Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

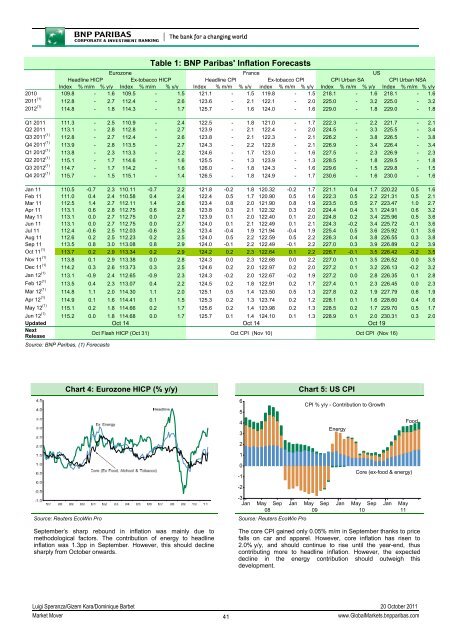

Table 1: <strong>BNP</strong> Paribas' Inflation ForecastsEurozoneFranceUSHeadline HICPEx-tobacco HICPHeadline CPIEx-tobacco CPICPI Urban SA CPI Urban NSAIndex % m/m % y/y Index % m/m % y/y Index % m/m % y/y index % m/m % y/y Index % m/m % y/y Index % m/m % y/y2010 109.8 - 1.6 109.5 - 1.5 121.1 - 1.5 119.8 - 1.5 218.1 - 1.6 218.1 - 1.62011 (1) 112.8 - 2.7 112.4 - 2.6 123.6 - 2.1 122.1 - 2.0 225.0 - 3.2 225.0 - 3.22012 (1) 114.8 - 1.8 114.3 - 1.7 125.7 - 1.6 124.0 - 1.6 229.0 - 1.8 229.0 - 1.8Q1 2011 111.3 - 2.5 110.9 - 2.4 122.5 - 1.8 121.0 - 1.7 222.3 - 2.2 221.7 - 2.1Q2 2011 113.1 - 2.8 112.8 - 2.7 123.9 - 2.1 122.4 - 2.0 224.5 - 3.3 225.5 - 3.4Q3 2011 (1) 112.8 - 2.7 112.4 - 2.6 123.8 - 2.1 122.3 - 2.1 226.2 - 3.8 226.5 - 3.8Q4 2011 (1) 113.9 - 2.8 113.5 - 2.7 124.3 - 2.2 122.8 - 2.1 226.9 - 3.4 226.4 - 3.4Q1 2012 (1) 113.8 - 2.3 113.3 - 2.2 124.6 - 1.7 123.0 - 1.6 227.5 - 2.3 226.9 - 2.3Q2 2012 (1) 115.1 - 1.7 114.6 - 1.6 125.5 - 1.3 123.9 - 1.3 228.5 - 1.8 229.5 - 1.8Q3 2012 (1) 114.7 - 1.7 114.2 - 1.6 126.0 - 1.8 124.3 - 1.6 229.6 - 1.5 229.8 - 1.5Q4 2012 (1) 115.7 - 1.5 115.1 - 1.4 126.5 - 1.8 124.9 - 1.7 230.6 - 1.6 230.0 - 1.6Jan 11 110.5 -0.7 2.3 110.11 -0.7 2.2 121.8 -0.2 1.8 120.32 -0.2 1.7 221.1 0.4 1.7 220.22 0.5 1.6Feb 11 111.0 0.4 2.4 110.58 0.4 2.4 122.4 0.5 1.7 120.90 0.5 1.6 222.3 0.5 2.2 221.31 0.5 2.1Mar 11 112.5 1.4 2.7 112.11 1.4 2.6 123.4 0.8 2.0 121.90 0.8 1.9 223.5 0.5 2.7 223.47 1.0 2.7Apr 11 113.1 0.6 2.8 112.75 0.6 2.8 123.8 0.3 2.1 122.32 0.3 2.0 224.4 0.4 3.1 224.91 0.6 3.2May 11 113.1 0.0 2.7 112.75 0.0 2.7 123.9 0.1 2.0 122.40 0.1 2.0 224.8 0.2 3.4 225.96 0.5 3.6Jun 11 113.1 0.0 2.7 112.75 0.0 2.7 124.0 0.1 2.1 122.49 0.1 2.1 224.3 -0.2 3.4 225.72 -0.1 3.6Jul 11 112.4 -0.6 2.5 112.03 -0.6 2.5 123.4 -0.4 1.9 121.94 -0.4 1.9 225.4 0.5 3.6 225.92 0.1 3.6Aug 11 112.6 0.2 2.5 112.23 0.2 2.5 124.0 0.5 2.2 122.59 0.5 2.2 226.3 0.4 3.8 226.55 0.3 3.8Sep 