Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

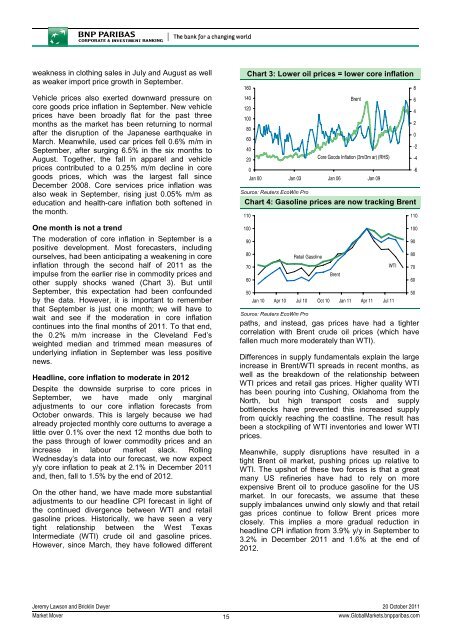

weakness in clothing sales in July and August as wellas weaker import price growth in September.Vehicle prices also exerted downward pressure oncore goods price inflation in September. New vehicleprices have been broadly flat for the past threemonths as the market has been returning to normalafter the disruption of the Japanese earthquake inMarch. Meanwhile, used car prices fell 0.6% m/m inSeptember, after surging 6.5% in the six months toAugust. Together, the fall in apparel and vehicleprices contributed to a 0.25% m/m decline in coregoods prices, which was the largest fall sinceDecember 2008. Core services price inflation wasalso weak in September, rising just 0.05% m/m aseducation and health-care inflation both softened inthe month.One month is not a trendThe moderation of core inflation in September is apositive development. Most forecasters, includingourselves, had been anticipating a weakening in coreinflation through the second half of 2011 as theimpulse from the earlier rise in commodity prices andother supply shocks waned (Chart 3). But untilSeptember, this expectation had been confoundedby the data. However, it is important to rememberthat September is just one month; we will have towait and see if the moderation in core inflationcontinues into the final months of 2011. To that end,the 0.2% m/m increase in the Cleveland Fed’sweighted median and trimmed mean measures ofunderlying inflation in September was less positivenews.Headline, core inflation to moderate in 2012Despite the downside surprise to core prices inSeptember, we have made only marginaladjustments to our core inflation forecasts fromOctober onwards. This is largely because we hadalready projected monthly core outturns to average alittle over 0.1% over the next 12 months due both tothe pass through of lower commodity prices and anincrease in labour market slack. RollingWednesday’s data into our forecast, we now expecty/y core inflation to peak at 2.1% in December 2011and, then, fall to 1.5% by the end of 2012.On the other hand, we have made more substantialadjustments to our headline CPI forecast in light ofthe continued divergence between WTI and retailgasoline prices. Historically, we have seen a verytight relationship between the West TexasIntermediate (WTI) crude oil and gasoline prices.However, since March, they have followed differentChart 3: Lower oil prices = lower core inflation160140120100806040200BrentCore Goods Inflation (3m/3m ar) (RHS)Jan 00 Jan 03 Jan 06 Jan 09Source: Reuters EcoWin ProChart 4: Gasoline prices are now tracking Brent1101009080706050Retail GasolineJan 10 Apr 10 Jul 10 Oct 10 Jan 11 Apr 11 Jul 11Source: Reuters EcoWin ProBrentpaths, and instead, gas prices have had a tightercorrelation with Brent crude oil prices (which havefallen much more moderately than WTI).Differences in supply fundamentals explain the largeincrease in Brent/WTI spreads in recent months, aswell as the breakdown of the relationship betweenWTI prices and retail gas prices. Higher quality WTIhas been pouring into Cushing, Oklahoma from theNorth, but high transport costs and supplybottlenecks have prevented this increased supplyfrom quickly reaching the coastline. The result hasbeen a stockpiling of WTI inventories and lower WTIprices.Meanwhile, supply disruptions have resulted in atight Brent oil market, pushing prices up relative toWTI. The upshot of these two forces is that a greatmany US refineries have had to rely on moreexpensive Brent oil to produce gasoline for the USmarket. In our forecasts, we assume that thesesupply imbalances unwind only slowly and that retailgas prices continue to follow Brent prices moreclosely. This implies a more gradual reduction inheadline CPI inflation from 3.9% y/y in September to3.2% in December 2011 and 1.6% at the end of2012.WTI864209080706050-2-4-6110100Jeremy Lawson and Bricklin Dwyer 20 October 2011<strong>Market</strong> Mover15www.Global<strong>Market</strong>s.bnpparibas.com