Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

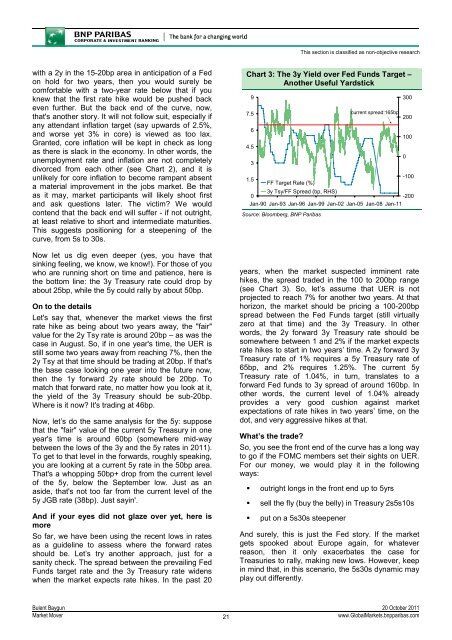

This section is classified as non-objective researchwith a 2y in the 15-20bp area in anticipation of a Fedon hold for two years, then you would surely becomfortable with a two-year rate below that if youknew that the first rate hike would be pushed backeven further. But the back end of the curve, now,that's another story. It will not follow suit, especially ifany attendant inflation target (say upwards of 2.5%,and worse yet 3% in core) is viewed as too lax.Granted, core inflation will be kept in check as longas there is slack in the economy. In other words, theunemployment rate and inflation are not completelydivorced from each other (see Chart 2), and it isunlikely for core inflation to become rampant absenta material improvement in the jobs market. Be thatas it may, market participants will likely shoot firstand ask questions later. The victim? We wouldcontend that the back end will suffer - if not outright,at least relative to short and intermediate maturities.This suggests positioning for a steepening of thecurve, from 5s to 30s.Now let us dig even deeper (yes, you have thatsinking feeling, we know, we know!). For those of youwho are running short on time and patience, here isthe bottom line: the 3y Treasury rate could drop byabout 25bp, while the 5y could rally by about 50bp.On to the detailsLet's say that, whenever the market views the firstrate hike as being about two years away, the "fair"value for the 2y Tsy rate is around 20bp – as was thecase in August. So, if in one year's time, the UER isstill some two years away from reaching 7%, then the2y Tsy at that time should be trading at 20bp. If that'sthe base case looking one year into the future now,then the 1y forward 2y rate should be 20bp. Tomatch that forward rate, no matter how you look at it,the yield of the 3y Treasury should be sub-20bp.Where is it now? It's trading at 46bp.Now, let’s do the same analysis for the 5y: supposethat the "fair" value of the current 5y Treasury in oneyear's time is around 60bp (somewhere mid-waybetween the lows of the 3y and the 5y rates in 2011).To get to that level in the forwards, roughly speaking,you are looking at a current 5y rate in the 50bp area.That's a whopping 50bp+ drop from the current levelof the 5y, below the September low. Just as anaside, that's not too far from the current level of the5y JGB rate (38bp). Just sayin'.And if your eyes did not glaze over yet, here ismoreSo far, we have been using the recent lows in ratesas a guideline to assess where the forward ratesshould be. Let’s try another approach, just for asanity check. The spread between the prevailing FedFunds target rate and the 3y Treasury rate widenswhen the market expects rate hikes. In the past 20Chart 3: The 3y Yield over Fed Funds Target –Another Useful Yardstick97.564.53-1001.5FF Target Rate (%)3y Tsy/FF Spread (bp, RHS)0-200Jan-90 Jan-93 Jan-96 Jan-99 Jan-02 Jan-05 Jan-08 Jan-11Source: Bloomberg, <strong>BNP</strong> Paribasyears, when the market suspected imminent ratehikes, the spread traded in the 100 to 200bp range(see Chart 3). So, let’s assume that UER is notprojected to reach 7% for another two years. At thathorizon, the market should be pricing a 100-200bpspread between the Fed Funds target (still virtuallyzero at that time) and the 3y Treasury. In otherwords, the 2y forward 3y Treasury rate should besomewhere between 1 and 2% if the market expectsrate hikes to start in two years’ time. A 2y forward 3yTreasury rate of 1% requires a 5y Treasury rate of65bp, and 2% requires 1.25%. The current 5yTreasury rate of 1.04%, in turn, translates to aforward Fed funds to 3y spread of around 160bp. Inother words, the current level of 1.04% alreadyprovides a very good cushion against marketexpectations of rate hikes in two years’ time, on thedot, and very aggressive hikes at that.What’s the trade?So, you see the front end of the curve has a long wayto go if the FOMC members set their sights on UER.For our money, we would play it in the followingways:• outright longs in the front end up to 5yrs• sell the fly (buy the belly) in Treasury 2s5s10s• put on a 5s30s steepenercurrent spread:165bp300200100And surely, this is just the Fed story. If the marketgets spooked about Europe again, for whateverreason, then it only exacerbates the case forTreasuries to rally, making new lows. However, keepin mind that, in this scenario, the 5s30s dynamic mayplay out differently.0Bulent Baygun 20 October 2011<strong>Market</strong> Mover21www.Global<strong>Market</strong>s.bnpparibas.com