Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

44 ANNUAL<br />

MANAGEMENT REPORT<br />

<strong>Capgemini</strong><br />

• Option 1: an exchange ratio of 1 new Cap Gemini share to<br />

be issued for every 3 Transiciel shares;<br />

• Option 2: an exchange ratio of 5 Cap Gemini shares to be<br />

issued, plus 16 equity warrants giving entitlement for up to<br />

1 new Cap Gemini share, for 16 Transiciel shares.<br />

Option 2 includes an earn-out mechanism which would allow Transiciel<br />

shareholders to receive additional Cap Gemini shares subject to<br />

the Sogeti/Transiciel entity attaining certain earnings targets in 2004<br />

and <strong>2005</strong>. This earn-out mechanism is described in the prospectus<br />

which was approved by the "Commission des Opérations de Bourse"<br />

under reference no. 03-935 on October 29, 2003. As of Decem-<br />

REPORT <strong>2005</strong> <strong>Capgemini</strong><br />

ber 31, <strong>2005</strong>, the application of the methods for calculating the<br />

“earn-out” component would result in the issuance of 315,790<br />

new Cap Gemini shares to holders of warrants against a total of<br />

508,600 shares. The amount of new shares to be issued will be<br />

submitted for the approval of the independent arbitrator within 30<br />

days of the General Shareholders’ Meeting of May 11, 2006, in accordance<br />

with article 1.4.13.10. of the information memorandum.<br />

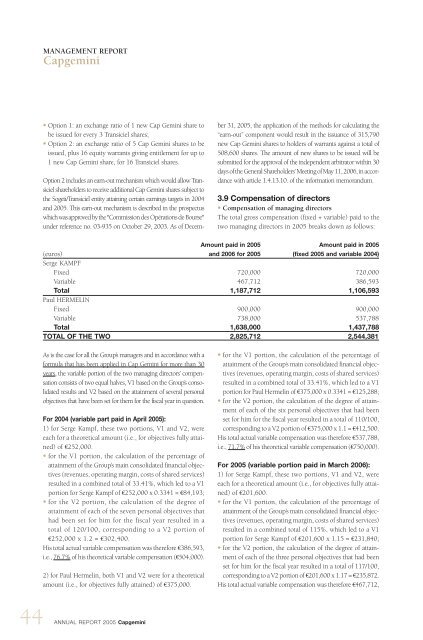

3.9 Compensation of directors<br />

• Compensation of managing directors<br />

The total gross compensation (fixed + variable) paid to the<br />

two managing directors in <strong>2005</strong> breaks down as follows:<br />

Amount paid in <strong>2005</strong> Amount paid in <strong>2005</strong><br />

(euros) and 2006 for <strong>2005</strong> (fixed <strong>2005</strong> and variable 2004)<br />

Serge KAMPF<br />

Fixed 720,000 720,000<br />

Variable 467,712 386,593<br />

Total 1,187,712 1,106,593<br />

Paul HERMELIN<br />

Fixed 900,000 900,000<br />

Variable 738,000 537,788<br />

Total 1,638,000 1,437,788<br />

TOTAL OF THE TWO 2,825,712 2,544,381<br />

As is the case for all the Group’s managers and in accordance with a<br />

formula that has been applied in Cap Gemini for more than 30<br />

years, the variable portion of the two managing directors’ compensation<br />

consists of two equal halves, V1 based on the Group’s consolidated<br />

results and V2 based on the attainment of several personal<br />

objectives that have been set for them for the fiscal year in question.<br />

For 2004 (variable part paid in April <strong>2005</strong>):<br />

1) for Serge Kampf, these two portions, V1 and V2, were<br />

each for a theoretical amount (i.e., for objectives fully attained)<br />

of €252,000.<br />

• for the V1 portion, the calculation of the percentage of<br />

attainment of the Group’s main consolidated financial objectives<br />

(revenues, operating margin, costs of shared services)<br />

resulted in a combined total of 33.41%, which led to a V1<br />

portion for Serge Kampf of €252,000 x 0.3341 = €84,193;<br />

• for the V2 portion, the calculation of the degree of<br />

attainment of each of the seven personal objectives that<br />

had been set for him for the fiscal year resulted in a<br />

total of 120/100, corresponding to a V2 portion of<br />

€252,000 x 1.2 = €302,400.<br />

His total actual variable compensation was therefore €386,593,<br />

i.e., 76.7% of his theoretical variable compensation (€504,000).<br />

2) for Paul Hermelin, both V1 and V2 were for a theoretical<br />

amount (i.e., for objectives fully attained) of €375,000.<br />

• for the V1 portion, the calculation of the percentage of<br />

attainment of the Group’s main consolidated financial objectives<br />

(revenues, operating margin, costs of shared services)<br />

resulted in a combined total of 33.41%, which led to a V1<br />

portion for Paul Hermelin of €375,000 x 0.3341 = €125,288;<br />

• for the V2 portion, the calculation of the degree of attainment<br />

of each of the six personal objectives that had been<br />

set for him for the fiscal year resulted in a total of 110/100,<br />

corresponding to a V2 portion of €375,000 x 1.1 = €412,500.<br />

His total actual variable compensation was therefore €537,788,<br />

i.e., 71.7% of his theoretical variable compensation (€750,000).<br />

For <strong>2005</strong> (variable portion paid in March 2006):<br />

1) for Serge Kampf, these two portions, V1 and V2, were<br />

each for a theoretical amount (i.e., for objectives fully attained)<br />

of €201,600.<br />

• for the V1 portion, the calculation of the percentage of<br />

attainment of the Group’s main consolidated financial objectives<br />

(revenues, operating margin, costs of shared services)<br />

resulted in a combined total of 115%, which led to a V1<br />

portion for Serge Kampf of €201,600 x 1.15 = €231,840;<br />

• for the V2 portion, the calculation of the degree of attainment<br />

of each of the three personal objectives that had been<br />

set for him for the fiscal year resulted in a total of 117/100,<br />

corresponding to a V2 portion of €201,600 x 1.17 = €235,872.<br />

His total actual variable compensation was therefore €467,712,