Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

Market Outlook - BNP PARIBAS - Investment Services India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

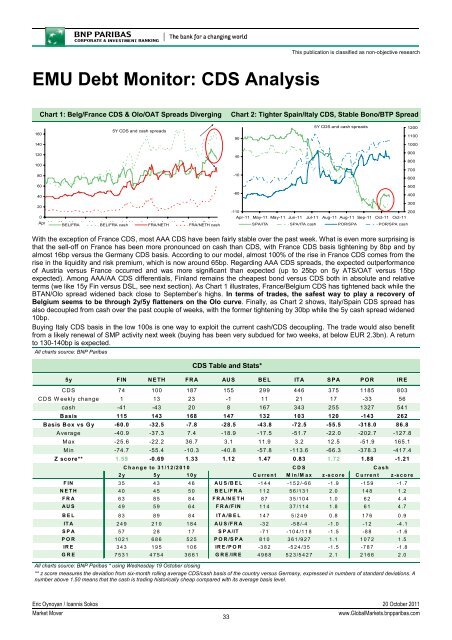

This publication is classified as non-objective researchEMU Debt Monitor: CDS AnalysisChart 1: Belg/France CDS & Olo/OAT Spreads DivergingChart 2: Tighter Spain/Italy CDS, Stable Bono/BTP Spread1605Y CDS and cash spreads905Y CDS and cash spreads1200110014010001201008040-109008007006006040200Apr-11 May-11BEL/FRAJun-11BEL/FRAJun-11cashJul-11 Aug-11FRA/NETHAug-11 Sep-11FRA/NETHOct-11cash500-60400300-110200Apr-11 May-11 May-11 Jun-11 Jul-11 Aug-11 Aug-11 Sep-11 Oct-11 Oct-11SPA/ITA SPA/ITA cash POR/SPA POR/SPA cashWith the exception of France CDS, most AAA CDS have been fairly stable over the past week. What is even more surprising isthat the sell-off on France has been more pronounced on cash than CDS, with France CDS basis tightening by 8bp and byalmost 16bp versus the Germany CDS basis. According to our model, almost 100% of the rise in France CDS comes from therise in the liquidity and risk premium, which is now around 65bp. Regarding AAA CDS spreads, the expected outperformanceof Austria versus France occurred and was more significant than expected (up to 25bp on 5y ATS/OAT versus 15bpexpected). Among AAA/AA CDS differentials, Finland remains the cheapest bond versus CDS both in absolute and relativeterms (we like 15y Fin versus DSL, see next section). As Chart 1 illustrates, France/Belgium CDS has tightened back while theBTAN/Olo spread widened back close to September’s highs. In terms of trades, the safest way to play a recovery ofBelgium seems to be through 2y/5y flatteners on the Olo curve. Finally, as Chart 2 shows, Italy/Spain CDS spread hasalso decoupled from cash over the past couple of weeks, with the former tightening by 30bp while the 5y cash spread widened10bp.Buying Italy CDS basis in the low 100s is one way to exploit the current cash/CDS decoupling. The trade would also benefitfrom a likely renewal of SMP activity next week (buying has been very subdued for two weeks, at below EUR 2.3bn). A returnto 130-140bp is expected.All charts source: <strong>BNP</strong> ParibasCDS Table and Stats*5y FIN NETH FRA AUS BEL ITA SPA POR IRECDS 74 100 187 155 299 446 375 1185 803CDS Weekly change 1 13 23 -1 11 21 17 -33 56cash -41 -43 20 8 167 343 255 1327 541Basis 115 143 168 147 132 103 120 -143 262Basis Box vs Gy -60.0 -32.5 -7.8 -28.5 -43.8 -72.5 -55.5 -318.0 86.8Average -40.9 -37.3 7.4 -18.9 -17.5 -51.7 -22.0 -202.7 -127.8Max -25.6 -22.2 36.7 3.1 11.9 3.2 12.5 -51.9 165.1Min -74.7 -55.4 -10.3 -40.8 -57.8 -113.6 -66.3 -378.3 -417.4Z score** 1.59 -0.69 1.33 1.12 1.47 0.83 1.72 1.88 -1.21Change to 31/12/2010 CDS Cash2y 5y 10y Current Min/Max z-score Current z-scoreFIN 35 43 46 AUS/BEL -144 -152/-66 -1.9 -159 -1.7NETH 40 45 50 BEL/FRA 112 56/131 2.0 148 1.2FRA 63 85 84 FRA/NETH 87 35/104 1.0 62 4.4AUS 49 59 64 FRA/FIN 114 37/114 1.8 61 4.7BEL 83 89 84 ITA/B EL 147 5/249 0.8 176 0.9ITA 249 210 184 AUS/FRA -32 -58/-4 -1.0 -12 -4.1SPA 57 28 17 SPA/IT -71 -104/118 -1.5 -88 -1.6POR 1021 686 525 POR/SPA 810 361/927 1.1 1072 1.5IR E 343 195 106 IR E /PO R -382 -524/35 -1.5 -787 -1.8GRE 7531 4754 3661 GRE/IRE 4968 523/5427 2.1 2166 2.0All charts source: <strong>BNP</strong> Paribas * using Wednesday 19 October closing** z score measures the deviation from six-month rolling average CDS/cash basis of the country versus Germany, expressed in numbers of standard deviations. Anumber above 1.50 means that the cash is trading historically cheap compared with its average basis level.Eric Oynoyan / Ioannis Sokos 20 October 2011<strong>Market</strong> Mover33www.Global<strong>Market</strong>s.bnpparibas.com