DEFENCE SERVICE REGULATIONS - Military Engineer Services

DEFENCE SERVICE REGULATIONS - Military Engineer Services

DEFENCE SERVICE REGULATIONS - Military Engineer Services

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

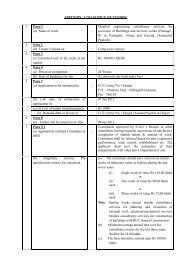

274. Expendible tools such as picks, shovels, files, chises, etc., will be charged off finally to the<br />

work or maintenance head concerned. They will be accounted for numerically in a separate register on IAFW-<br />

2279. The service to which they were charged will be noted against each article in the register. In the case of<br />

serviceable articles transferred for use on other works, the proceeds will be credited as laid down in para 273.<br />

275. When T & P are transferred from the charge of one MES Division to another, the transfer will<br />

be without value except as laid down in para 273.<br />

276. Sale proceeds of T & P other than those under para 273, will be credited to Revenue except<br />

when the sale is to another department of the Central Government in which case the proceeds will be adjusted<br />

against the Detailed Head ‘Deduct–Credits from other Departments, under Sub-Head E.<br />

When the amount is not recovered in the month in which the articles are sold, credit will be given to<br />

Revenue or to the budget sub-head concerned by a corresponding debit to Sub-Head G-MES Advances.<br />

277. The cost of maintenance, repairs and renewals of all articles is chargeable against Sub-head E<br />

except that in the case of General T & P, running repairs and expenses (e.g. pay of drivers, fuel, lubricants<br />

etc.) connected with the use of such articles and the cost of overhaul, or repairs (except fair wear and tear) will<br />

both be charged to the service concerned and not to Sub-Head E.<br />

In the case of load-carrying vehicles, running expenses will be charged to Sub-Head E which will<br />

subsequently be relieved by a minus debit to the extent the vehicles have been employed on specific jobs by<br />

contra debit to the relevant works.<br />

Running expenses for personnel-carrying vehicles will be charged to Minor Head 105- Transportation<br />

Sob Head ‘A’- Travelling and Ontstation Allowance. 2. Temporary duty moves- M.E.S. (including E in C’s<br />

Branch & ESD).<br />

In the case of ESDs, the cost of repairs and maintenance of all vehicles and plant and machinery used<br />

in the operation of the Depot will be debited to Minor Head 800 Sub Head ‘B’ (a) IS (a)- Maintenance and<br />

operation of ESD’s.<br />

Running expenses of personnel-carrying vehicles will be charged to Minor Head 105- Transportation<br />

Sub Head ‘A’- Travelling and Outstation Allowance. 2. Temporary duty moves- M.E.S. (including E in C’s<br />

Branch & ESD).<br />

With regard to load-carrying vehicles and plant and machinery, the pay of drivers will be debited to<br />

Minor Head 104 - Civilians Sub Head K - MES (b) ESD Establishment. The cost of fuel, lubricants, etc., will<br />

be borne by Minor Head 800 Sub Head ‘B’ (a) 15 (a)-Maintenance and operation of ESD’s..<br />

Sub-head F-Stores<br />

278. The cost of stores specifically purchased for a work is charged direct to the work. The cost of<br />

stores procured for stock in <strong>Engineer</strong> Parks and Divisional Stocks to meet demands for works, maintenance,<br />

etc., is charged in the first instance to the Detailed Head 1. Procurement of stores for Parks and Divisonal<br />

Stocks—under Sub Head F. When these stores are issued, their value is adjusted under the Deduct Head F.2.<br />

by a corresponding debit to the ‘Works’ ‘Maintenance’, etc., heads.<br />

Detailed Head 3 provides for all expenditure incurred in connection with , the maintenance and<br />

operation of <strong>Engineer</strong> Parks and Divisional Stocks.<br />

Stores procured for ESD stocks will be operated under Minor Head 110-Stores, Sub-Head E-<strong>Engineer</strong><br />

Stores.<br />

Detailed procedure is given in Chapter X.<br />

Sub-Head G-MES Advances<br />

279. The following items will be charged to this heads–<br />

(a) Sales on credit (para 276 and 802).<br />

(b) Expenditure on deposit works in excess of the amount deposited. This form of expenditure<br />

should occur only in exceptional cases and will be adjusted as soon as possible.<br />

(c) Outstandings against contractors not immediately recoverable (para 476).<br />

(d) Expenditure in a workshop on labour and materials on an ‘Outside Work Order’ for which a<br />

corresponding debit cannot be taken against the work, etc., concerned, during the current year.<br />

(e) Debits, the classification of which cannot at once be determined.<br />

(f) Recoverable debits not pertaining to the accounts of a work.<br />

Except as specified above, no expenditure may be debited to this head on the ground of absence or<br />

insufficiency of sanction or allotment.<br />

44