May-2015

May-2015

May-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

can be utilized for payment of the duty of<br />

excise specified in the First Schedule to<br />

the Excise Tariff Act:<br />

The credit of Education Cess and<br />

Secondary and Higher Education Cess<br />

paid on input services received by the<br />

manufacturer of final product on or after the<br />

1st day of March, <strong>2015</strong> can be utilized for<br />

payment of the duty of excise specified in<br />

the First Schedule to the Excise Tariff Act.”<br />

Source: Notification No. 12/<strong>2015</strong><br />

- Central Excise (N.T.) dated:<br />

30th April, <strong>2015</strong><br />

Govt. exempts excise duty on goods<br />

cleared against Post Export EPCG<br />

duty credit scrip vide Notification<br />

No.18/<strong>2015</strong>-C.E dated 1-4-<strong>2015</strong><br />

The exemption shall be subject to the<br />

following conditions, name¬ly:- (a)<br />

that the conditions (1) to (14) specified<br />

in paragraph 2 of the Notification No.<br />

17/<strong>2015</strong> – Customs, dated the 1st April,<br />

<strong>2015</strong> are complied and the said scrip has<br />

been registered by the Customs authority<br />

at the specified port of registration<br />

(hereinafter referred as the said Customs<br />

authority); (b) that the holder of the<br />

scrip, who may either be the person to<br />

whom the scrip was originally issued<br />

or a transferee-holder, presents the said<br />

scrip to the said Customs authority along<br />

with a letter or proforma invoice from the<br />

supplier or manufacturer indicating details<br />

of its jurisdictional Central Excise Officer<br />

(hereinafter referred as the said Officer)<br />

and the description, quantity.<br />

Read more at:<br />

http://gst.taxmann.com/<br />

topstories/104010000000044665/govtexempts-excise-duty-on-goods-clearedagainst-post-export-ep¬cg-duty-creditscrip.aspx<br />

Service Tax<br />

Implementation of Service Export<br />

from India Scheme (SEIS) under<br />

FTP <strong>2015</strong>-2020<br />

Central Government exempts the taxable<br />

services provided or agreed to be<br />

provided against a scrip by a person<br />

located in the taxable territory from the<br />

whole of the service tax leviable thereon<br />

under section 66B of the said Act.This<br />

notification shall be applicable to the<br />

Service Exports from India Scheme<br />

duty credit scrip issued by the Regional<br />

Authority in accordance with paragraph<br />

3.10 read with paragraph 3.08of the<br />

Foreign Trade Policy vide Notification<br />

No. 11 / <strong>2015</strong>– Service Tax dated: 8th<br />

April, <strong>2015</strong>.<br />

Read more at: http://www.servicetax.gov.<br />

in/st-notfns-home.htm<br />

Implementation of Merchandise<br />

Export from India Scheme (MEIS)<br />

under FTP <strong>2015</strong>-2020<br />

Central Governmentexempts the taxable<br />

services provided or agreed to be provided<br />

against a scrip by a person located in the<br />

taxable territory from the whole of the<br />

service tax leviable thereon under section<br />

66B of the said Act.This notification shall<br />

be applicable to the Merchandise Exports<br />

from India Scheme duty credit scripissued<br />

to an exporter by the Regional Authority in<br />

accordance with paragraph 3.04 read with<br />

paragraph 3.05of the Foreign Trade Policy<br />

vide Notification No. 10/ <strong>2015</strong>– Service<br />

Tax dated: 8th April, <strong>2015</strong>.<br />

Read more at: http://www.<br />

servicetax.gov.in/st-notfns-home.<br />

htm<br />

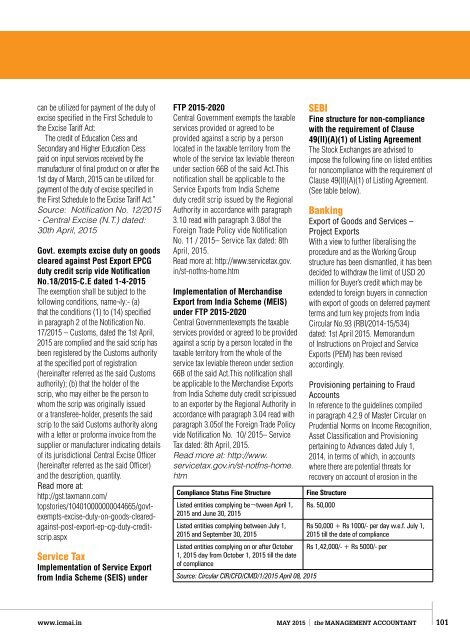

SEBI<br />

Fine structure for non-compliance<br />

with the requirement of Clause<br />

49(II)(A)(1) of Listing Agreement<br />

The Stock Exchanges are advised to<br />

impose the following fine on listed entities<br />

for noncompliance with the requirement of<br />

Clause 49(II)(A)(1) of Listing Agreement.<br />

(See table below).<br />

Banking<br />

Export of Goods and Services –<br />

Project Exports<br />

With a view to further liberalising the<br />

procedure and as the Working Group<br />

structure has been dismantled, it has been<br />

decided to withdraw the limit of USD 20<br />

million for Buyer’s credit which may be<br />

extended to foreign buyers in connection<br />

with export of goods on deferred payment<br />

terms and turn key projects from India<br />

Circular No.93 (RBI/2014-15/534)<br />

dated: 1st April <strong>2015</strong>. Memorandum<br />

of Instructions on Project and Service<br />

Exports (PEM) has been revised<br />

accordingly.<br />

Provisioning pertaining to Fraud<br />

Accounts<br />

In reference to the guidelines compiled<br />

in paragraph 4.2.9 of Master Circular on<br />

Prudential Norms on Income Recognition,<br />

Asset Classification and Provisioning<br />

pertaining to Advances dated July 1,<br />

2014, in terms of which, in accounts<br />

where there are potential threats for<br />

recovery on account of erosion in the<br />

Compliance Status Fine Structure<br />

Fine Structure<br />

Listed entities complying be¬tween April 1, Rs. 50,000<br />

<strong>2015</strong> and June 30, <strong>2015</strong><br />

Listed entities complying between July 1, Rs 50,000 + Rs 1000/- per day w.e.f. July 1,<br />

<strong>2015</strong> and September 30, <strong>2015</strong><br />

<strong>2015</strong> till the date of compliance<br />

Listed entities complying on or after October Rs 1,42,000/- + Rs 5000/- per<br />

1, <strong>2015</strong> day from October 1, <strong>2015</strong> till the date<br />

of compliance<br />

Source: Circular CIR/CFD/CMD/1/<strong>2015</strong> April 08, <strong>2015</strong><br />

www.icmai.in<br />

MAY <strong>2015</strong><br />

the MANAGEMENT ACCOUNTANT<br />

101