Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

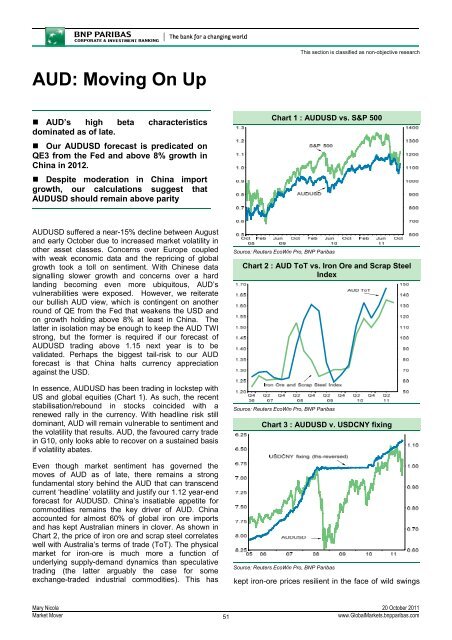

This section is classified as non-objective researchAUD: Moving On Up• AUD’s high beta characteristicsdominated as of late.• Our AUDUSD forecast is predicated onQE3 from the Fed and above 8% growth inChina in 2012.• Despite moderation in China importgrowth, our calculations suggest thatAUDUSD should remain above parityChart 1 : AUDUSD vs. S&P 500AUDUSD suffered a near-15% decline between Augustand early October due to increased market volatility inother asset classes. Concerns over Europe coupledwith weak economic data and the repricing of globalgrowth took a toll on sentiment. With Chinese datasignalling slower growth and concerns over a hardlanding becoming even more ubiquitous, AUD’svulnerabilities were exposed. However, we reiterateour bullish AUD view, which is contingent on anotherround of QE from the Fed that weakens the USD andon growth holding above 8% at least in China. Thelatter in isolation may be enough to keep the AUD TWIstrong, but the former is required if our forecast ofAUDUSD trading above 1.15 next year is to bevalidated. Perhaps the biggest tail-risk to our AUDforecast is that China halts currency appreciationagainst the USD.In essence, AUDUSD has been trading in lockstep withUS and global equities (Chart 1). As such, the recentstabilisation/rebound in stocks coincided with arenewed rally in the currency. With headline risk stilldominant, AUD will remain vulnerable to sentiment andthe volatility that results. AUD, the favoured carry tradein G10, only looks able to recover on a sustained basisif volatility abates.Even though market sentiment has governed themoves of AUD as of late, there remains a strongfundamental story behind the AUD that can transcendcurrent ‘headline’ volatility and justify our 1.12 year-endforecast for AUDUSD. China’s insatiable appetite forcommodities remains the key driver of AUD. Chinaaccounted for almost 60% of global iron ore importsand has kept Australian miners in clover. As shown inChart 2, the price of iron ore and scrap steel correlateswell with Australia’s terms of trade (ToT). The physicalmarket for iron-ore is much more a function ofunderlying supply-demand dynamics than speculativetrading (the latter arguably the case for someexchange-traded industrial commodities). This hasSource: Reuters EcoWin Pro, <strong>BNP</strong> ParibasChart 2 : AUD ToT vs. Iron Ore and Scrap SteelIndexSource: Reuters EcoWin Pro, <strong>BNP</strong> ParibasChart 3 : AUDUSD v. USDCNY fixingSource: Reuters EcoWin Pro, <strong>BNP</strong> Paribaskept iron-ore prices resilient in the face of wild swingsMary Nicola 20 October 2011<strong>Market</strong> Mover51www.Global<strong>Market</strong>s.bnpparibas.com