Commentary - Santos

Commentary - Santos

Commentary - Santos

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Reserves<br />

and resources<br />

<strong>Santos</strong>’ growing reserve position, combined<br />

with existing infrastructure, leaves the company<br />

strategically well placed to supply the growing<br />

demand for natural gas in Australia and Asia.<br />

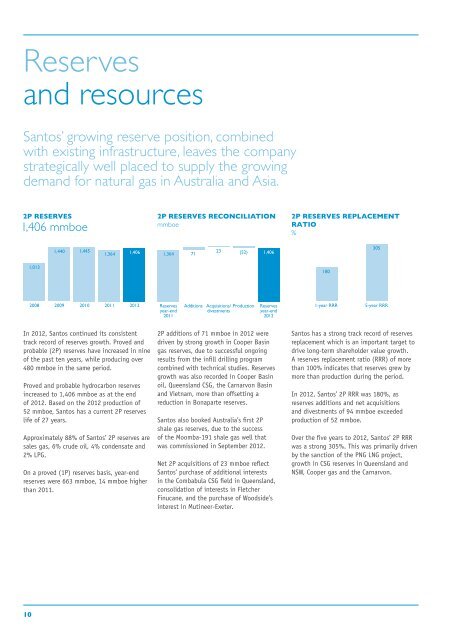

2P RESERVES<br />

1,406 mmboe<br />

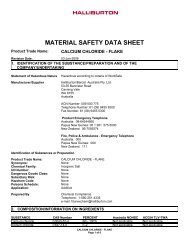

2P RESERVES RECONCILIATION<br />

mmboe<br />

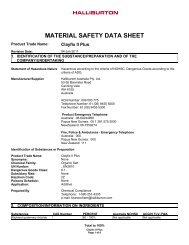

2P RESERVES REPLACEMENT<br />

RATIO<br />

%<br />

1,440<br />

1,445<br />

1,364<br />

1,406<br />

1,364 71<br />

23 (52)<br />

1,406<br />

305<br />

1,013<br />

180<br />

2008 2009<br />

2010 2011<br />

2012<br />

Reserves<br />

year-end<br />

2011<br />

Additions<br />

Acquisitions/<br />

divestments Production<br />

Reserves<br />

year-end<br />

2012<br />

1-year RRR<br />

5-year RRR<br />

In 2012, <strong>Santos</strong> continued its consistent<br />

track record of reserves growth. Proved and<br />

probable (2P) reserves have increased in nine<br />

of the past ten years, while producing over<br />

480 mmboe in the same period.<br />

Proved and probable hydrocarbon reserves<br />

increased to 1,406 mmboe as at the end<br />

of 2012. Based on the 2012 production of<br />

52 mmboe, <strong>Santos</strong> has a current 2P reserves<br />

life of 27 years.<br />

Approximately 88% of <strong>Santos</strong>’ 2P reserves are<br />

sales gas, 6% crude oil, 4% condensate and<br />

2% LPG.<br />

On a proved (1P) reserves basis, year-end<br />

reserves were 663 mmboe, 14 mmboe higher<br />

than 2011.<br />

2P additions of 71 mmboe in 2012 were<br />

driven by strong growth in Cooper Basin<br />

gas reserves, due to successful ongoing<br />

results from the infill drilling program<br />

combined with technical studies. Reserves<br />

growth was also recorded in Cooper Basin<br />

oil, Queensland CSG, the Carnarvon Basin<br />

and Vietnam, more than offsetting a<br />

reduction in Bonaparte reserves.<br />

<strong>Santos</strong> also booked Australia’s first 2P<br />

shale gas reserves, due to the success<br />

of the Moomba-191 shale gas well that<br />

was commissioned in September 2012.<br />

Net 2P acquisitions of 23 mmboe reflect<br />

<strong>Santos</strong>’ purchase of additional interests<br />

in the Combabula CSG field in Queensland,<br />

consolidation of interests in Fletcher<br />

Finucane, and the purchase of Woodside’s<br />

interest in Mutineer-Exeter.<br />

<strong>Santos</strong> has a strong track record of reserves<br />

replacement which is an important target to<br />

drive long-term shareholder value growth.<br />

A reserves replacement ratio (RRR) of more<br />

than 100% indicates that reserves grew by<br />

more than production during the period.<br />

In 2012, <strong>Santos</strong>’ 2P RRR was 180%, as<br />

reserves additions and net acquisitions<br />

and divestments of 94 mmboe exceeded<br />

production of 52 mmboe.<br />

Over the five years to 2012, <strong>Santos</strong>’ 2P RRR<br />

was a strong 305%. This was primarily driven<br />

by the sanction of the PNG LNG project,<br />

growth in CSG reserves in Queensland and<br />

NSW, Cooper gas and the Carnarvon.<br />

10