Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EUR: Peripheral ASW Curves Re-Steepening<br />

• As the contagion from Greece to other<br />

peripherals has been mainly taking place<br />

through a flattening of their ASW curves…<br />

• …we expect this to correct once the EU<br />

support package for Greece is announced. The<br />

correction has already started for Portugal but<br />

Spain has lagged relative to other peripherals.<br />

• STRATEGY: Expect the Spanish 2/10s to resteepen<br />

in the coming days. This could also be<br />

expressed via a 2/10s BOX of Spain vs Italy.<br />

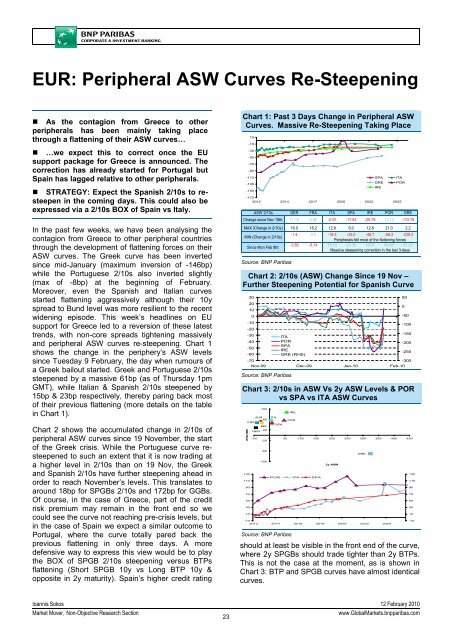

In the past few weeks, we have been analysing the<br />

contagion from Greece to other peripheral countries<br />

through the development of flattening forces on their<br />

ASW curves. The Greek curve has been inverted<br />

since mid-January (maximum inversion of -146bp)<br />

while the Portuguese 2/10s also inverted slightly<br />

(max of -8bp) at the beginning of February.<br />

Moreover, even the Spanish and Italian curves<br />

started flattening aggressively although their 10y<br />

spread to Bund level was more resilient to the recent<br />

widening episode. This week’s headlines on EU<br />

support for Greece led to a reversion of these latest<br />

trends, with non-core spreads tightening massively<br />

and peripheral ASW curves re-steepening. Chart 1<br />

shows the change in the periphery’s ASW levels<br />

since Tuesday 9 February, the day when rumours of<br />

a Greek bailout started. Greek and Portuguese 2/10s<br />

steepened by a massive 61bp (as of Thursday 1pm<br />

GMT), while Italian & Spanish 2/10s steepened by<br />

15bp & 23bp respectively, thereby paring back most<br />

of their previous flattening (more details on the table<br />

in Chart 1).<br />

Chart 2 shows the accumulated change in 2/10s of<br />

peripheral ASW curves since 19 November, the start<br />

of the Greek crisis. While the Portuguese curve resteepened<br />

to such an extent that it is now trading at<br />

a higher level in 2/10s than on 19 Nov, the Greek<br />

and Spanish 2/10s have further steepening ahead in<br />

order to reach November’s levels. This translates to<br />

around 18bp for SPGBs 2/10s and 172bp for GGBs.<br />

Of course, in the case of Greece, part of the credit<br />

risk premium may remain in the front end so we<br />

could see the curve not reaching pre-crisis levels, but<br />

in the case of Spain we expect a similar outcome to<br />

Portugal, where the curve totally pared back the<br />

previous flattening in only three days. A more<br />

defensive way to express this view would be to play<br />

the BOX of SPGB 2/10s steepening versus BTPs<br />

flattening (Short SPGB 10y vs Long BTP 10y &<br />

opposite in 2y maturity). Spain’s higher credit rating<br />

Chart 1: Past 3 Days Change in Peripheral ASW<br />

Curves. Massive Re-Steepening Taking Place<br />

10<br />

-10<br />

-30<br />

-50<br />

-70<br />

-90<br />

-110<br />

-130<br />

-150<br />

-170<br />

2012 2014 2017 2020 2022 2025<br />

should at least be visible in the front end of the curve,<br />

where 2y SPGBs should trade tighter than 2y BTPs.<br />

This is not the case at the moment, as is shown in<br />

Chart 3: BTP and SPGB curves have almost identical<br />

curves.<br />

SPA<br />

GRE<br />

IRE<br />

ITA<br />

POR<br />

ASW 2/10s GER FRA ITA SPA IRE POR GRE<br />

Change since Nov 19th: 11.10 8.96 -0.05 -17.83 -26.78 12.13 -172.78<br />

MAX (Change in 2/10s) 16.0 18.2 12.9 6.0 12.8 21.0 2.2<br />

MIN (Change in 2/10s)<br />

Since Mon Feb 8th:<br />

Source: <strong>BNP</strong> Paribas<br />

-1.4 0.0 -19.3 -43.0 -46.7 -56.2 -239.3<br />

Peripherals felt most of the flattening forces<br />

-3.86 -8.14 15.70 23.35 19.91 60.86 61.22<br />

Massive steepening correction in the last 3-days<br />

Chart 2: 2/10s (ASW) Change Since 19 Nov –<br />

Further Steepening Potential for Spanish Curve<br />

30<br />

20<br />

10<br />

0<br />

-10<br />

-20<br />

-30<br />

-40<br />

-50<br />

-60<br />

-100<br />

-150<br />

-200<br />

-250<br />

-70<br />

-300<br />

Nov-09 Dec-09 Jan-10 Feb-10<br />

Source: <strong>BNP</strong> Paribas<br />

ITA<br />

POR<br />

SPA<br />

IRE<br />

GRE (RHS)<br />

Chart 3: 2/10s in ASW Vs 2y ASW Levels & POR<br />

vs SPA vs ITA ASW Curves<br />

2/10s ASW<br />

130<br />

110<br />

FRA<br />

90<br />

70<br />

50<br />

30<br />

10<br />

-10<br />

AUS<br />

GER<br />

100<br />

60<br />

BEL<br />

20<br />

-60<br />

-100<br />

ITA<br />

SPA<br />

IRE<br />

POR<br />

-50 0 50 100 150 200 250 300 350 400 450<br />

-20<br />

2y ASW<br />

GRE<br />

2012 2014 2016 2018 2020 2022 2024<br />

Source: <strong>BNP</strong> Paribas<br />

POR ITA SPA<br />

50<br />

0<br />

-50<br />

130<br />

110<br />

90<br />

70<br />

50<br />

30<br />

10<br />

-10<br />

Ioannis Sokos 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong>, Non-Objective Research Section<br />

23<br />

www.Global<strong>Market</strong>s.bnpparibas.com