br />

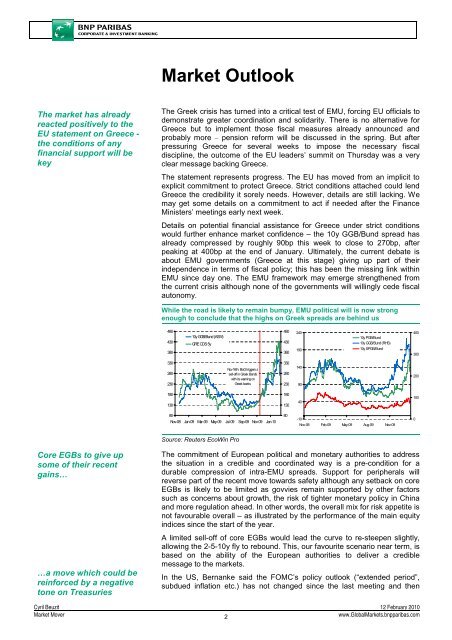

While the road is likely to remain bumpy, EMU political will is now strong<br />

enough to conclude that the highs on Greek spreads are behind us<br />

480<br />

430<br />

380<br />

10y GGB/Bund (ASW)<br />

GRE CDS 5y<br />

480<br />

430<br />

380<br />

240<br />

190<br />

10y PGB/Bund<br />

10y GGB/Bund (RHS)<br />

10y SPGB/Bund<br />

400<br />

300<br />

330<br />

280<br />

230<br />

Nov 16th: BoG triggers a<br />

sell-off in Greek Bonds<br />

with its warning on<br />

Greek banks<br />

330<br />

280<br />

230<br />

140<br />

90<br />

200<br />

180<br />

130<br />

180<br />

130<br />

40<br />

100<br />

80<br />

Nov-08 Jan-09 Mar-09 May-09 Jul-09 Sep-09 Nov-09 Jan-10<br />

80<br />

-10<br />

Nov-08 Feb-09 May-09 Aug-09 Nov-09<br />

0<br />

Source: Reuters EcoWin Pro<br />

Core EGBs to give up<br />

some of their recent<br />

gains…<br />

…a move which could be<br />

reinforced by a negative<br />

tone on Treasuries<br />

The commitment of European political and monetary authorities to address<br />

the situation in a credible and coordinated way is a pre-condition for a<br />

durable compression of intra-EMU spreads. Support for peripherals will<br />

reverse part of the recent move towards safety although any setback on core<br />

EGBs is likely to be limited as govvies remain supported by other factors<br />

such as concerns about growth, the risk of tighter monetary policy in China<br />

and more regulation ahead. In other words, the overall mix for risk appetite is<br />

not favourable overall – as illustrated by the performance of the main equity<br />

indices since the start of the year.<br />

A limited sell-off of core EGBs would lead the curve to re-steepen slightly,<br />

allowing the 2-5-10y fly to rebound. This, our favourite scenario near term, is<br />

based on the ability of the European authorities to deliver a credible<br />

message to the markets.<br />

In the US, Bernanke said the FOMC’s policy outlook (“extended period”,<br />

subdued inflation etc.) has not changed since the last meeting and then<br />

Cyril Beuzit 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

2<br />

www.Global<strong>Market</strong>s.bnpparibas.com