Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

Market Mover - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Key Data Preview<br />

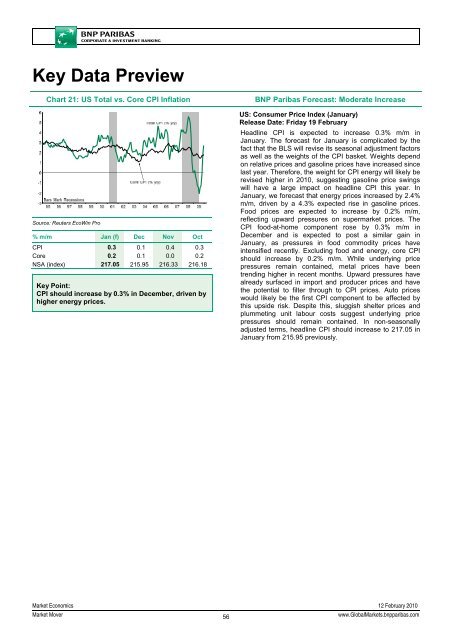

Chart 21: US Total vs. Core CPI Inflation<br />

Source: Reuters EcoWin Pro<br />

% m/m Jan (f) Dec Nov Oct<br />

CPI 0.3 0.1 0.4 0.3<br />

Core 0.2 0.1 0.0 0.2<br />

NSA (index) 217.05 215.95 216.33 216.18<br />

Key Point:<br />

CPI should increase by 0.3% in December, driven by<br />

higher energy prices.<br />

<strong>BNP</strong> Paribas Forecast: Moderate Increase<br />

US: Consumer Price Index (January)<br />

Release Date: Friday 19 February<br />

Headline CPI is expected to increase 0.3% m/m in<br />

January. The forecast for January is complicated by the<br />

fact that the BLS will revise its seasonal adjustment factors<br />

as well as the weights of the CPI basket. Weights depend<br />

on relative prices and gasoline prices have increased since<br />

last year. Therefore, the weight for CPI energy will likely be<br />

revised higher in 2010, suggesting gasoline price swings<br />

will have a large impact on headline CPI this year. In<br />

January, we forecast that energy prices increased by 2.4%<br />

m/m, driven by a 4.3% expected rise in gasoline prices.<br />

Food prices are expected to increase by 0.2% m/m,<br />

reflecting upward pressures on supermarket prices. The<br />

CPI food-at-home component rose by 0.3% m/m in<br />

December and is expected to post a similar gain in<br />

January, as pressures in food commodity prices have<br />

intensified recently. Excluding food and energy, core CPI<br />

should increase by 0.2% m/m. While underlying price<br />

pressures remain contained, metal prices have been<br />

trending higher in recent months. Upward pressures have<br />

already surfaced in import and producer prices and have<br />

the potential to filter through to CPI prices. Auto prices<br />

would likely be the first CPI component to be affected by<br />

this upside risk. Despite this, sluggish shelter prices and<br />

plummeting unit labour costs suggest underlying price<br />

pressures should remain contained. In non-seasonally<br />

adjusted terms, headline CPI should increase to 217.05 in<br />

January from 215.95 previously.<br />

<strong>Market</strong> Economics 12 February 2010<br />

<strong>Market</strong> <strong>Mover</strong><br />

56<br />

www.Global<strong>Market</strong>s.bnpparibas.com