Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

On inflation, Riksbank’s language was hawkish<br />

compared with the December statement. The<br />

increase in inflation in recent months was noted.<br />

Also, the expectation of weak wage increases was<br />

perceived to “help reduce inflationary pressures in<br />

the period ahead”. This is a marked change from the<br />

emphasis on the “downside risks to inflation” in the<br />

December statement.<br />

Revisions to Riksbank’s forecasts<br />

In terms of revisions to growth and inflation<br />

projections, the GDP growth forecast for this year<br />

has been revised down from 2.7% to 2.5%. Inflation<br />

forecasts for 2010, on the other hand, were revised<br />

upwards in light of the surprises on inflation. CPI was<br />

revised up from 0.8% to 1.6%, hence why the<br />

Riksbank now expects to deliver its first rate hike<br />

earlier, and CPIF from 1.2% to 1.9%. 2011 forecasts<br />

were revised down only by 0.1pp for both CPI and<br />

CPIF (to 2.9% and 1.4% respectively).<br />

Chart 3: GDP and Unemployment<br />

Source: Reuters EcoWin Pro<br />

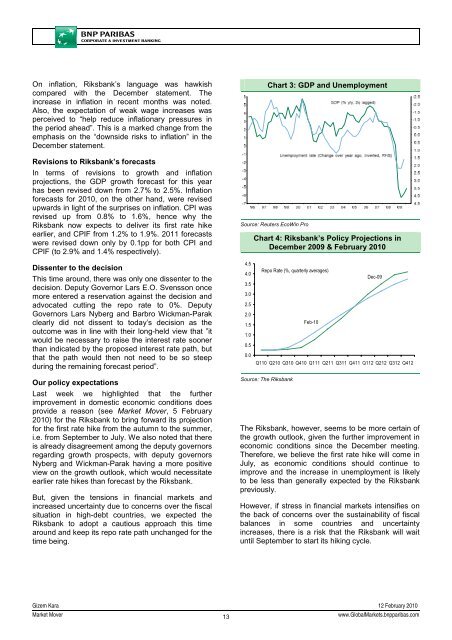

Chart 4: Riksbank’s Policy Projections in<br />

December 2009 & February 2010<br />

Dissenter to the decision<br />

This time around, there was only one dissenter to the<br />

decision. Deputy Governor Lars E.O. Svensson once<br />

more entered a reservation against the decision and<br />

advocated cutting the repo rate to 0%. Deputy<br />

Governors Lars Nyberg and Barbro Wickman-Parak<br />

clearly did not dissent to today’s decision as the<br />

outcome was in line with their long-held view that ”it<br />

would be necessary to raise the interest rate sooner<br />

than indicated by the proposed interest rate path, but<br />

that the path would then not need to be so steep<br />

during the remaining forecast period”.<br />

4.5<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

Repo Rate (%, quarterly averages)<br />

Dec-09<br />

Feb-10<br />

Q110 Q210 Q310 Q410 Q111 Q211 Q311 Q411 Q112 Q212 Q312 Q412<br />

Our policy expectations<br />

Last week we highlighted that the further<br />

improvement in domestic economic conditions does<br />

provide a reason (see <strong>Market</strong> <strong>Mover</strong>, 5 February<br />

2010) for the Riksbank to bring forward its projection<br />

for the first rate hike from the autumn to the summer,<br />

i.e. from September to July. We also noted that there<br />

is already disagreement among the deputy governors<br />

regarding growth prospects, with deputy governors<br />

Nyberg and Wickman-Parak having a more positive<br />

view on the growth outlook, which would necessitate<br />

earlier rate hikes than forecast by the Riksbank.<br />

But, given the tensions in financial markets and<br />

increased uncertainty due to concerns over the fiscal<br />

situation in high-debt countries, we expected the<br />

Riksbank to adopt a cautious approach this time<br />

around and keep its repo rate path unchanged for the<br />

time being.<br />

Source: The Riksbank<br />

The Riksbank, however, seems to be more certain of<br />

the growth outlook, given the further improvement in<br />

economic conditions since the December meeting.<br />

Therefore, we believe the first rate hike will come in<br />

July, as economic conditions should continue to<br />

improve and the increase in unemployment is likely<br />

to be less than generally expected by the Riksbank<br />

previously.<br />

However, if stress in financial markets intensifies on<br />

the back of concerns over the sustainability of fiscal<br />

balances in some countries and uncertainty<br />

increases, there is a risk that the Riksbank will wait<br />

until September to start its hiking cycle.<br />

Gizem Kara 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

13<br />

www.Global<strong>Market</strong>s.bnpparibas.com