Commentary - Santos

Commentary - Santos

Commentary - Santos

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Directors’ Report<br />

(continued)<br />

Net Profit<br />

The 2012 net profit attributable to equity holders of <strong>Santos</strong> Limited of $519 million is $234 million lower than in 2011. This decrease is<br />

primarily due to a $529 million before tax ($408 million after tax) gain on sale of non-current assets during 2011, combined with higher<br />

cost of sales, offset by higher sales revenue driven by higher liquids volumes and higher gas prices in the current period.<br />

Net profit includes items before tax of $96 million ($87 million after tax), as referred to in the reconciliation of net profit to underlying<br />

profit below.<br />

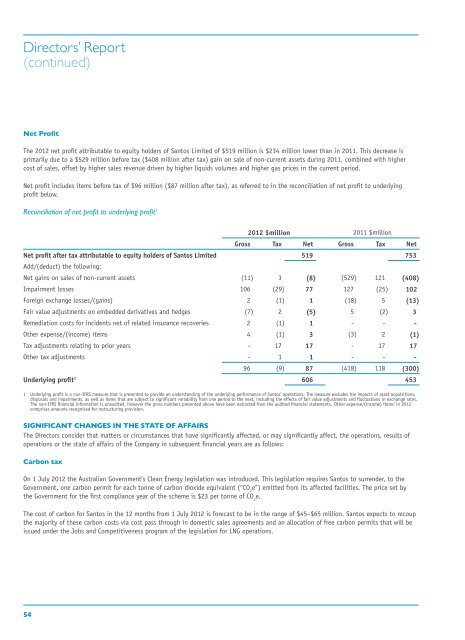

Reconciliation of net profit to underlying profit 1 2012 $million 2011 $million<br />

Gross Tax Net Gross Tax Net<br />

Net profit after tax attributable to equity holders of <strong>Santos</strong> Limited 519 753<br />

Add/(deduct) the following:<br />

Net gains on sales of non-current assets (11) 3 (8) (529) 121 (408)<br />

Impairment losses 106 (29) 77 127 (25) 102<br />

Foreign exchange losses/(gains) 2 (1) 1 (18) 5 (13)<br />

Fair value adjustments on embedded derivatives and hedges (7) 2 (5) 5 (2) 3<br />

Remediation costs for incidents net of related insurance recoveries 2 (1) 1 - - -<br />

Other expense/(income) items 4 (1) 3 (3) 2 (1)<br />

Tax adjustments relating to prior years - 17 17 - 17 17<br />

Other tax adjustments - 1 1 - - -<br />

96 (9) 87 (418) 118 (300)<br />

Underlying profit 1 606 453<br />

1 Underlying profit is a non-IFRS measure that is presented to provide an understanding of the underlying performance of <strong>Santos</strong>’ operations. The measure excludes the impacts of asset acquisitions,<br />

disposals and impairments, as well as items that are subject to significant variability from one period to the next, including the effects of fair value adjustments and fluctuations in exchange rates.<br />

The non-IFRS financial information is unaudited, however the gross numbers presented above have been extracted from the audited financial statements. ‘Other expense/(income) items’ in 2012<br />

comprises amounts recognised for restructuring provision.<br />

Significant Changes in the State of Affairs<br />

The Directors consider that matters or circumstances that have significantly affected, or may significantly affect, the operations, results of<br />

operations or the state of affairs of the Company in subsequent financial years are as follows:<br />

Carbon tax<br />

On 1 July 2012 the Australian Government’s Clean Energy legislation was introduced. This legislation requires <strong>Santos</strong> to surrender, to the<br />

Government, one carbon permit for each tonne of carbon dioxide equivalent (“CO 2<br />

e”) emitted from its affected facilities. The price set by<br />

the Government for the first compliance year of the scheme is $23 per tonne of CO 2<br />

e.<br />

The cost of carbon for <strong>Santos</strong> in the 12 months from 1 July 2012 is forecast to be in the range of $45–$65 million. <strong>Santos</strong> expects to recoup<br />

the majority of these carbon costs via cost pass through in domestic sales agreements and an allocation of free carbon permits that will be<br />

issued under the Jobs and Competitiveness program of the legislation for LNG operations.<br />

54