May-2015

May-2015

May-2015

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IMPACT OF SERVICE TAX<br />

ON TELECOM SERVICES<br />

Though the telecom industry is the highest contributor of service<br />

tax, a number of state governments have imposed heterogeneous<br />

taxes/charges on the operators. Although these taxes are not<br />

significantly high, they delay the rollout of networks. The myriad of<br />

taxes hopefully would go away with the implementation of GST<br />

CMA Dr. M.<br />

Govindarajan<br />

Sr. Accounts officer,<br />

BSNL, Madurai<br />

Telephone service is among the three services<br />

brought into the service tax net with<br />

effect from the date of inception itself. The<br />

Telecom industry is monopoly in the hands of<br />

the Central Government. After the introduction<br />

of liberalization and globalization private<br />

operators were encouraged to enter into telecom<br />

sector. The technology in the telecom<br />

is changing frequently. The technology today<br />

will be obsolete within two years because of<br />

the introduction of new technology.<br />

On introducing the mobile phone services<br />

the telecom industry has witnessed the rapid<br />

growth. Telecommunications services are a<br />

global market worth over US$ 1.5 trillion in<br />

revenue as on 22nd March 2012. Mobile services<br />

account for roughly 40 per cent of this,<br />

while mobile subscribers worldwide currently<br />

outnumber the use of fixed telephone lines by<br />

more than two to one. Over the past decade,<br />

the market has witnessed far-reaching changes,<br />

with the introduction of competition into<br />

a sector that was once principally a monopoly.<br />

The Telecom services, after the liberalization<br />

process reached the gross root level. As on<br />

31.08.2014 the number of subscribers is as per<br />

the table below:<br />

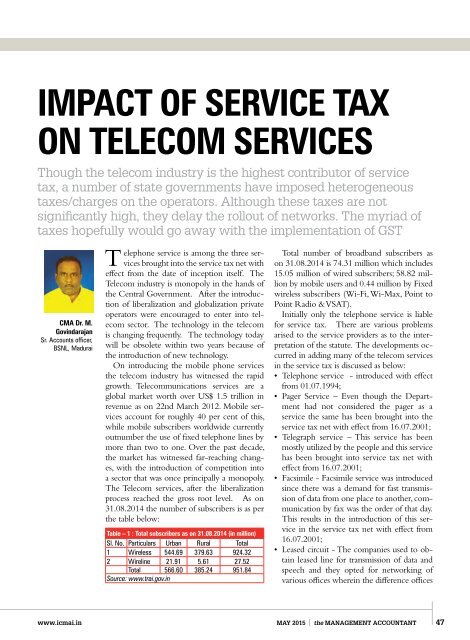

Table – 1 : Total subscribers as on 31.08.2014 (in million)<br />

Sl. No. Particulars Urban Rural Total<br />

1 Wireless 544.69 379.63 924.32<br />

2 Wireline 21.91 5.61 27.52<br />

Total 566.60 385.24 951.84<br />

Source: www.trai.gov.in<br />

Total number of broadband subscribers as<br />

on 31.08.2014 is 74.31 million which includes<br />

15.05 million of wired subscribers; 58.82 million<br />

by mobile users and 0.44 million by Fixed<br />

wireless subscribers (Wi-Fi, Wi-Max, Point to<br />

Point Radio & VSAT).<br />

Initially only the telephone service is liable<br />

for service tax. There are various problems<br />

arised to the service providers as to the interpretation<br />

of the statute. The developments occurred<br />

in adding many of the telecom services<br />

in the service tax is discussed as below:<br />

• Telephone service - introduced with effect<br />

from 01.07.1994;<br />

• Pager Service – Even though the Department<br />

had not considered the pager as a<br />

service the same has been brought into the<br />

service tax net with effect from 16.07.2001;<br />

• Telegraph service – This service has been<br />

mostly utilized by the people and this service<br />

has been brought into service tax net with<br />

effect from 16.07.2001;<br />

• Facsimile - Facsimile service was introduced<br />

since there was a demand for fast transmission<br />

of data from one place to another, communication<br />

by fax was the order of that day.<br />

This results in the introduction of this service<br />

in the service tax net with effect from<br />

16.07.2001;<br />

• Leased circuit - The companies used to obtain<br />

leased line for transmission of data and<br />

speech and they opted for networking of<br />

various offices wherein the difference offices<br />

www.icmai.in<br />

MAY <strong>2015</strong> the MANAGEMENT ACCOUNTANT 47