Commentary - Santos

Commentary - Santos

Commentary - Santos

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

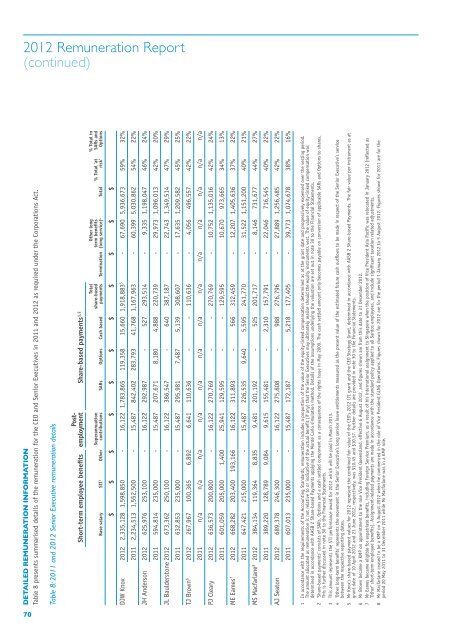

2012 Remuneration Report<br />

(continued)<br />

Detailed Remuneration Information<br />

Table 8 presents summarised details of the remuneration for the CEO and Senior Executives in 2011 and 2012 as required under the Corporations Act.<br />

Table 8: 2011 and 2012 Senior Executive remuneration details<br />

Short-term employee benefits<br />

Postemployment<br />

Share-based payments 1,2<br />

Base salary STI 3 Other<br />

Superannuation<br />

contributions SARs Options Cash based<br />

Total<br />

share-based<br />

payments Termination<br />

Other long<br />

term benefits<br />

(long service) Total<br />

$ $ $ $ $ $ $ $ $ $ $<br />

DJW Knox 2012 2,335,128 1,598,850 - 16,122 1,783,865 119,358 15,660 1,918,883 5 - 67,690 5,936,673 59% 32%<br />

2011 2,234,513 1,552,500 - 15,487 842,402 283,793 41,768 1,167,963 - 60,399 5,030,862 54% 22%<br />

JH Anderson 2012 625,976 253,100 - 16,122 292,987 - 527 293,514 - 9,335 1,198,047 46% 24%<br />

2011 594,814 235,000 - 15,487 207,671 8,180 4,888 220,739 - 29,973 1,096,013 42% 20%<br />

JL Baulderstone 2012 673,362 250,100 - 16,122 386,547 - 640 387,187 - 22,743 1,349,514 47% 29%<br />

2011 632,853 235,000 - 15,487 295,981 7,487 5,139 308,607 - 17,635 1,209,582 45% 25%<br />

TJ Brown 6 2012 267,967 100,365 6,892 6,641 110,636 - - 110,636 - 4,056 496,557 42% 22%<br />

2011 n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a n/a<br />

PJ Cleary 2012 636,573 200,800 - 16,122 270,769 - - 270,769 - 10,752 1,135,016 42% 24%<br />

2011 601,059 205,000 1,400 25,941 129,595 - - 129,595 10,670 973,665 34% 13%<br />

ME Eames 7 2012 668,282 203,400 193,166 16,122 311,893 - 566 312,459 - 12,207 1,405,636 37% 22%<br />

2011 647,421 215,000 - 15,487 226,535 9,640 5,595 241,770 - 31,522 1,151,200 40% 21%<br />

MS Macfarlane 8 2012 384,134 119,364 8,835 9,481 201,192 - 525 201,717 - 8,146 731,677 44% 27%<br />

2011 389,220 128,789 9,084 9,615 155,481 - 2,310 157,791 - 22,046 716,545 40% 22%<br />

AJ Seaton 2012 689,378 246,300 - 16,122 275,808 - 988 276,796 - 27,889 1,256,485 42% 22%<br />

2011 607,013 235,000 - 15,487 172,187 - 5,218 177,405 - 39,773 1,074,678 38% 16%<br />

% Total ‘at<br />

risk’<br />

% Total in<br />

SARs and<br />

Options<br />

1 In accordance with the requirements of the Accounting Standards, remuneration includes a proportion of the value of the equity-linked compensation determined as at the grant date and progressively expensed over the vesting period.<br />

The amount allocated as remuneration is not relative to or indicative of the actual benefit (if any) that the Senior Executives may ultimately realise should the equity instruments vest. The value of equity-linked compensation was<br />

determined in accordance with AASB 2 Share-based Payments applying the Monte Carlo simulation method. Details of the assumptions underlying the valuation are set out in note 30 to the Financial Statements.<br />

2 ‘Share-based payments’ consists of SARs, Options and a cash settled component as a consequence of the rights issue in May 2009. The cash settled amount only becomes payable on conversion of applicable SARs and Options to shares.<br />

This is further discussed in note 30 to the Financial Statements.<br />

3 This amount represents the STI performance award for 2012 which will be paid in March 2013.<br />

4 ‘Other long-term benefits’ represents the movement in the Senior Executive’s long service leave entitlements measured as the present value of the estimated future cash outflows to be made in respect of the Senior Executive’s service<br />

between the respective reporting dates.<br />

5 Mr Knox’s share-based payment values for 2012 represent the combined fair value of the CEO’s 2012 LTI grant and the CEO Strategy Grant, determined in accordance with AASB 2 Share-based Payments. The fair value per instrument as at<br />

grant date of 10 April 2012 and 21 June 2012, respectively, was $10.45 and $10.57. Further details are provided in note 30 to the Financial Statements.<br />

6 Mr Brown became a KMP on appointment to the role Vice President Queensland, effective 6 August 2012, and figures shown are from this date to 31 December 2012.<br />

7 Mr Eames became eligible for expatriate benefits, including Foreign Service Premium, as a result of his international assignment to Singapore when the position of Vice President Asia Pacific was relocated in January 2012 (reflected as<br />

‘Other’ short-term employee benefits). Assignment-related payments are made in accordance with the standard policy applied to all <strong>Santos</strong> employees, and include significant taxation related adjustments.<br />

8 Mr Macfarlane ceased to be a KMP on 5 August 2012 when he commenced in the role of Vice President GLNG Operations. Figures shown for 2012 are for the period 1 January 2012 to 5 August 2012. Figures shown for 2011 are for the<br />

period 20 May 2011 to 31 December 2011 while Mr Macfarlane was in a KMP role.<br />

4<br />

70