11 113.5 0.8 3.0 113.08 0.8 2.9 124.0 -0.1 2.2 122.49 -0.1 2.2 227.0 0.3 3.9 226.89 0.2 3.9Oct 11 (1) 113.7 0.2 2.9 113.34 0.2 2.9 124.2 0.2 2.3 122.64 0.1 2.2 226.7 -0.1 3.5 226.42 -0.2 3.5Nov 11 (1) 113.8 0.1 2.9 113.38 0.0 2.8 124.3 0.0 2.3 122.68 0.0 2.2 227.0 0.1 3.5 226.52 0.0 3.5Dec 11 (1) 114.2 0.3 2.6 113.73 0.3 2.5 124.6 0.2 2.0 122.97 0.2 2.0 227.2 0.1 3.2 226.13 -0.2 3.2Jan 12 (1) 113.1 -0.9 2.4 112.65 -0.9 2.3 124.3 -0.2 2.0 122.67 -0.2 1.9 227.2 0.0 2.8 226.35 0.1 2.8Feb 12 (1) 113.5 0.4 2.3 113.07 0.4 2.2 124.5 0.2 1.8 122.91 0.2 1.7 227.4 0.1 2.3 226.45 0.0 2.3Mar 12 (1) 114.8 1.1 2.0 114.30 1.1 2.0 125.1 0.5 1.4 123.50 0.5 1.3 227.8 0.2 1.9 227.79 0.6 1.9Apr 12 (1) 114.9 0.1 1.6 114.41 0.1 1.5 125.3 0.2 1.3 123.74 0.2 1.2 228.1 0.1 1.6 228.60 0.4 1.6May 12 (1) 115.1 0.2 1.8 114.66 0.2 1.7 125.6 0.2 1.4 123.98 0.2 1.3 228.5 0.2 1.7 229.70 0.5 1.7Jun 12 (1) 115.2 0.0 1.8 114.68 0.0 1.7 125.7 0.1 1.4 124.10 0.1 1.3 228.9 0.1 2.0 230.31 0.3 2.0UpdatedNextReleaseOct 14Oct Flash HICP (Oct 31)Oct 14Oct CPI (Nov 10)Oct 19Oct CPI (Nov 16)Source: <strong>BNP</strong> Paribas, (1) ForecastsChart 4: Eurozone HICP (% y/y)654321Chart 5: US CPICPI % y/y - Contribution to GrowthEnergyFood0-1Core (ex-food & energy)-2Source: Reuters EcoWin ProSeptember’s sharp rebound in inflation was mainly due tomethodological factors. The contribution of energy to headlineinflation was 1.3pp in September. However, this should declinesharply from October onwards.-3Jan May Sep Jan May Sep Jan May Sep Jan May08 09 10 11Source: Reuters EcoWin ProThe core CPI gained only 0.05% m/m in September thanks to pricefalls on car and apparel. However, core inflation has risen to2.0% y/y, and should continue to rise until the year-end, thuscontributing more to headline inflation. However, the expecteddecline in the energy contribution should outweigh thisdevelopment.Luigi Speranza/Gizem Kara/Dominique Barbet 20 October 2011<strong>Market</strong> Mover41www.Global<strong>Market</strong>s.bnpparibas.com