Commentary - Santos

Commentary - Santos

Commentary - Santos

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

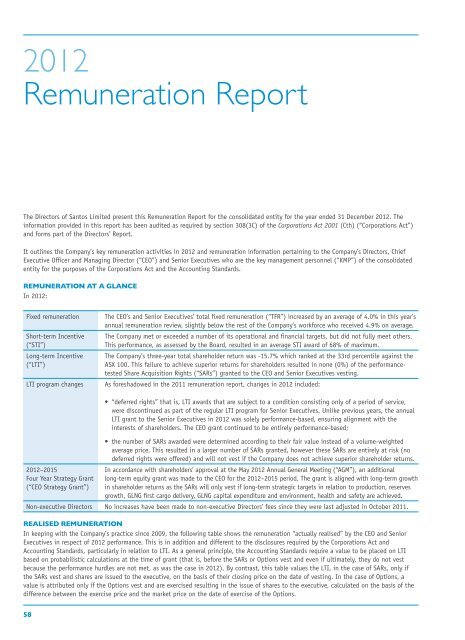

2012<br />

Remuneration Report<br />

The Directors of <strong>Santos</strong> Limited present this Remuneration Report for the consolidated entity for the year ended 31 December 2012. The<br />

information provided in this report has been audited as required by section 308(3C) of the Corporations Act 2001 (Cth) (“Corporations Act”)<br />

and forms part of the Directors’ Report.<br />

It outlines the Company’s key remuneration activities in 2012 and remuneration information pertaining to the Company’s Directors, Chief<br />

Executive Officer and Managing Director (“CEO”) and Senior Executives who are the key management personnel (“KMP”) of the consolidated<br />

entity for the purposes of the Corporations Act and the Accounting Standards.<br />

Remuneration at a Glance<br />

In 2012:<br />

Fixed remuneration<br />

Short-term Incentive<br />

(“STI”)<br />

Long-term Incentive<br />

(“LTI”)<br />

LTI program changes<br />

The CEO’s and Senior Executives’ total fixed remuneration (“TFR”) increased by an average of 4.0% in this year’s<br />

annual remuneration review, slightly below the rest of the Company’s workforce who received 4.9% on average.<br />

The Company met or exceeded a number of its operational and financial targets, but did not fully meet others.<br />

This performance, as assessed by the Board, resulted in an average STI award of 68% of maximum.<br />

The Company’s three-year total shareholder return was -15.7% which ranked at the 33rd percentile against the<br />

ASX 100. This failure to achieve superior returns for shareholders resulted in none (0%) of the performancetested<br />

Share Acquisition Rights (“SARs”) granted to the CEO and Senior Executives vesting.<br />

As foreshadowed in the 2011 remuneration report, changes in 2012 included:<br />

2012–2015<br />

Four Year Strategy Grant<br />

(“CEO Strategy Grant”)<br />

• “deferred rights” that is, LTI awards that are subject to a condition consisting only of a period of service,<br />

were discontinued as part of the regular LTI program for Senior Executives. Unlike previous years, the annual<br />

LTI grant to the Senior Executives in 2012 was solely performance-based, ensuring alignment with the<br />

interests of shareholders. The CEO grant continued to be entirely performance-based;<br />

• the number of SARs awarded were determined according to their fair value instead of a volume-weighted<br />

average price. This resulted in a larger number of SARs granted, however these SARs are entirely at risk (no<br />

deferred rights were offered) and will not vest if the Company does not achieve superior shareholder returns.<br />

In accordance with shareholders’ approval at the May 2012 Annual General Meeting (“AGM”), an additional<br />

long-term equity grant was made to the CEO for the 2012–2015 period. The grant is aligned with long-term growth<br />

in shareholder returns as the SARs will only vest if long-term strategic targets in relation to production, reserves<br />

growth, GLNG first cargo delivery, GLNG capital expenditure and environment, health and safety are achieved.<br />

Non-executive Directors No increases have been made to non-executive Directors’ fees since they were last adjusted in October 2011.<br />

Realised Remuneration<br />

In keeping with the Company’s practice since 2009, the following table shows the remuneration “actually realised” by the CEO and Senior<br />

Executives in respect of 2012 performance. This is in addition and different to the disclosures required by the Corporations Act and<br />

Accounting Standards, particularly in relation to LTI. As a general principle, the Accounting Standards require a value to be placed on LTI<br />

based on probabilistic calculations at the time of grant (that is, before the SARs or Options vest and even if ultimately, they do not vest<br />

because the performance hurdles are not met, as was the case in 2012). By contrast, this table values the LTI, in the case of SARs, only if<br />

the SARs vest and shares are issued to the executive, on the basis of their closing price on the date of vesting. In the case of Options, a<br />

value is attributed only if the Options vest and are exercised resulting in the issue of shares to the executive, calculated on the basis of the<br />

difference between the exercise price and the market price on the date of exercise of the Options.<br />

58