Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

JGBs: Wait for Price Dips in Q2<br />

• JGBs tend to fall in the second quarter of<br />

the fiscal year, due to the reduction of<br />

purchases by postal savings and public<br />

pensions. In addition, numerous factors will<br />

combine to loosen JGB supply-demand<br />

conditions in Q2 FY 2010.<br />

• Our fundamental recommendation is that<br />

investors wait for sufficient price dips before<br />

starting to buy JGBs in H1 FY 2010.<br />

• Moreover, investors need to note the<br />

unexpected resilience of the economy, equities<br />

and the dollar. Such resilience could sway<br />

expectations about BoJ easing, depending on<br />

how it unfolds.<br />

• Looking out through March book closings,<br />

we will remain cautious on the medium sector<br />

of the curve where banks have significantly<br />

increased their long positions.<br />

Many factors to loosen JGB supply/demand in Q2<br />

There is a reason for JGBs’ recent weakness. A<br />

devil-plagued period for many market participants is<br />

approaching. JGBs fell sharply in the second quarter<br />

of both FY 2008 and FY 2009. This was not mere<br />

coincidence. As the repayment of funds entrusted to<br />

the FILP runs its course, JGB purchases by postal<br />

savings and public pensions gradually fall at the start<br />

of each fiscal year. Moreover, other investors,<br />

understanding this, wait for price dips before buying,<br />

exerting further downward pressure on JGBs in Q2 of<br />

the new fiscal year.<br />

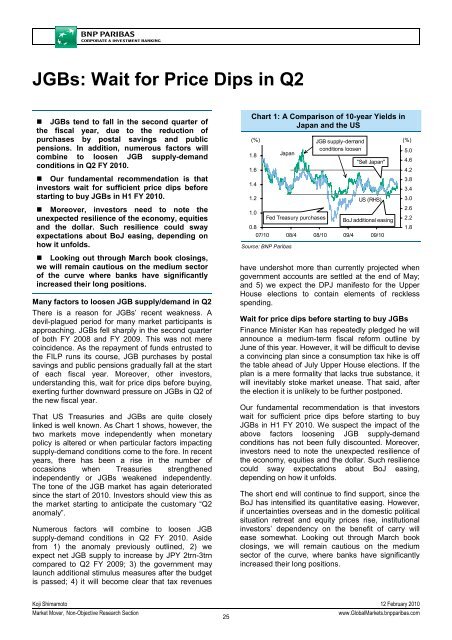

That US Treasuries and JGBs are quite closely<br />

linked is well known. As Chart 1 shows, however, the<br />

two markets move independently when monetary<br />

policy is altered or when particular factors impacting<br />

supply-demand conditions come to the fore. In recent<br />

years, there has been a rise in the number of<br />

occasions when Treasuries strengthened<br />

independently or JGBs weakened independently.<br />

The tone of the JGB market has again deteriorated<br />

since the start of 2010. Investors should view this as<br />

the market starting to anticipate the customary “Q2<br />

anomaly”.<br />

Numerous factors will combine to loosen JGB<br />

supply-demand conditions in Q2 FY 2010. Aside<br />

from 1) the anomaly previously outlined, 2) we<br />

expect net JGB supply to increase by JPY 2trn-3trn<br />

compared to Q2 FY 2009; 3) the government may<br />

launch additional stimulus measures after the budget<br />

is passed; 4) it will become clear that tax revenues<br />

Chart 1: A Comparison of 10-year Yields in<br />

Japan and the US<br />

2.0 (%) JGB supply-demand<br />

(%) 5.4<br />

1.8 Japan<br />

conditions loosen<br />

5.0<br />

"Sell Japan" 4.6<br />

1.6<br />

4.2<br />

1.4<br />

1.2<br />

1.0<br />

Fed Treasury purchases<br />

BoJ additional easing<br />

0.8<br />

07/10 08/4 08/10 09/4 09/10<br />

Source: <strong>BNP</strong> Paribas<br />

US (RHS)<br />

have undershot more than currently projected when<br />

government accounts are settled at the end of May;<br />

and 5) we expect the DPJ manifesto for the Upper<br />

House elections to contain elements of reckless<br />

spending.<br />

Wait for price dips before starting to buy JGBs<br />

Finance Minister Kan has repeatedly pledged he will<br />

announce a medium-term fiscal reform outline by<br />

June of this year. However, it will be difficult to devise<br />

a convincing plan since a consumption tax hike is off<br />

the table ahead of July Upper House elections. If the<br />

plan is a mere formality that lacks true substance, it<br />

will inevitably stoke market unease. That said, after<br />

the election it is unlikely to be further postponed.<br />

Our fundamental recommendation is that investors<br />

wait for sufficient price dips before starting to buy<br />

JGBs in H1 FY 2010. We suspect the impact of the<br />

above factors loosening JGB supply-demand<br />

conditions has not been fully discounted. Moreover,<br />

investors need to note the unexpected resilience of<br />

the economy, equities and the dollar. Such resilience<br />

could sway expectations about BoJ easing,<br />

depending on how it unfolds.<br />

The short end will continue to find support, since the<br />

BoJ has intensified its quantitative easing. However,<br />

if uncertainties overseas and in the domestic political<br />

situation retreat and equity prices rise, institutional<br />

investors’ dependency on the benefit of carry will<br />

ease somewhat. Looking out through March book<br />

closings, we will remain cautious on the medium<br />

sector of the curve, where banks have significantly<br />

increased their long positions.<br />

3.8<br />

3.4<br />

3.0<br />

2.6<br />

2.2<br />

1.8<br />

Koji Shimamoto 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong>, Non-Objective Research Section<br />

25<br />

www.Global<strong>Market</strong>s.bnpparibas.com