Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

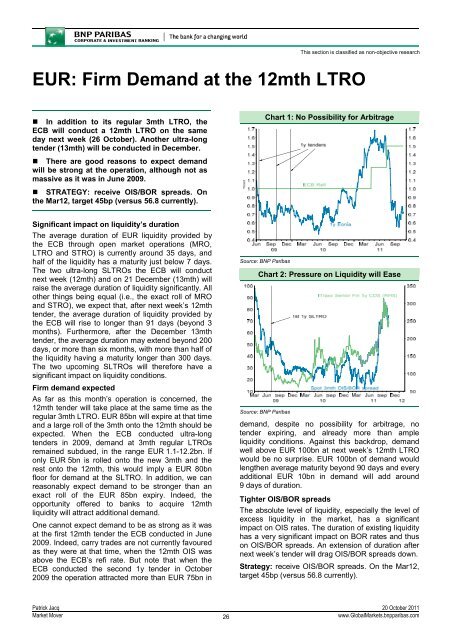

This section is classified as non-objective researchEUR: Firm Demand at the 12mth LTRO• In addition to its regular 3mth LTRO, theECB will conduct a 12mth LTRO on the sameday next week (26 October). Another ultra-longtender (13mth) will be conducted in December.• There are good reasons to expect demandwill be strong at the operation, although not asmassive as it was in June 2009.• STRATEGY: receive OIS/BOR spreads. Onthe Mar12, target 45bp (versus 56.8 currently).Chart 1: No Possibility for ArbitrageSignificant impact on liquidity’s durationThe average duration of EUR liquidity provided bythe ECB through open market operations (MRO,LTRO and STRO) is currently around 35 days, andhalf of the liquidity has a maturity just below 7 days.The two ultra-long SLTROs the ECB will conductnext week (12mth) and on 21 December (13mth) willraise the average duration of liquidity significantly. Allother things being equal (i.e., the exact roll of MROand STRO), we expect that, after next week’s 12mthtender, the average duration of liquidity provided bythe ECB will rise to longer than 91 days (beyond 3months). Furthermore, after the December 13mthtender, the average duration may extend beyond 200days, or more than six months, with more than half ofthe liquidity having a maturity longer than 300 days.The two upcoming SLTROs will therefore have asignificant impact on liquidity conditions.Firm demand expectedAs far as this month’s operation is concerned, the12mth tender will take place at the same time as theregular 3mth LTRO. EUR 85bn will expire at that timeand a large roll of the 3mth onto the 12mth should beexpected. When the ECB conducted ultra-longtenders in 2009, demand at 3mth regular LTROsremained subdued, in the range EUR 1.1-12.2bn. Ifonly EUR 5bn is rolled onto the new 3mth and therest onto the 12mth, this would imply a EUR 80bnfloor for demand at the SLTRO. In addition, we canreasonably expect demand to be stronger than anexact roll of the EUR 85bn expiry. Indeed, theopportunity offered to banks to acquire 12mthliquidity will attract additional demand.One cannot expect demand to be as strong as it wasat the first 12mth tender the ECB conducted in June2009. Indeed, carry trades are not currently favouredas they were at that time, when the 12mth OIS wasabove the ECB’s refi rate. But note that when theECB conducted the second 1y tender in October2009 the operation attracted more than EUR 75bn inSource: <strong>BNP</strong> ParibasChart 2: Pressure on Liquidity will EaseSource: <strong>BNP</strong> Paribasdemand, despite no possibility for arbitrage, notender expiring, and already more than ampleliquidity conditions. Against this backdrop, demandwell above EUR 100bn at next week’s 12mth LTROwould be no surprise. EUR 100bn of demand wouldlengthen average maturity beyond 90 days and everyadditional EUR 10bn in demand will add around9 days of duration.Tighter OIS/BOR spreadsThe absolute level of liquidity, especially the level ofexcess liquidity in the market, has a significantimpact on OIS rates. The duration of existing liquidityhas a very significant impact on BOR rates and thuson OIS/BOR spreads. An extension of duration afternext week’s tender will drag OIS/BOR spreads down.Strategy: receive OIS/BOR spreads. On the Mar12,target 45bp (versus 56.8 currently).Patrick Jacq 20 October 2011<strong>Market</strong> Mover26www.Global<strong>Market</strong>s.bnpparibas.com