Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

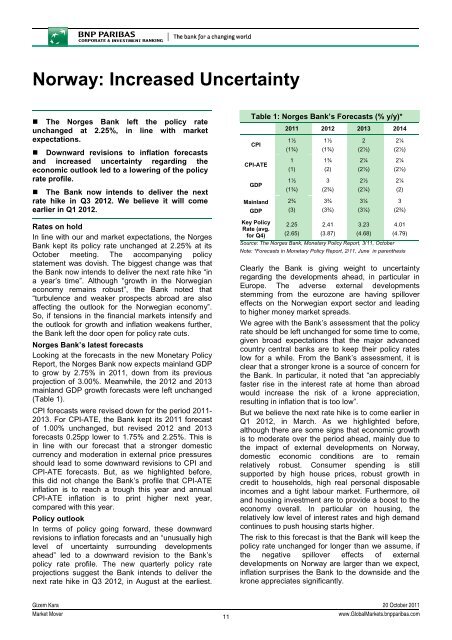

Norway: Increased Uncertainty• The Norges Bank left the policy rateunchanged at 2.25%, in line with marketexpectations.• Downward revisions to inflation forecastsand increased uncertainty regarding theeconomic outlook led to a lowering of the policyrate profile.• The Bank now intends to deliver the nextrate hike in Q3 2012. We believe it will comeearlier in Q1 2012.Rates on holdIn line with our and market expectations, the NorgesBank kept its policy rate unchanged at 2.25% at itsOctober meeting. The accompanying policystatement was dovish. The biggest change was thatthe Bank now intends to deliver the next rate hike “ina year’s time”. Although “growth in the Norwegianeconomy remains robust”, the Bank noted that“turbulence and weaker prospects abroad are alsoaffecting the outlook for the Norwegian economy”.So, if tensions in the financial markets intensify andthe outlook for growth and inflation weakens further,the Bank left the door open for policy rate cuts.Norges Bank’s latest forecastsLooking at the forecasts in the new Monetary PolicyReport, the Norges Bank now expects mainland GDPto grow by 2.75% in 2011, down from its previousprojection of 3.00%. Meanwhile, the 2012 and 2013mainland GDP growth forecasts were left unchanged(Table 1).CPI forecasts were revised down for the period 2011-2013. For CPI-ATE, the Bank kept its 2011 forecastof 1.00% unchanged, but revised 2012 and 2013forecasts 0.25pp lower to 1.75% and 2.25%. This isin line with our forecast that a stronger domesticcurrency and moderation in external price pressuresshould lead to some downward revisions to CPI andCPI-ATE forecasts. But, as we highlighted before,this did not change the Bank’s profile that CPI-ATEinflation is to reach a trough this year and annualCPI-ATE inflation is to print higher next year,compared with this year.Policy outlookIn terms of policy going forward, these downwardrevisions to inflation forecasts and an “unusually highlevel of uncertainty surrounding developmentsahead” led to a downward revision to the Bank’spolicy rate profile. The new quarterly policy rateprojections suggest the Bank intends to deliver thenext rate hike in Q3 2012, in August at the earliest.Table 1: Norges Bank’s Forecasts (% y/y)*CPICPI-ATEGDPMainlandGDP2011 2012 2013 20141½(1¾)1(1)1½(1¾)2¾(3)1½(1¾)1¾(2)3(2¾)3¾(3¾)2(2½)2¼(2½)2½(2¼)3¼(3¼)2¼(2½)2¼(2½)2¼(2)3(2¾)Key Policy 2.25 2.41 3.23 4.01Rate (avg.for Q4) (2.65) (3.87) (4.68) (4.79)Source: The Norges Bank, Monetary Policy Report, 3/11, OctoberNote: *Forecasts in Monetary Policy Report, 2/11, June in parenthesisClearly the Bank is giving weight to uncertaintyregarding the developments ahead, in particular inEurope. The adverse external developmentsstemming from the eurozone are having spillovereffects on the Norwegian export sector and leadingto higher money market spreads.We agree with the Bank’s assessment that the policyrate should be left unchanged for some time to come,given broad expectations that the major advancedcountry central banks are to keep their policy rateslow for a while. From the Bank’s assessment, it isclear that a stronger krone is a source of concern forthe Bank. In particular, it noted that “an appreciablyfaster rise in the interest rate at home than abroadwould increase the risk of a krone appreciation,resulting in inflation that is too low”.But we believe the next rate hike is to come earlier inQ1 2012, in March. As we highlighted before,although there are some signs that economic growthis to moderate over the period ahead, mainly due tothe impact of external developments on Norway,domestic economic conditions are to remainrelatively robust. Consumer spending is stillsupported by high house prices, robust growth incredit to households, high real personal disposableincomes and a tight labour market. Furthermore, oiland housing investment are to provide a boost to theeconomy overall. In particular on housing, therelatively low level of interest rates and high demandcontinues to push housing starts higher.The risk to this forecast is that the Bank will keep thepolicy rate unchanged for longer than we assume, ifthe negative spillover effects of externaldevelopments on Norway are larger than we expect,inflation surprises the Bank to the downside and thekrone appreciates significantly.Gizem Kara 20 October 2011<strong>Market</strong> Mover11www.Global<strong>Market</strong>s.bnpparibas.com